As the third quarter of 2023 came to a close, the Greater Toronto Area experienced notable price increases across all home types, culminating in an aggregate average home price of $1,119,428. This marked a monthly uptick of $36,932, marking the first such increase in the third quarter. While prices have maintained their resilience since the beginning of the year, a shift has emerged in the housing market: the resurgence of properties available for sale.

In September, total inventory reached 18,912 active listings, the highest level seen since June 2019. This monthly surge of 3,415 listings represents a 22% increase, the most substantial percentage gain since April 2022.

In September, all major property segments in the GTA showed positive price trends. The GTA's detached housing market saw a significant year-over-year increase of $71,600 or 5%, signifying a rebound from the earlier lows in the year. Similarly, semi-detached and townhouse homes saw price increases of $26,094 and $20,396, respectively, finishing the month with average sales prices of $1,094,074 for semi-detached properties and $1,043,076 for townhomes. The condo market also experienced modest monthly price increases, with values rising slightly by $1,493. These increased prices in September broke the price loss streak that the market had been experiencing since June.

The real estate landscape in the GTA has seen a complex interplay of factors as buyers navigated the challenging environment of rising interest rates over the past 18 months. Buyers and homeowners are now faced with the question of how long these elevated rates will persist. The rise in long-term bond yields, indicating the belief that interest rates will remain at their current levels, has a direct impact on borrowing costs, including mortgages up for renewal. The Canadian real estate market is now adapting to a "higher-for-longer" interest rate environment, where historically low rates may no longer be the norm.

While property prices continue to rebound and the market remains resilient, the surge in available properties and the uncertainty surrounding interest rates have created a cautious environment for both prospective buyers and sellers. The market's response to central banks' announcements and the potential for future interest rate changes underscores its acute sensitivity to broader economic factors. Despite a temporary dip in sales, the month of September witnessed positive price trends across various property segments, further illustrating the demand for housing even in evolving economic conditions.

