In August, home values in the Greater Toronto Area were essentially flat as compared to last year, with an average sales price of $1,082,496, pointing to the remarkable resilience in Toronto’s housing market. However, average prices have declined since interest rates started to rise again this past June. With the Bank of Canada’s announcement today, September 6th to not raise interest rates and the typically slow summer sales period coming to an end, the stage is set for increased buyer competition and upwards pressure on pricing to resume.

August saw a welcome increase in available inventory in the GTA, reaching 15,497 active listings, a notable uptick of 16.5% from the previous month. As inventory regains its equilibrium, sales figures have yet to catch up, with August witnessing a total of 5,294 sales— 33% less than the preceding 10 years of August data. While sales lag, competition remains tight, and sellers continued to find solace in the fact that they are, on average, achieving 100% of their listing price. In many cases, particularly for properties in established GTA neighbourhoods, multiple offers and sales above the asking price remain a reality.

“More balanced market conditions this summer compared to the tighter spring market resulted in selling prices hovering at last year’s levels and dipping slightly compared to July. As interest rates continued to increase in May, after a pause in the winter and early spring, many buyers have had to adjust their offers in order to qualify for higher monthly payments. Not all sellers have chosen to take lower than expected selling prices, resulting in fewer sales,” said TRREB Chief Market Analyst Jason Mercer.

The detached asset class seems impermeable to further impact of interest rate increases, with average prices ending August 3% higher than August 2022 and on par with last month. Detached homes are also selling quickly, on average 19 days.

Interestingly, the condo asset class defied the market trend by showing a 7% increase in sales compared to July. Since last year at this time, the average price of a condo in the GTA has dropped by approximately $6,000, and inventories have increased by 20% year-over-year, creating a more optimistic environment for those looking to purchase a condo, particularly first time buyers.

Turning to the townhouse and semi-detached markets, they closed August with average sales prices of $1,022,680 and $1,067,980, respectively. Townhouse values showed a marginal 1% dip on a monthly basis but remained resilient with a 4% year-over-year increase. In contrast, semi-detached values experienced a 3% monthly decline but posted an impressive 7% year-over-year gain. While available inventory has increased this summer, sales activity in this asset class followed suit, firmly maintaining pressure on prices.

As GTA aggregate property values have surged since January, culminating in an annual average of $1.121 million over the initial eight months of the year, a conspicuous housing shortage has become the prominent challenge affecting home affordability. Moreover, a recent article published by The Globe and Mail has brought to the forefront the additional fees developers are required to pay to bring properties to market, presenting yet another obstacle for prospective purchasers to navigate.

Supply, rising borrowing costs and housing prices have led to an increasing number of homeowners opting to become co-owners, as a recent survey done by Royal LePage highlights. According to the survey, 76 per cent of co-owners say that affordability was a major motivating factor in their decision to co-purchase their property. Not surprisingly, that number rises to 83 per cent for co-owners between the ages of 25 and 34. Thirty-two per cent of respondents who were influenced by a lack of affordability say that they co-purchased their property after the Bank of Canada began raising interest rates in March of 2022.

In summary, the GTA real estate market in August 2023 saw less activity, based on the impact of the interest rate increases in June and July, and typical seasonality. Now that Labour Day is over, and for now, the Bank of Canada has decided to hold interest rates, buyers are entering the start of the fall market with more confidence, and more homes to choose from. Whether the change of season and more buyers coming off the sidelines will have a marked impact on pricing remains to be seen, however those buyers looking to make a move would be well served to act now, instead of waiting to see if history repeats itself in the wake of the rate hold.

