April 2023 Greater Toronto Area Market Stats

The real estate market in the Greater Toronto Area is experiencing a surge in demand that is not being met by the limited inventory available. This has led to intense competition amongst buyers, resulting in properties selling quickly and often above the asking price. As a result, the average sale price of homes has increased across all market segments.

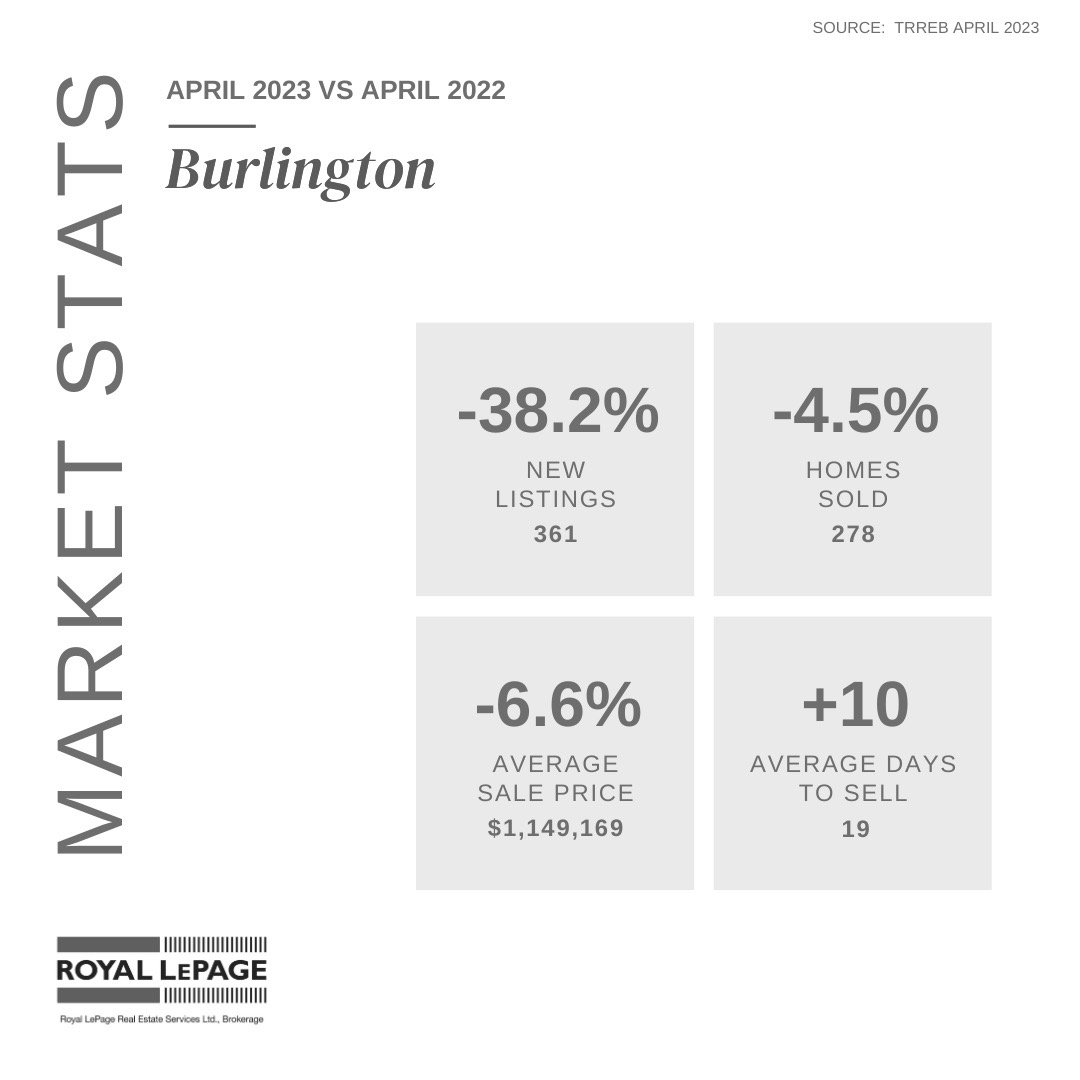

The average home sale price in April reaching an impressive $1,153,269, representing an 11% growth of $114,601 from the recent market low recorded in January.. One of the main drivers of this price surge is the remarkably low inventory levels observed so far this year, as evidenced by the total inventory of 10,373 properties in April, which is down 21% year-over-year and a striking 33% lower than the ten-year April average of 15,421 active listings.

