In 2025, 62,433 homes changed hands across the GTA. Here’s what that actually tells us about where we’re heading in 2026.

The Greater Toronto Area housing market ended 2025 with a clear shift in affordability.

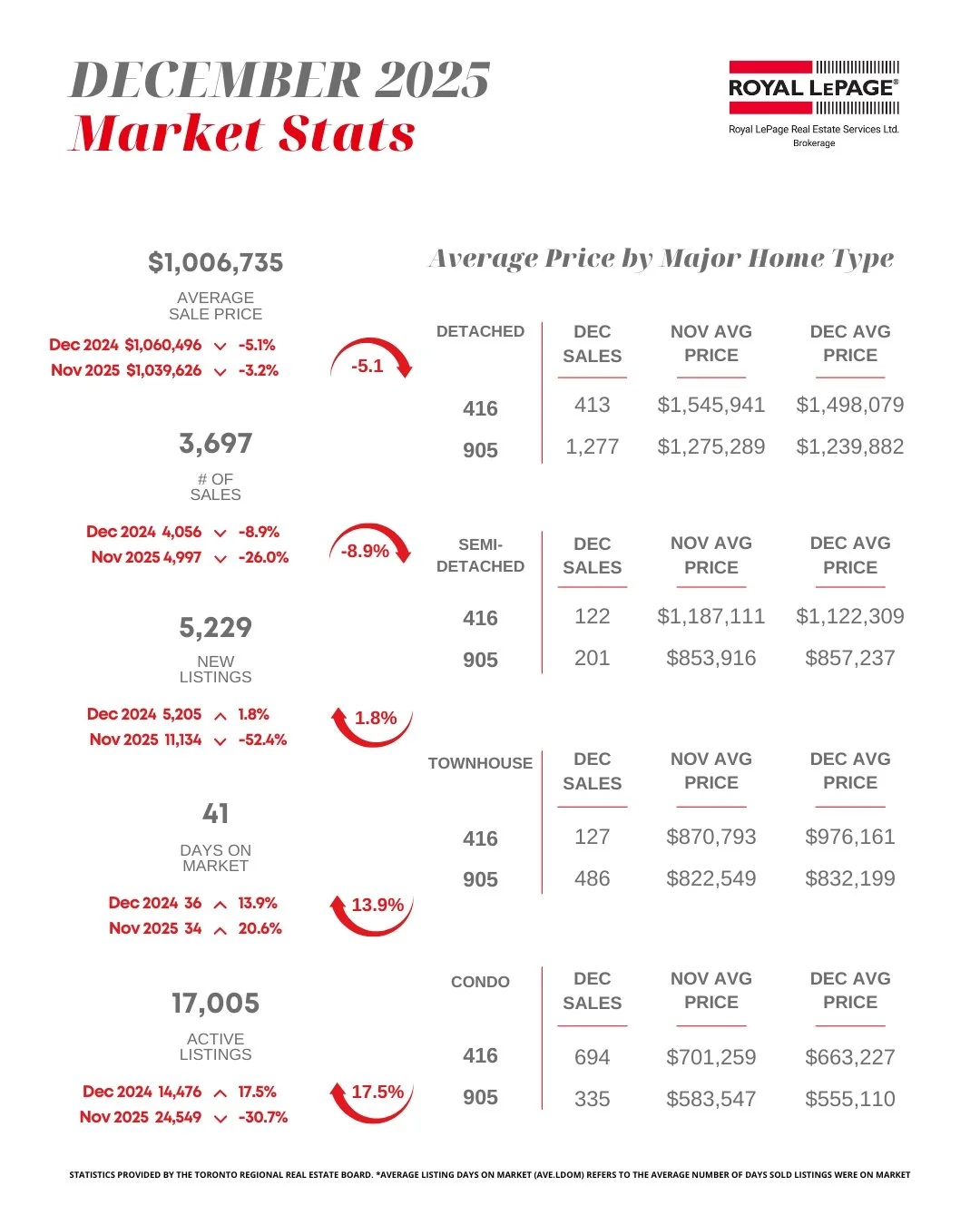

The average selling price in December was $1,006,735, down 5.1% compared to December 2024. For the full year, the average price came in at $1,067,968, a 4.7% decline from 2024.