JUNE 2023 MARKET STATS SUMMARY

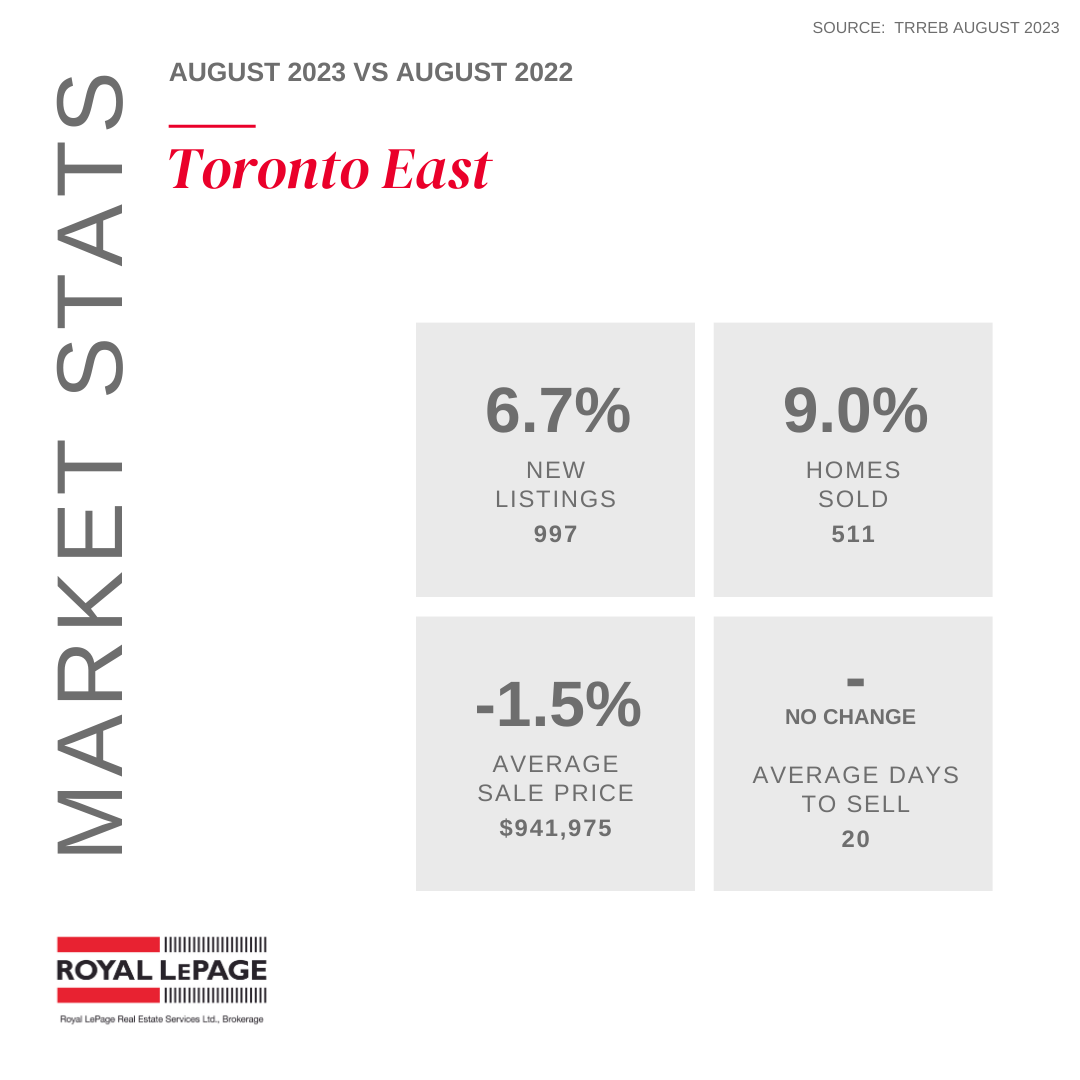

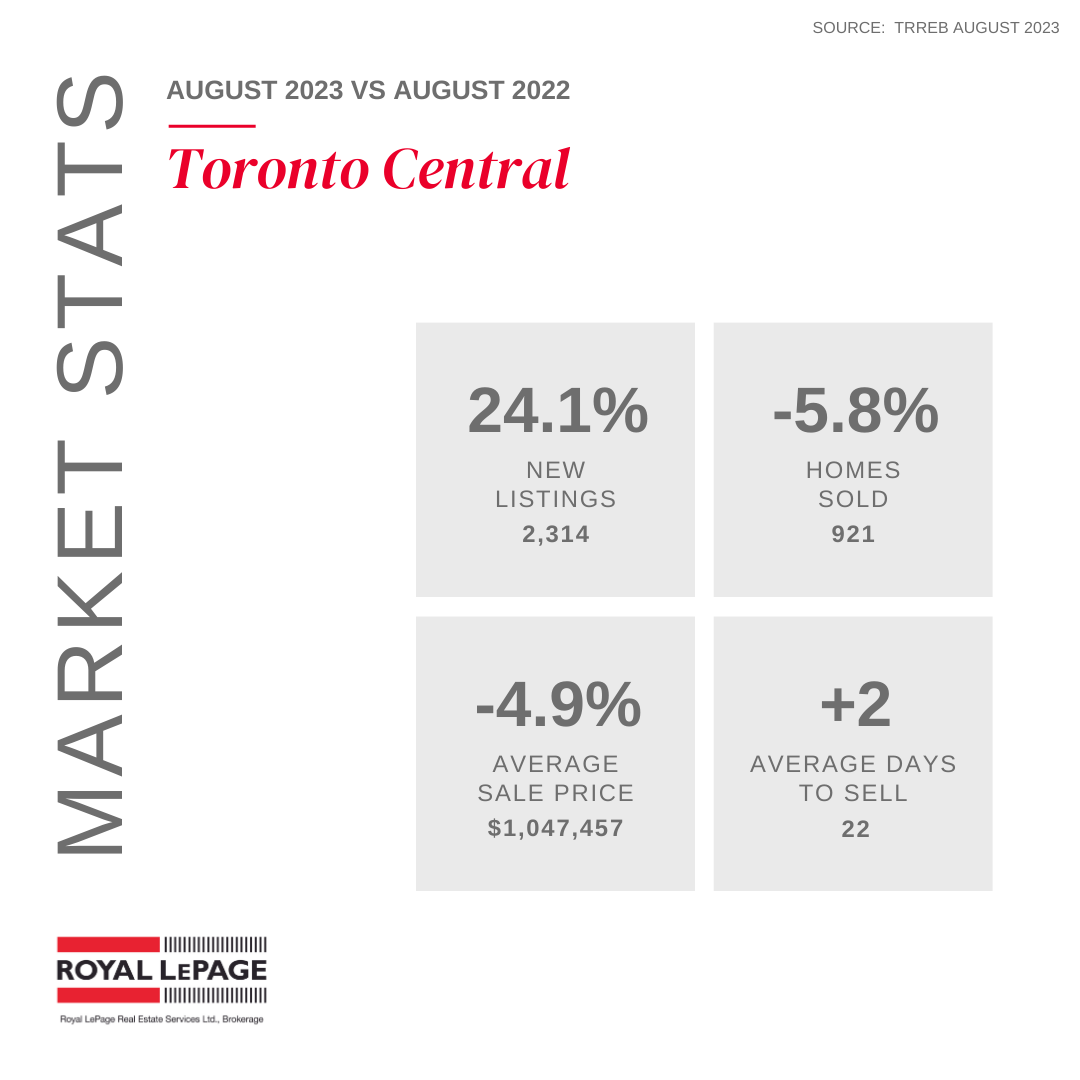

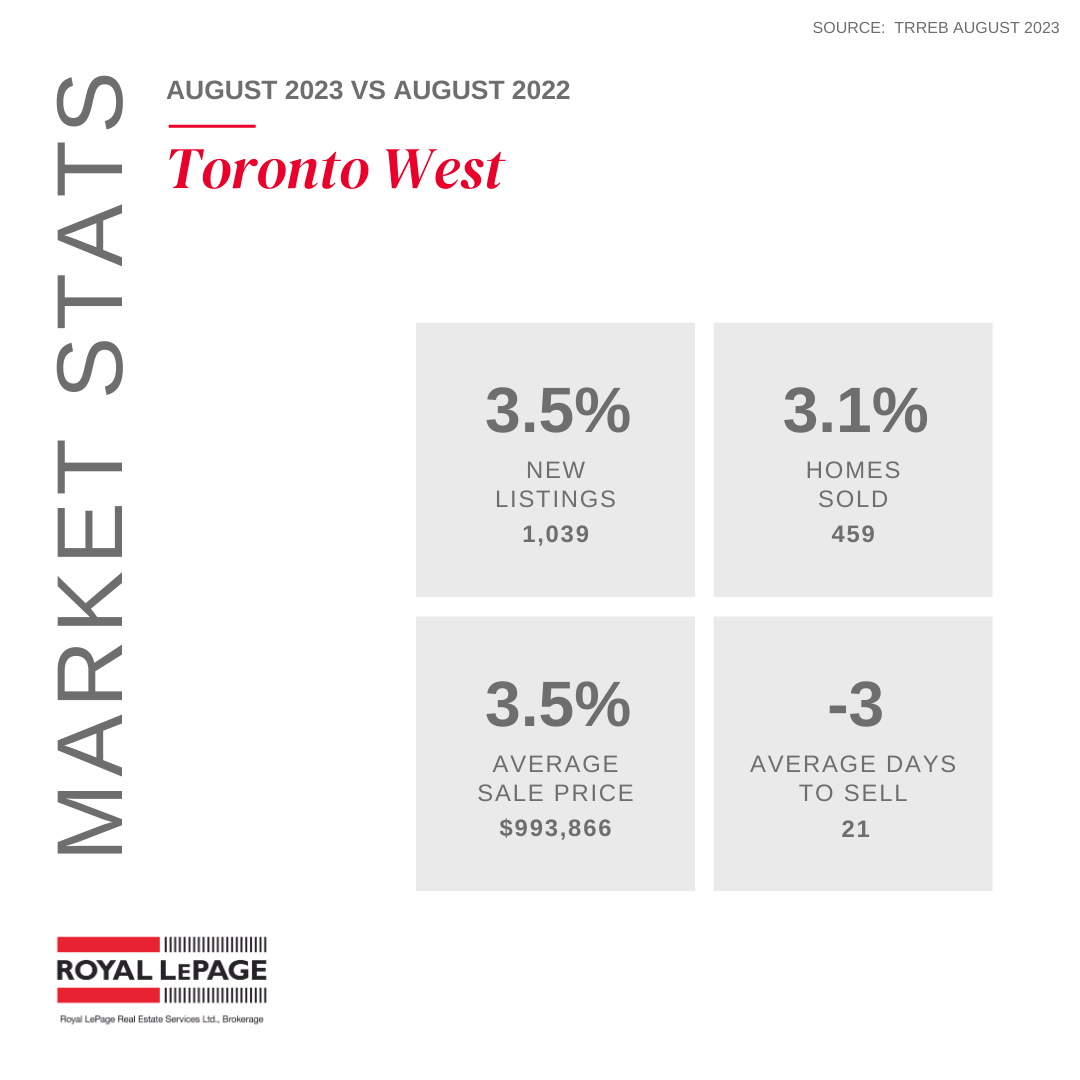