JUNE 2023 MARKET STATS SUMMARY

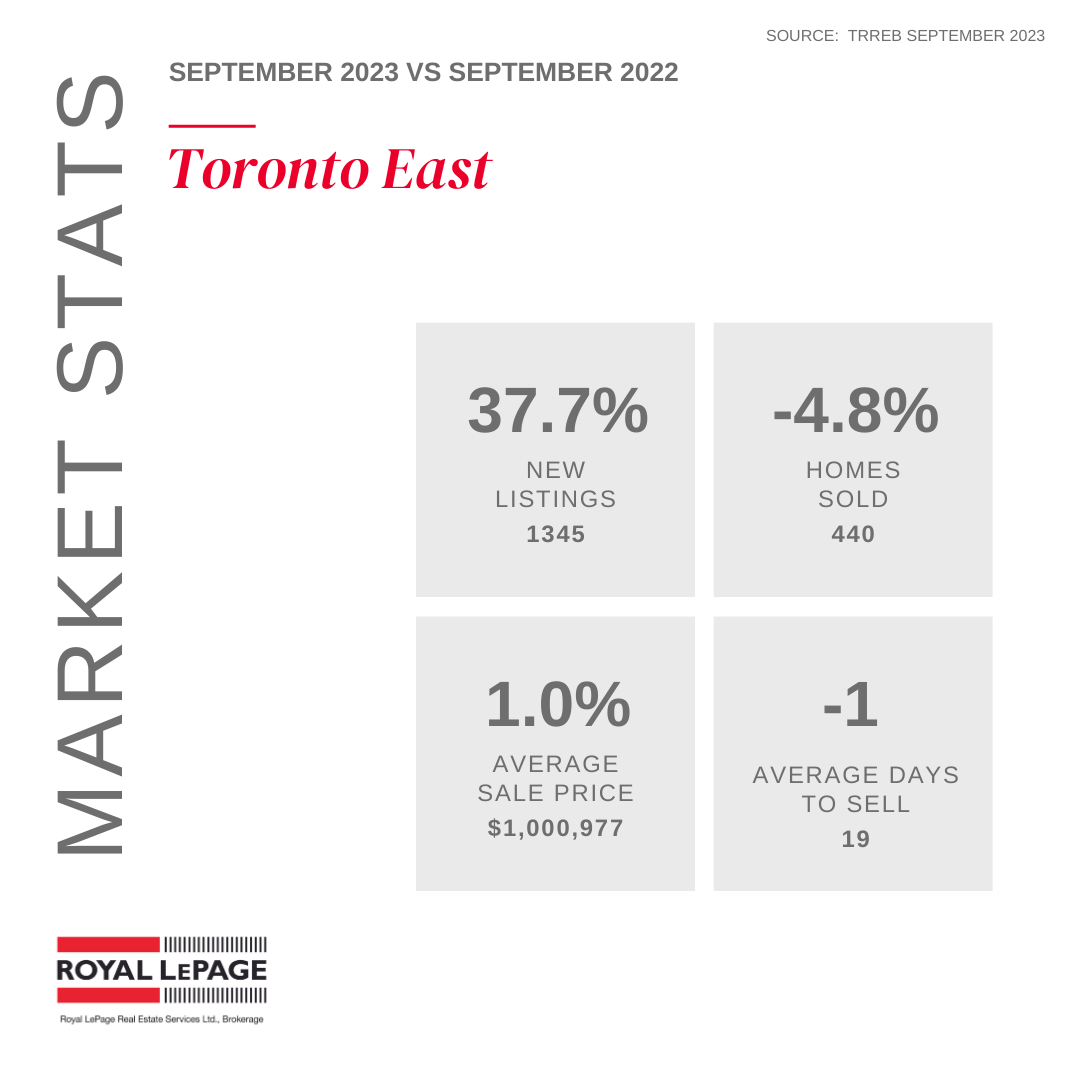

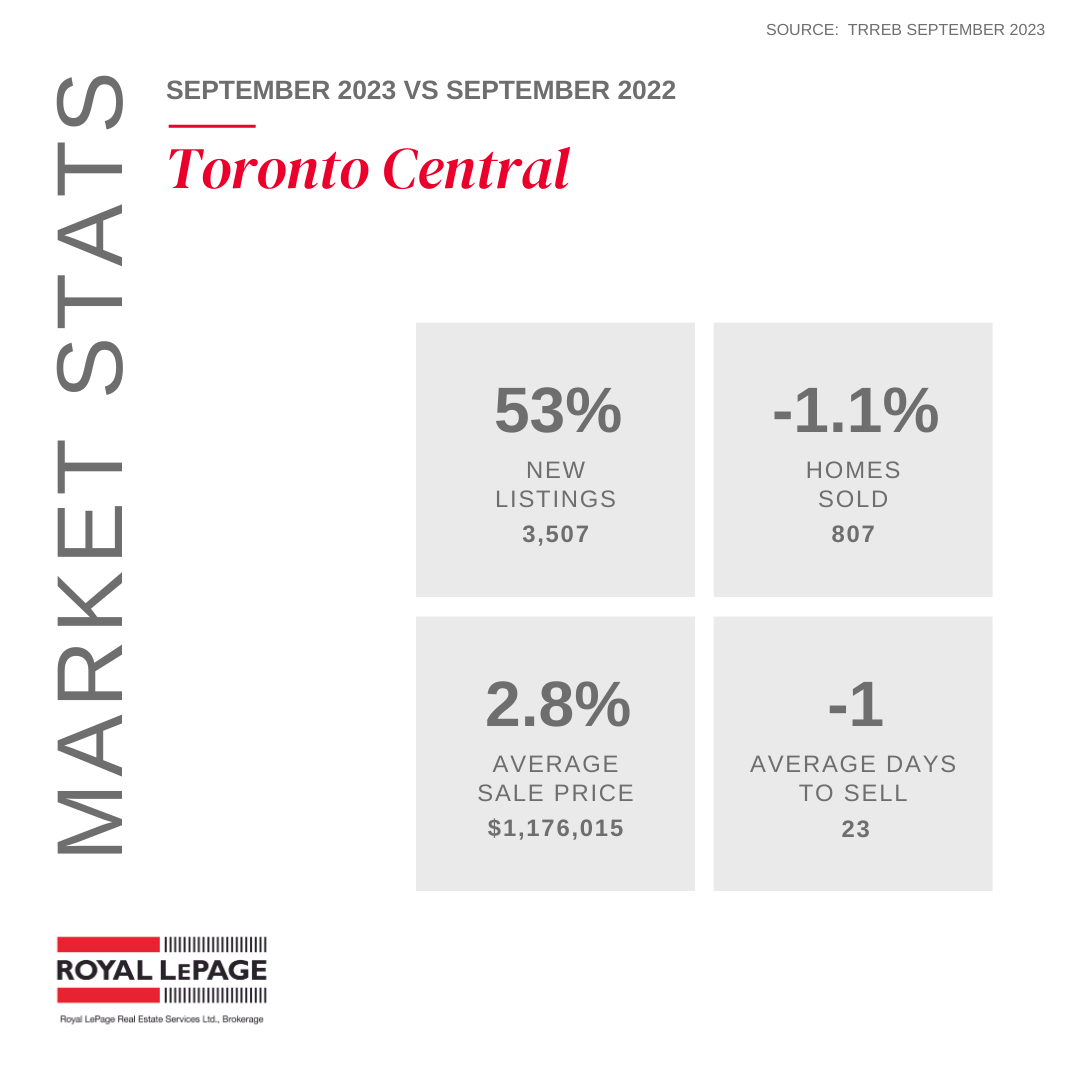

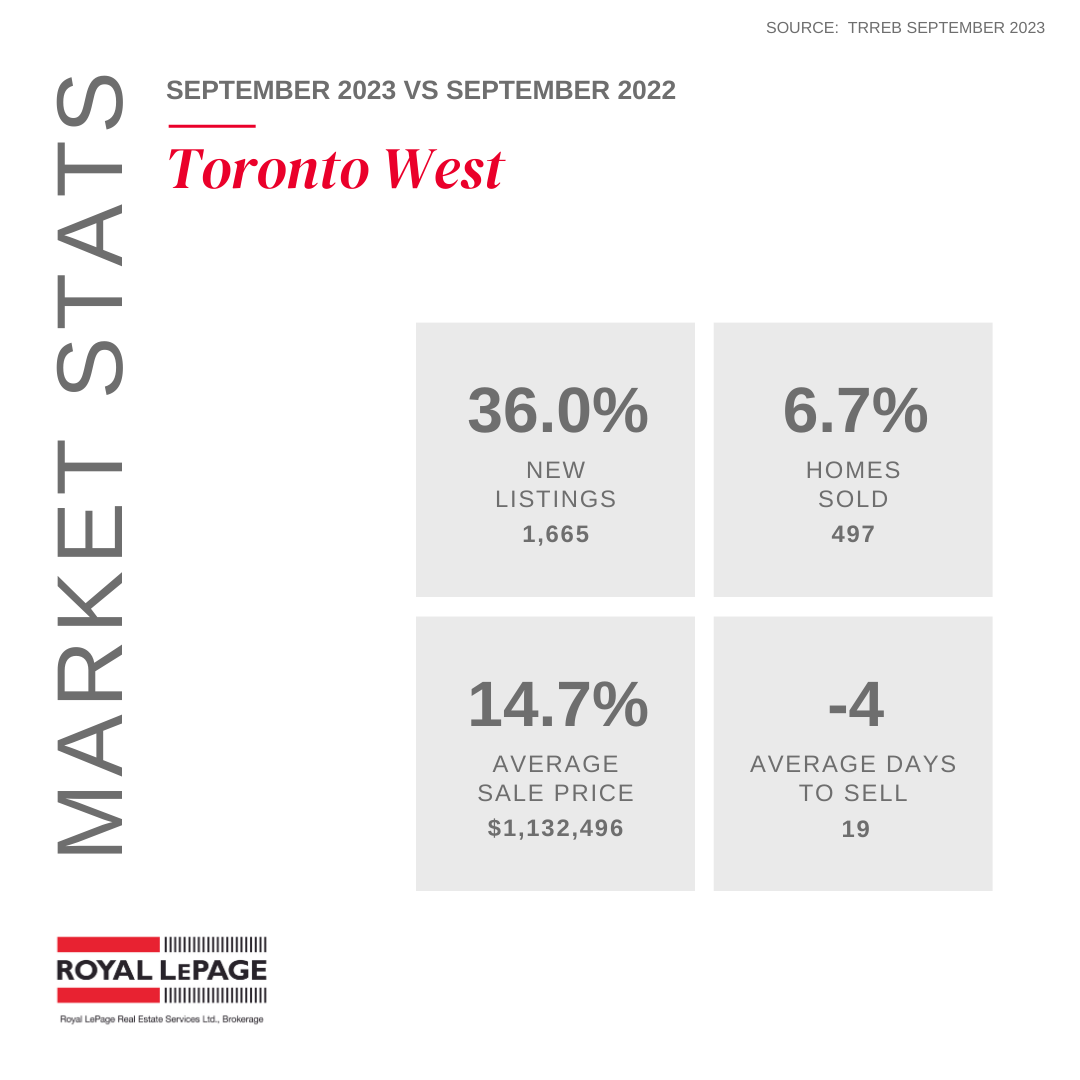