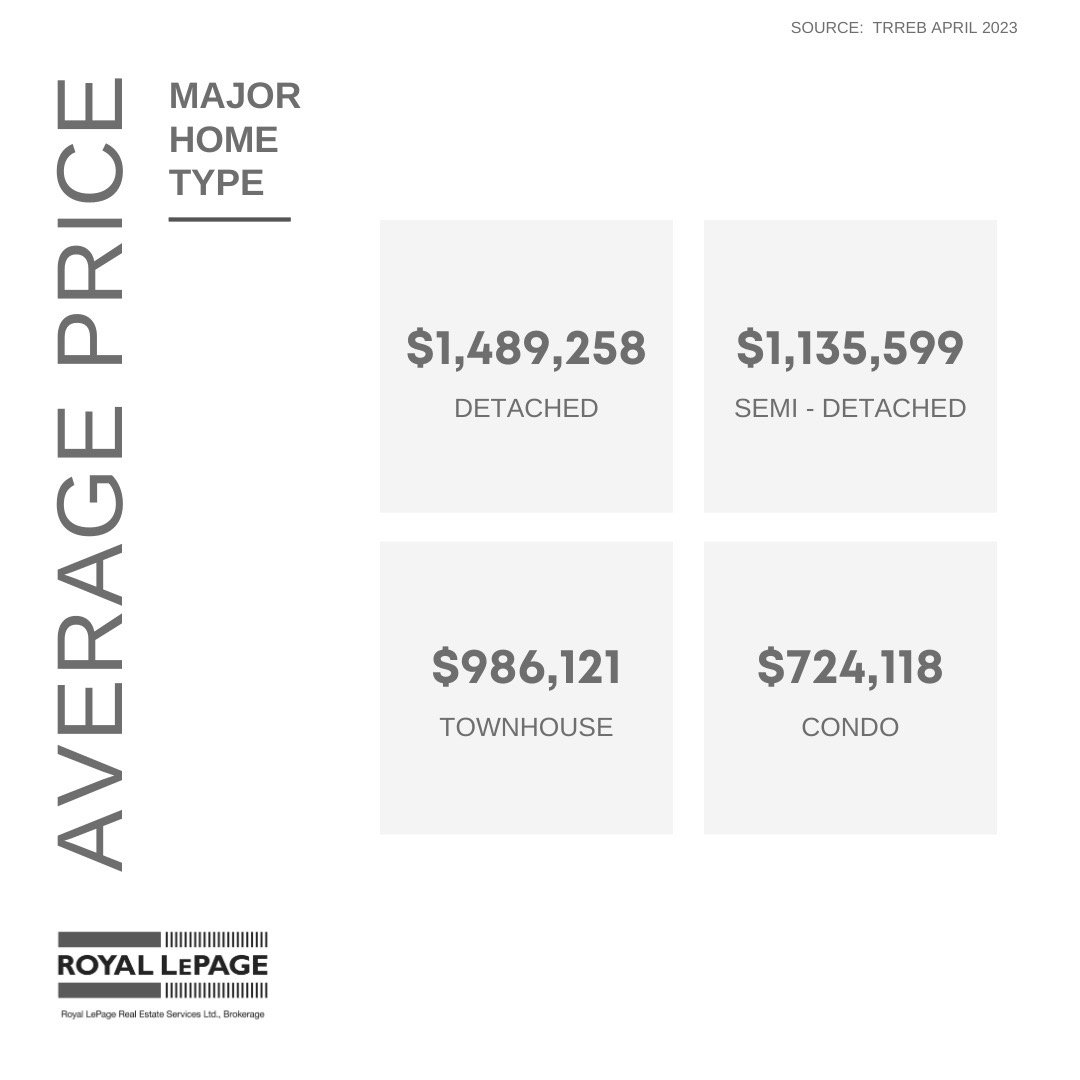

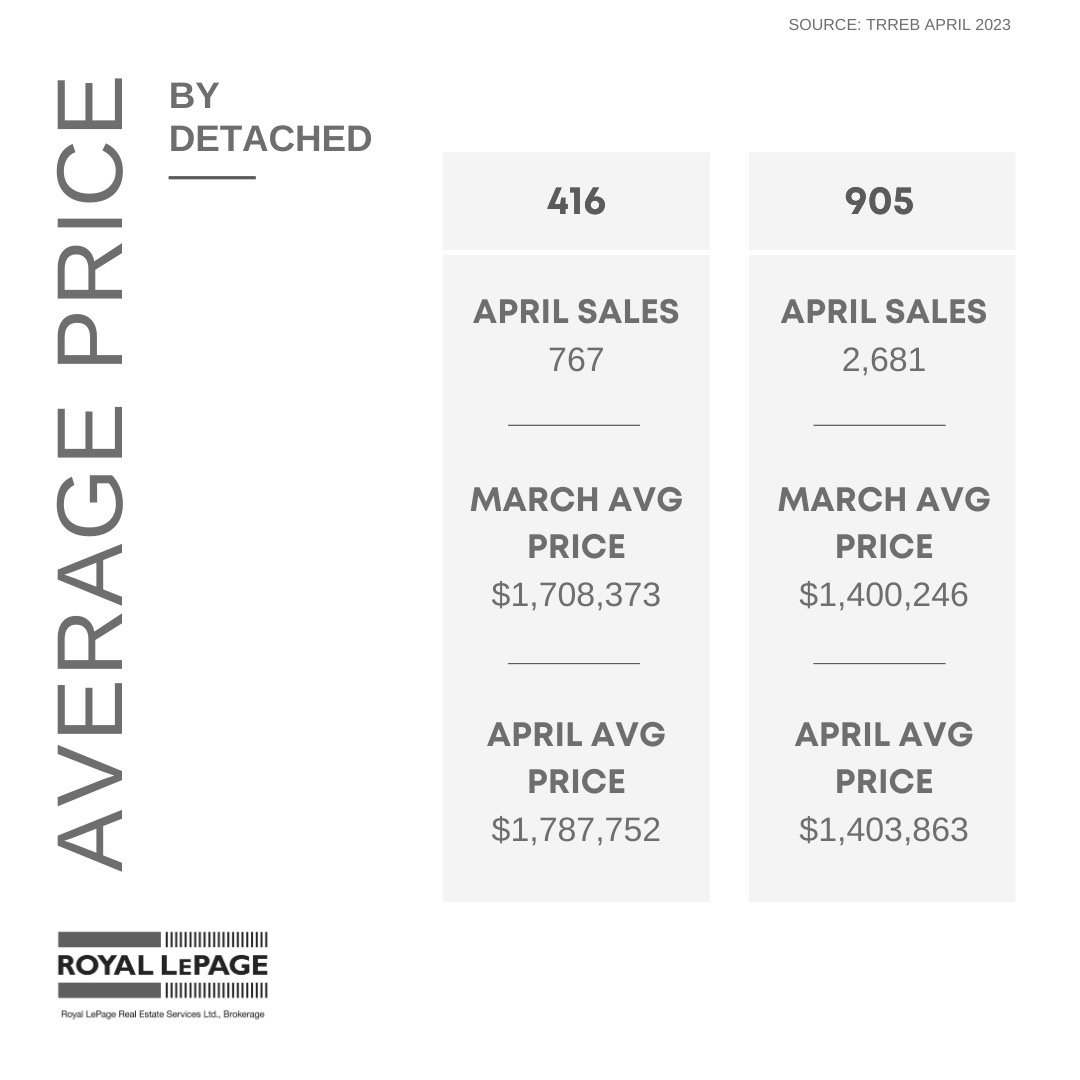

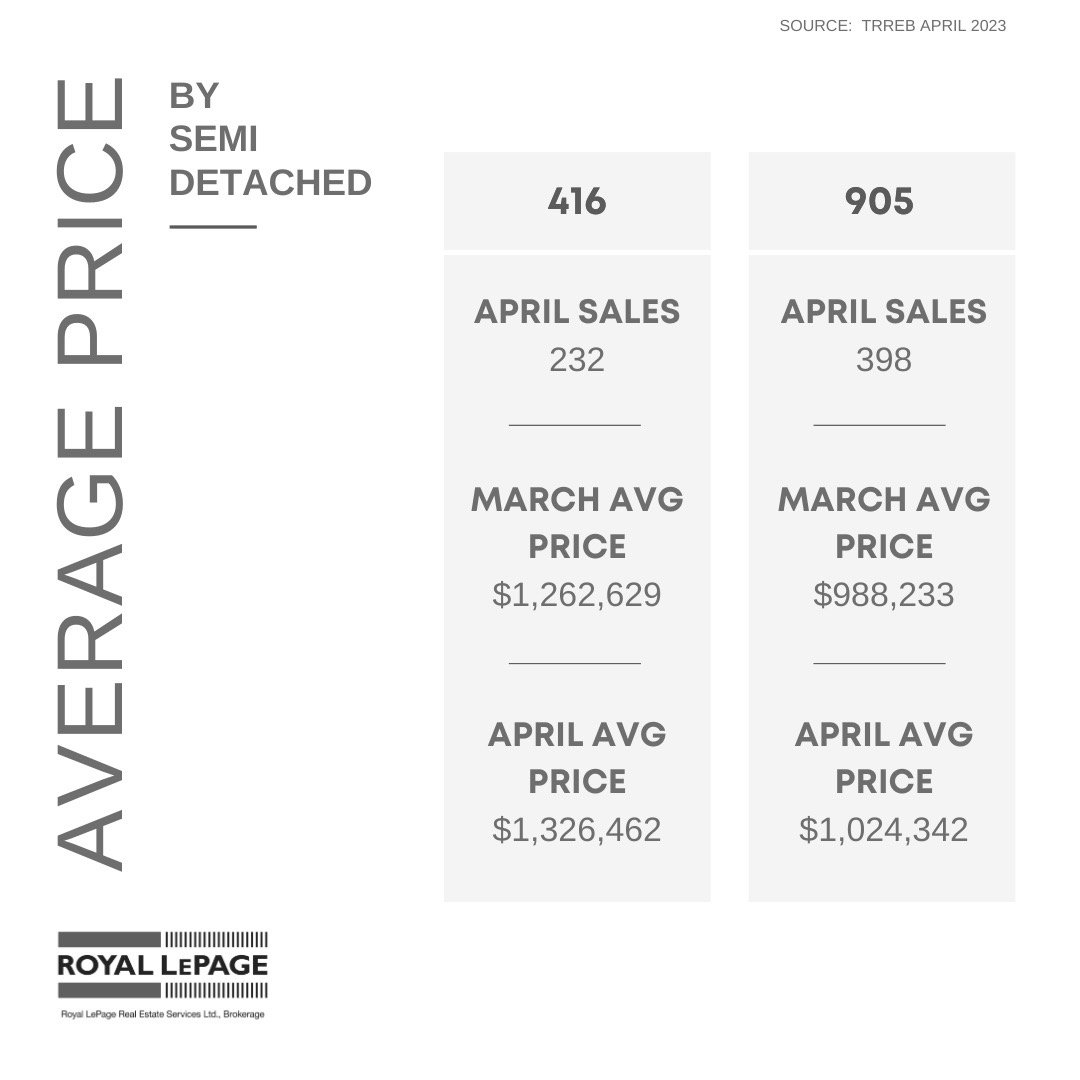

The detached market has seen a rise in the average sales price, which increased to $1,489,258 in April, 11% or $147,410 higher than in January 2023. The low levels of inventory are particularly apparent in the detached market, with only 4,536 active listings, which is down 26% year over year and 43% from the preceding ten-year average for April data. Low inventory is driving buyers to compete over the limited properties that are available. Numerous properties have received multiple offers, leading to a significant decline in the average days on the market, from 27 days in January to just 15 days in April. Properties sold in April were able to achieve 103% on average above the asking price, indicating the intensity of the competition.