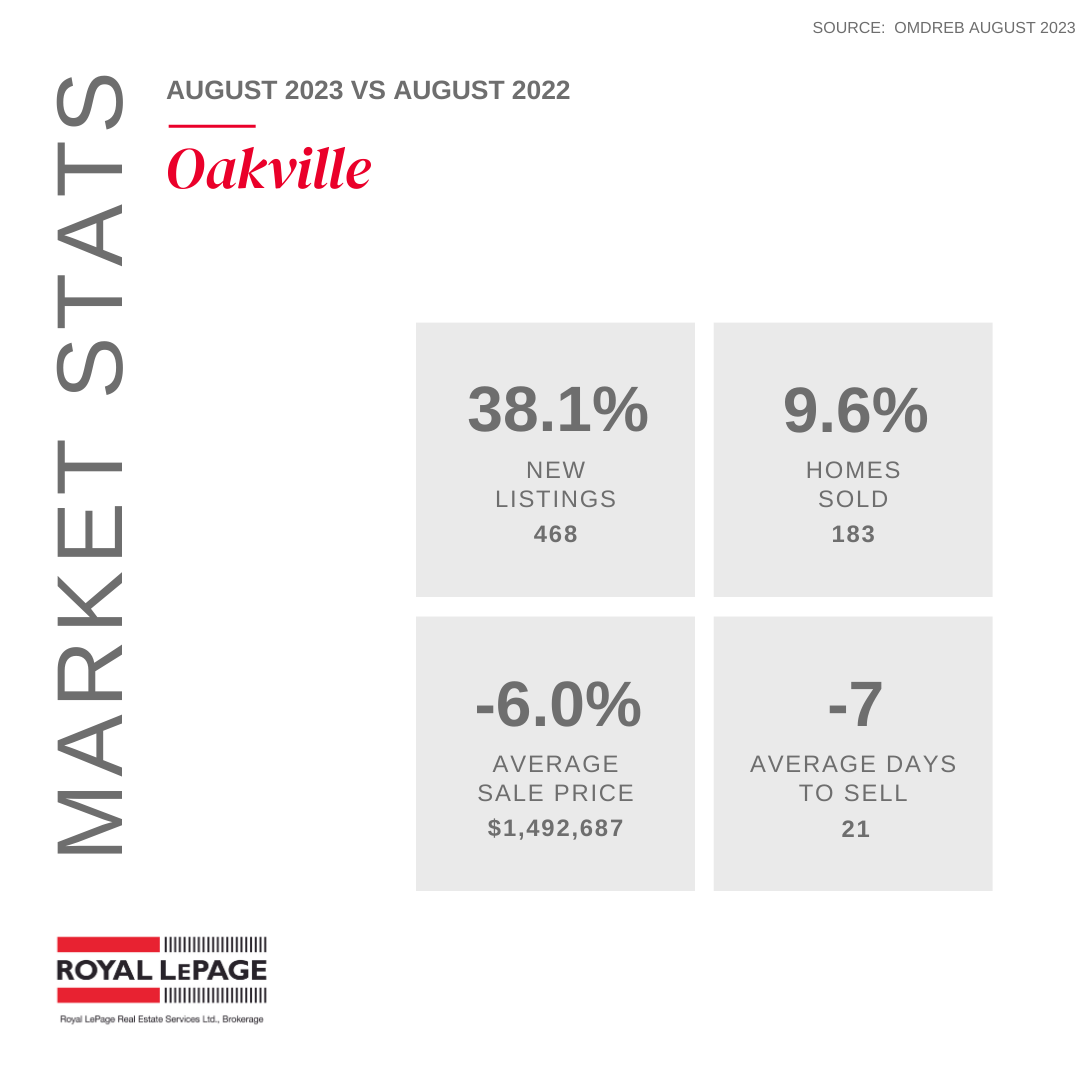

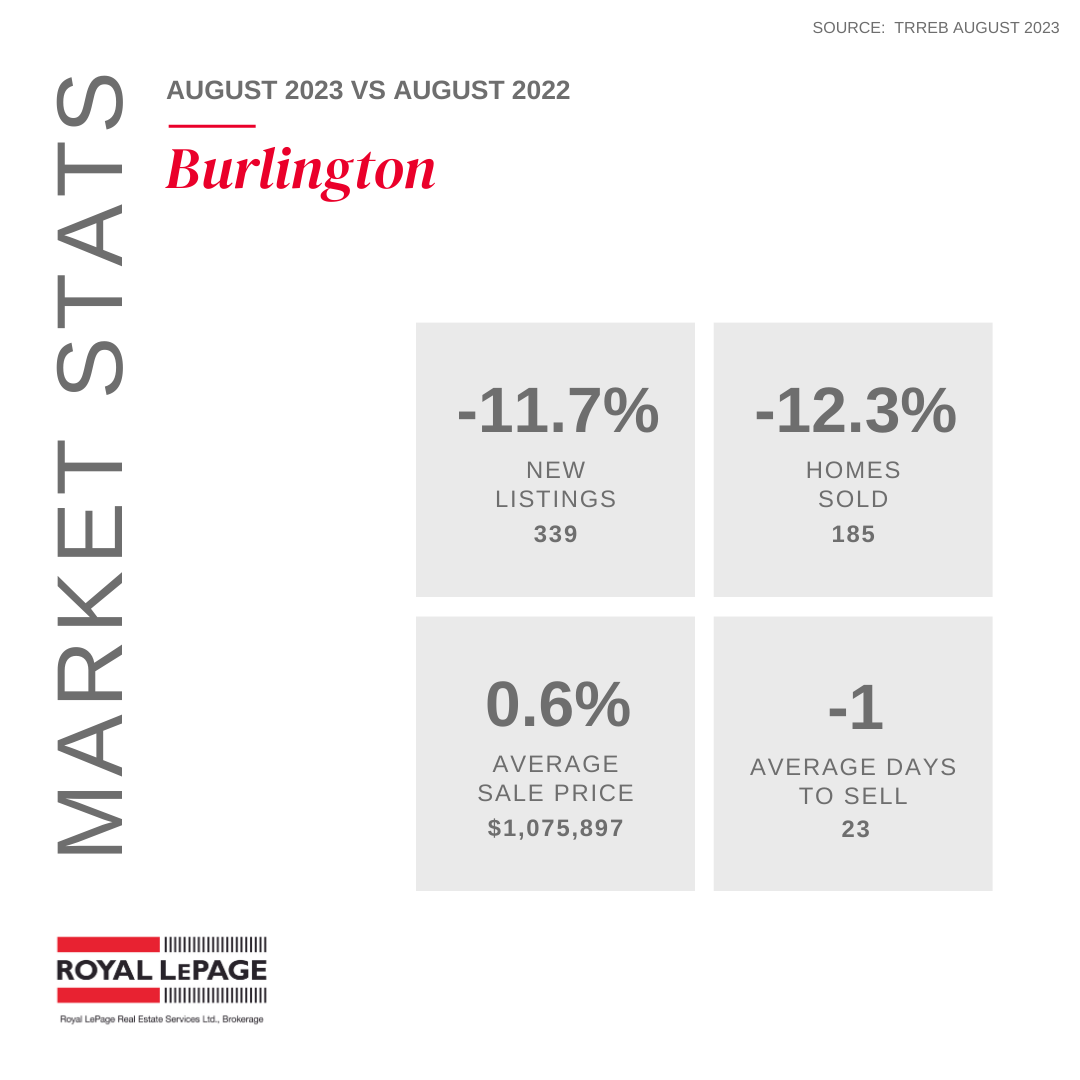

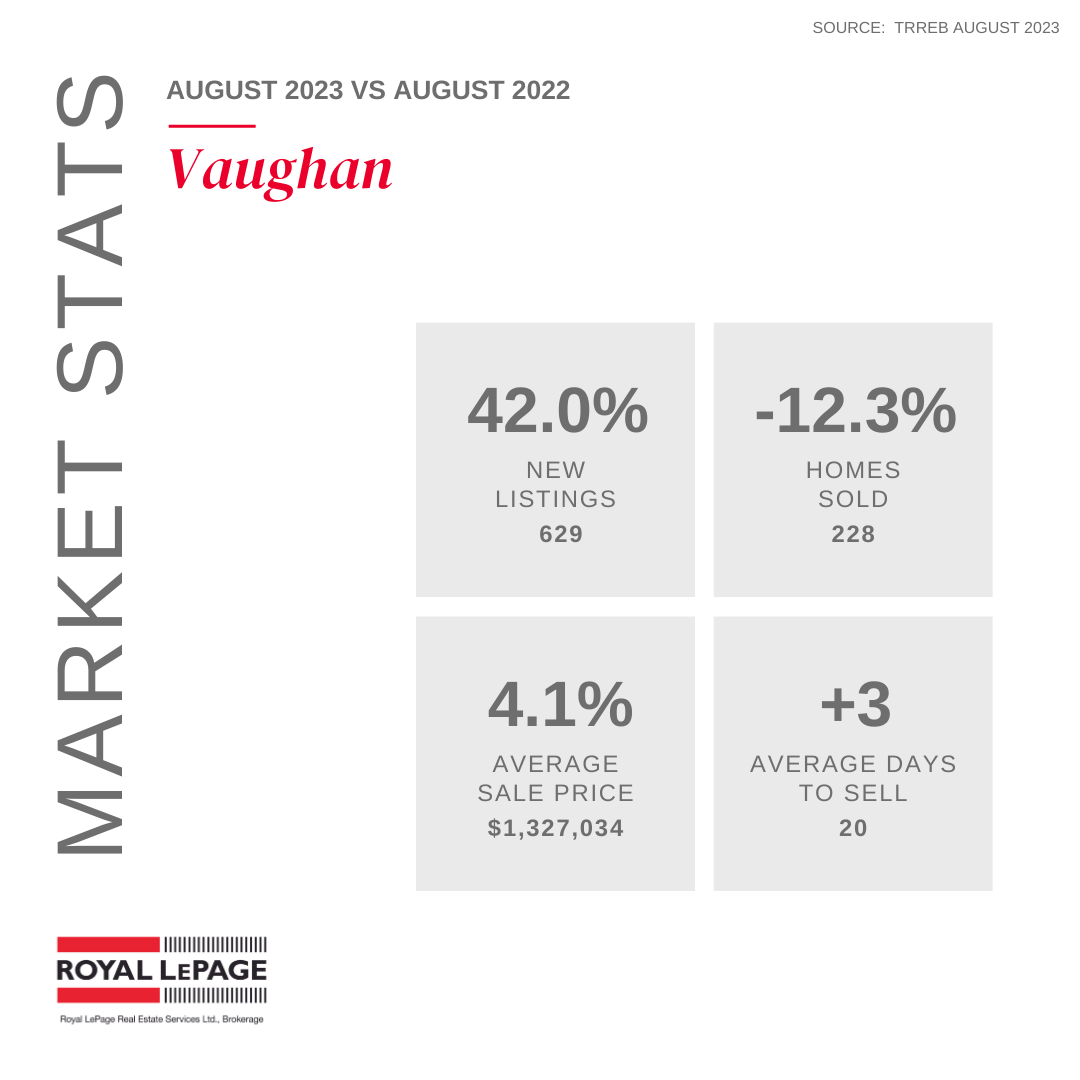

MARKET STATS BY CITY/TOWNS

If you would like to understand how these statistics relate to your specific situation or if you're curious about the current value of your property or your affordability for a new purchase, please don't hesitate to reach out.

If you found this article informative and useful, we kindly ask you to show your support by hitting the "Like" and "Share" buttons. Your engagement is greatly appreciated.

#Augustmarketreport #realestatemarketreport #royallepage #torontoliving #torontomarket #thejunction #highpark #bloorwestvillage #swansea #homesellers #homebuyers #realestatebroker #lubabeleybroker #sellingrealestate #sellingtorontohomes #serviceyoucantrust #workingforyou #lubabeleyrealestateservices #royallepagebroker