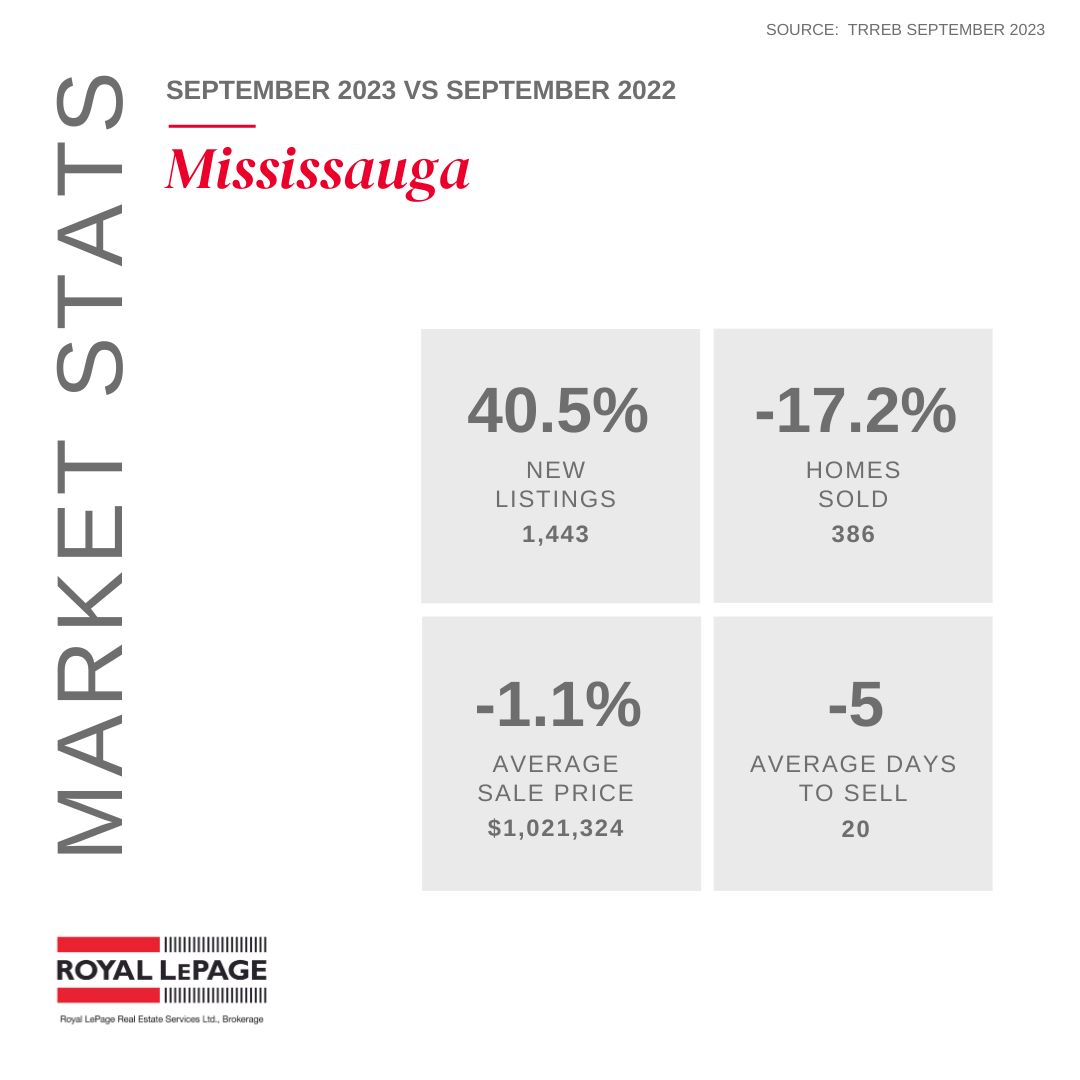

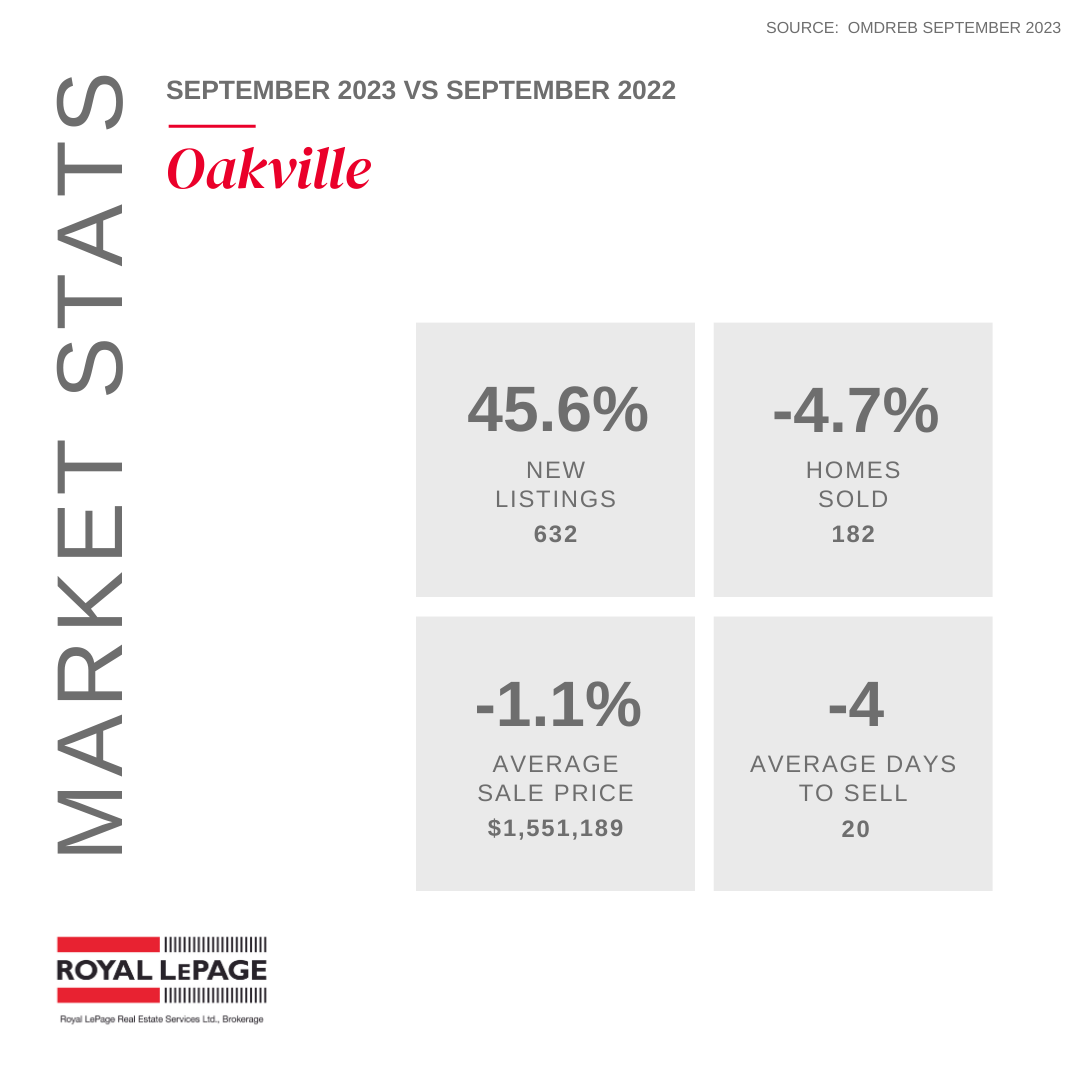

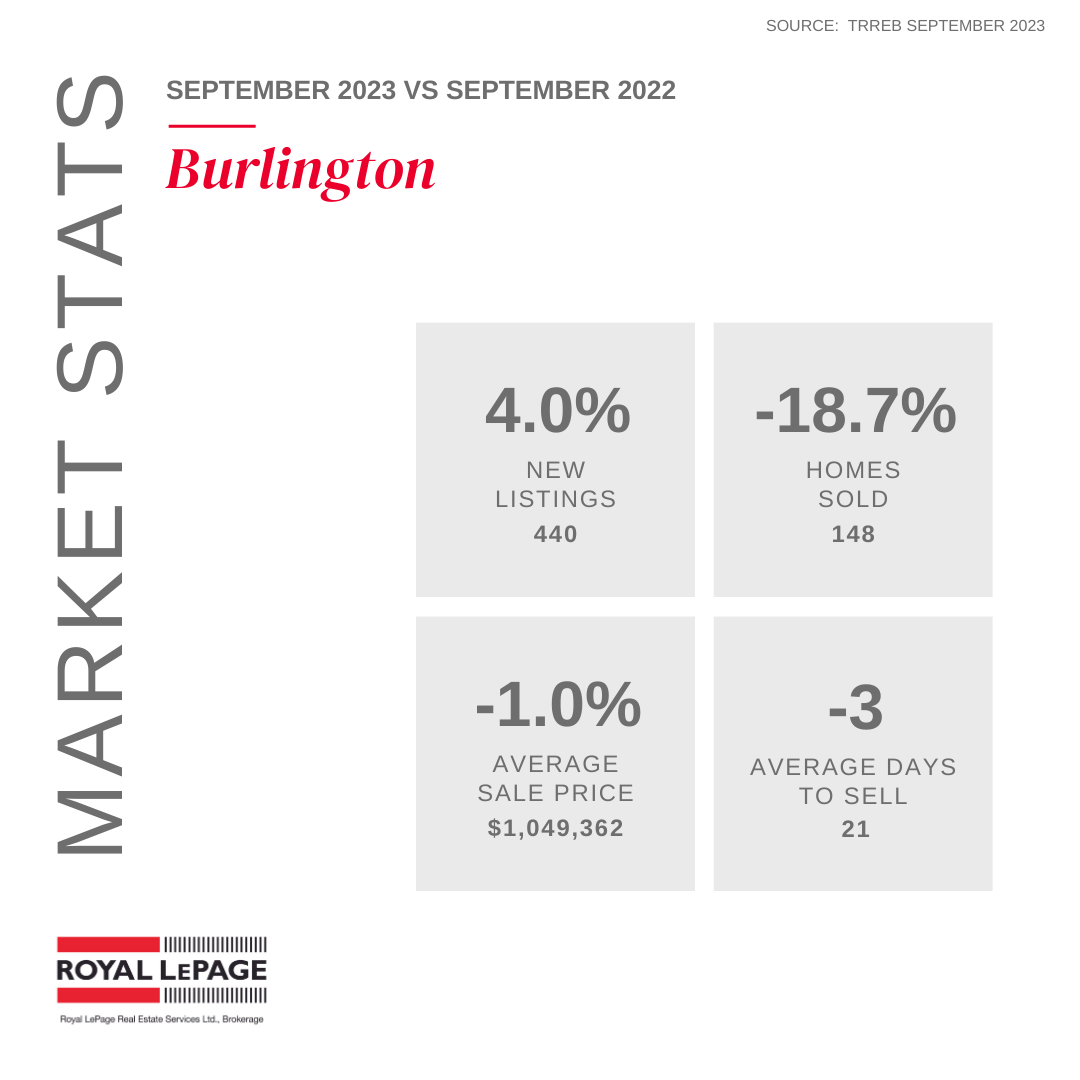

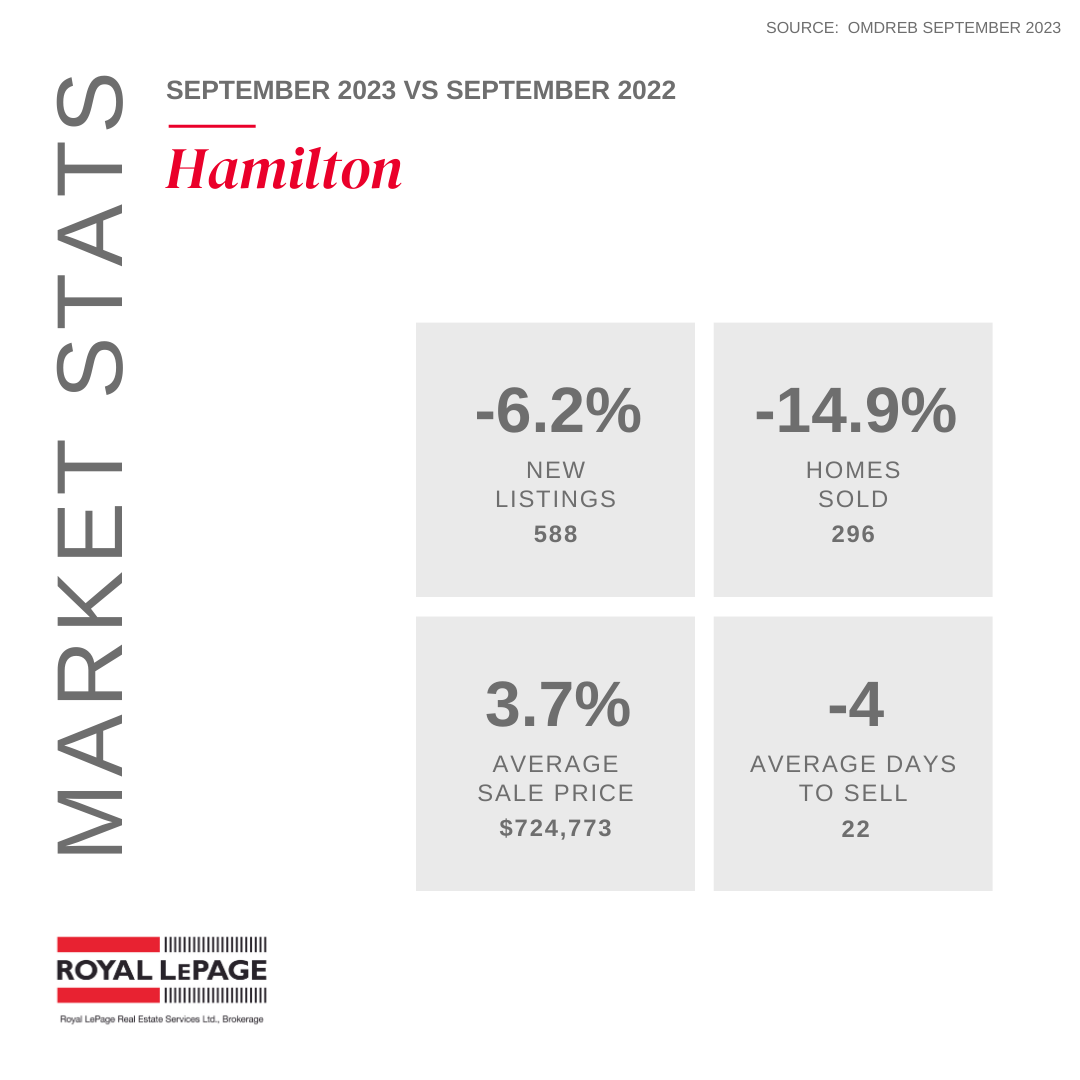