Total sales for 2025 reached 62,433 transactions across the GTA, an 11.2% drop year-over-year. At the same time, new listings rose by just over 10%, and December alone saw 3,697 sales with a 1.8% increase in new listings. More homes on the market and fewer sales meant buyers had more choice and more room to negotiate.

“The GTA housing market became more affordable in 2025 as selling prices and mortgage rates trended lower. This improved affordability has set the market up for a strong recovery,” said TRREB President Daniel Steinfeld. “Once households are convinced that the economy and labour market are on a solid footing, we expect sales to increase as pent-up demand is finally satisfied”.

What These Numbers Actually Mean

62,433 homes changed hands in the GTA in 2025. Every sale had a buyer and a seller. That means over 124,000 buyer and seller decisions were made in this market in 2025.

These were real properties, real offers, real keys exchanged. Life didn’t stop. It adjusted.

Local Picture: Toronto West and South Etobicoke

In Toronto’s West End, especially High Park, Bloor West Village, The Junction, Roncesvalles, and The Kingsway, freehold homes continued to sell, but the gap between “priced to the market” and “priced to a memory” became very obvious.

Detached and semi-detached homes with realistic pricing and solid preparation still attracted interest and offers. Homes that pushed beyond what buyers were willing to pay for the condition, layout, and location simply sat. We saw more examples of listings needing price reductions or longer days on market before a serious offer appeared.

In Mimico and surrounding South Etobicoke pockets, the pattern was similar but more noticeable in condos and townhomes. Higher maintenance fees, aging buildings, or units with weaker light and layouts were quickly discounted by buyers. Properties that presented well, in strong buildings with clear financials, continued to move—often after more negotiation than we were used to seeing in earlier years.

How Different Property Types Performed in December

Detached homes across the GTA averaged $1,302,980 in December 2025, a 5.9% drop from the year before. There were 1,690 detached sales, only slightly lower than December 2024, which tells us that demand for standalone homes never disappeared—it simply became more price-sensitive.

Semi-detached properties averaged $957,357, down 11.4% year-over-year, with 323 sales. This segment felt the correction more strongly, especially where semis were competing with smaller detached options or well-priced townhomes.

Townhomes averaged $862,024, a 6% decline from last December, with 613 sales—down 22.5%. This sharper drop in volume reflects buyers stepping back to reassess budget and monthly costs, not just purchase price.

Condo apartments averaged $628,029 in December 2025, a 7.3% price decline compared with December 2024. There were 1,029 condo sales, with sales volume down 11.2% from a year earlier. The condo market showed that lower prices alone aren’t enough. Buyers are looking closely at building quality, reserve funds, upcoming repairs, and overall carrying costs before they commit.

Looking Ahead to 2026

As we move into 2026, the GTA market is characterized by a cautious but optimistic outlook. With trade relationships reaffirming and large-scale domestic projects on the horizon, the foundation for growth is firming. While buyers remain mindful of employment stability, the combination of lower borrowing costs and more favorable entry prices is creating a compelling window for those looking to enter the market. With continued focus on tax relief and housing supply from all levels of government, the stage is set for a more active and stable market environment that supports households across the region.

In my 2026 Toronto Housing Forecast, I focus on three practical anchors for this year:

– Making timing decisions based on your life and your financing, not a generic “spring market” story

– Pricing from what buyers are paying today in your specific segment and neighbourhood, not from what the home “should be worth”

– Getting a clear picture of the costs and consequences of selling, holding, or buying, so you understand the impact of each option before you move

You can read the full forecast here:

https://www.lubabeley.com/real-estate-blog/2026-toronto-housing-forecast

Final Word

If you're thinking about selling, buying, or repositioning a property in 2026, this is the time to get your numbers straight and your plan clear. Nothing has to happen overnight. This is a good moment to look beyond the next few months and map out the next few years.

📞 Book a Clarity Call at HERE— and let’s look at your real options before the next wave of activity begins.

Whether you're buying, selling, or simply tracking the market—I’m here to help you navigate it with clarity, strategy, and grounded advice.

Luba Beley, BROKER

Real Estate With Integrity

📩 Let’s connect.

📞 416-419-5226

📍 Serving Toronto, Etobicoke, and the GTA West