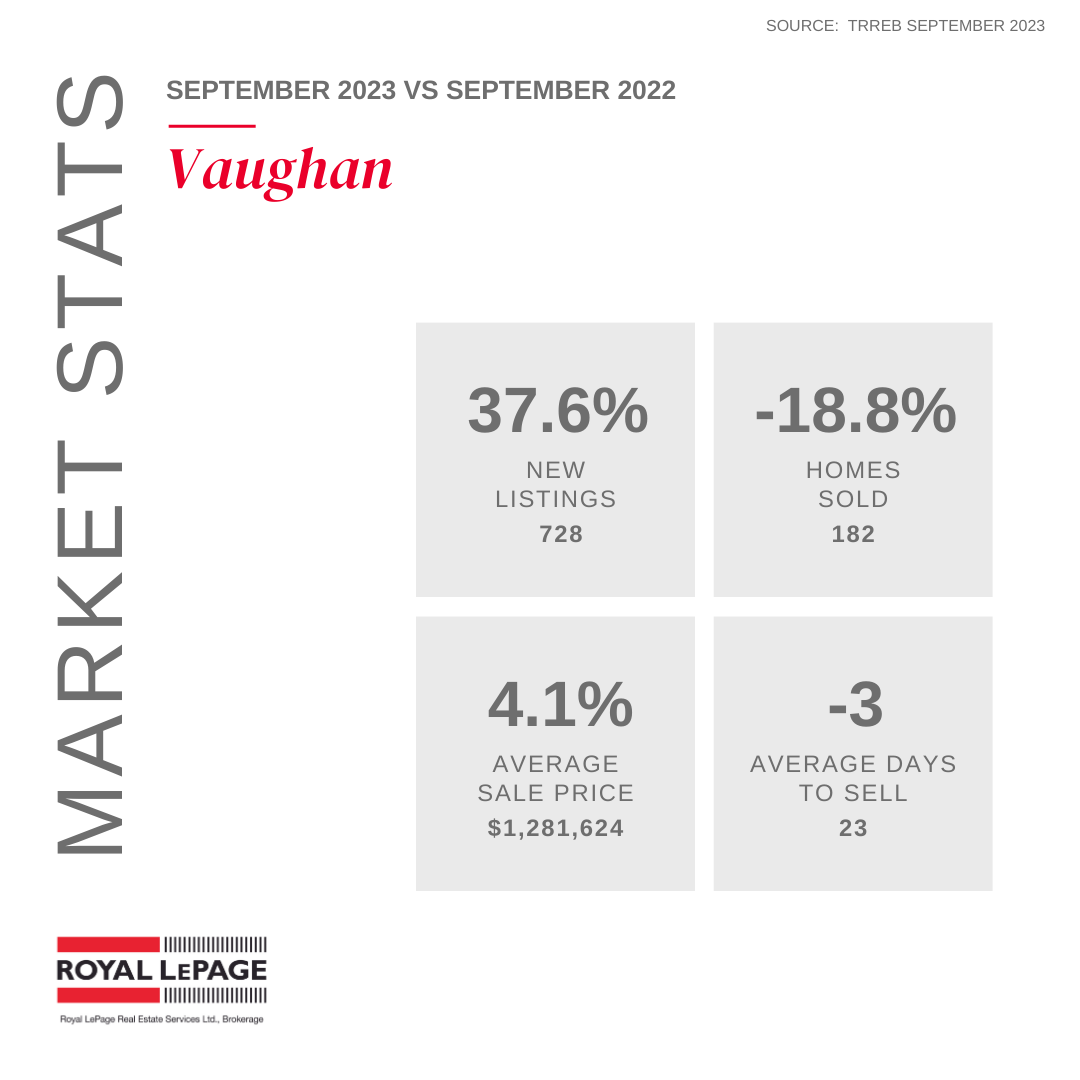

MARKET STATS BY CITY/TOWNS

If you would like to understand how these statistics relate to your specific situation or if you're curious about the current value of your property or your affordability for a new purchase, please don't hesitate to reach out.

If you found this article informative and useful, we kindly ask you to show your support by hitting the "Like" and "Share" buttons. Your engagement is greatly appreciated.

#Septembermarketreport #realestatemarketreport #royallepage #torontoliving #torontomarket #thejunction #highpark #bloorwestvillage #swansea #homesellers #homebuyers #realestatebroker #lubabeleybroker #sellingrealestate #sellingtorontohomes #serviceyoucantrust #workingforyou #lubabeleyrealestateservices #royallepagebroker