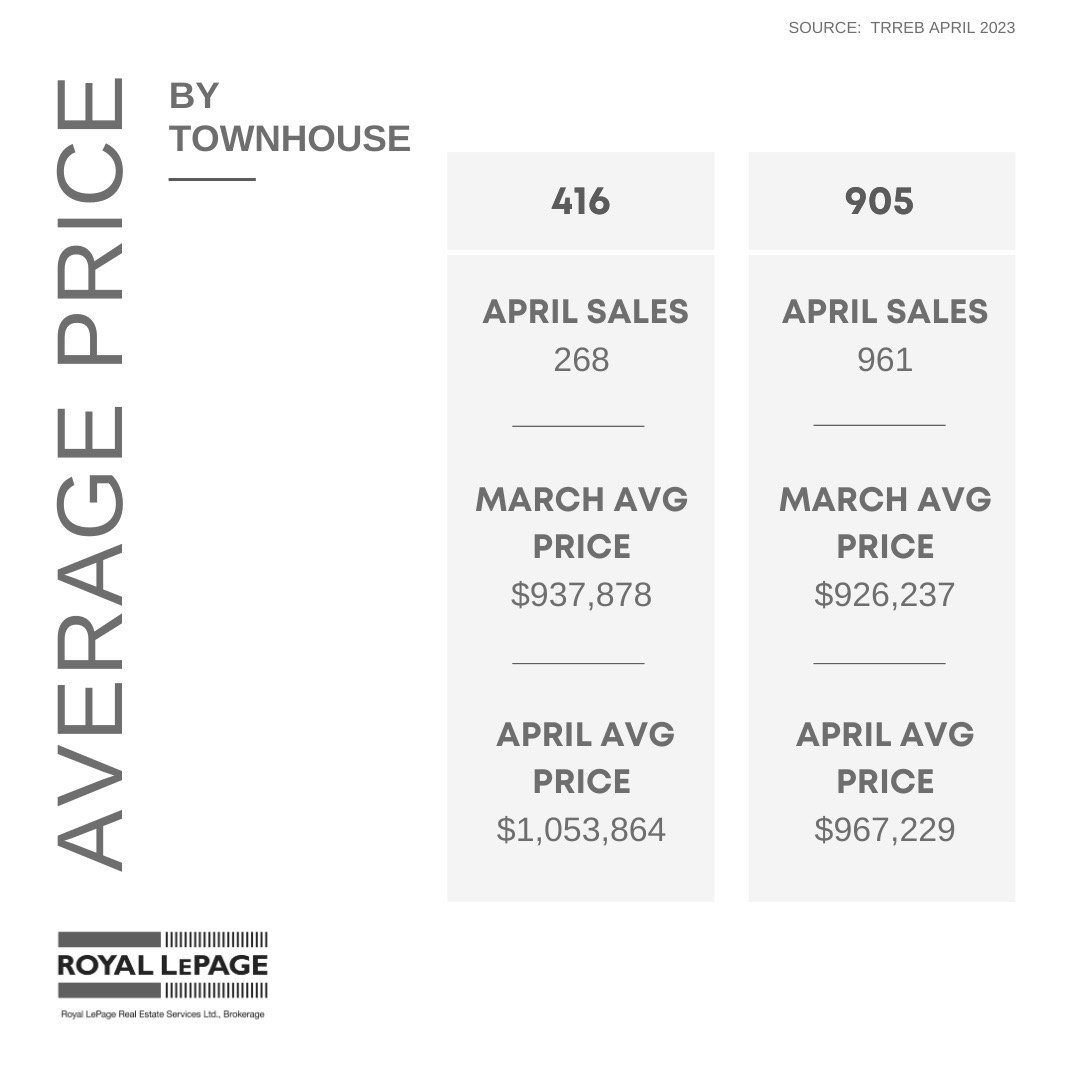

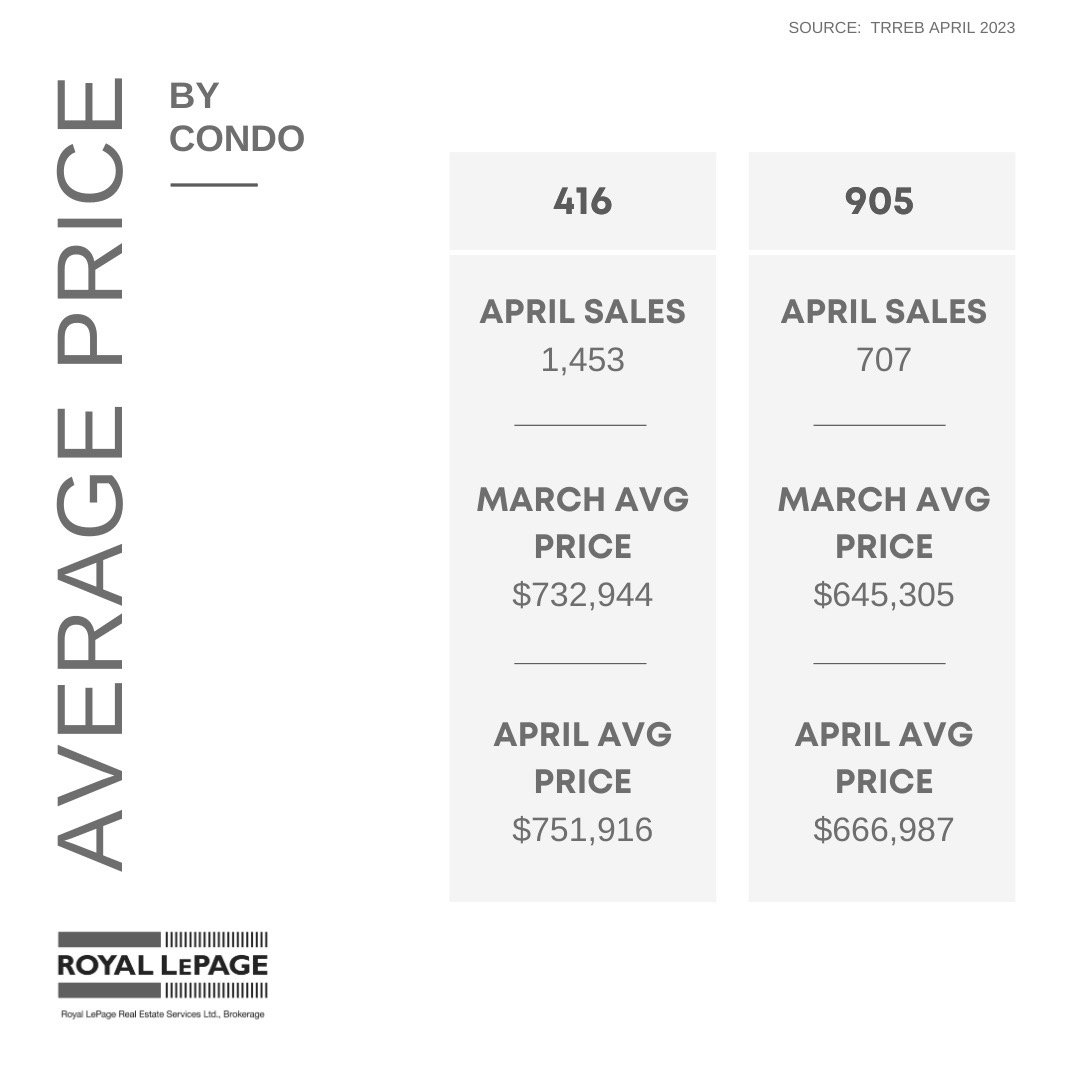

The condo and townhouse markets have also seen average values rise to $724,118 and $1,093,560, respectively. Inventory in both markets is still very low, with only 3,944 condos and 616 townhouses available for sale in April. Nevertheless, this did not deter buyers from being active, as there were 2,160 condo sales in April, the highest sales total since April of 2022, The condo market currently has only 1.82 months of inventory, while the townhouse market has less than 0.96 months' worth of listings available.

As discussed in the recent Royal LePage National release, The Bank of Canada’s overnight lending rate is holding at 4.5 percent. The central bank has indicated that it will maintain the rate at its current level if inflation continues to come down. “This was the signal that so many Canadians were waiting for. The Bank of Canada’s rate hold was the green light that stability is returning to the market, and it has had a swift and significant impact on buyer demand,” said President and CEO of Royal LePage Phil Soper.

These thoughts are echoed by TRREB President Paul Baron, “In line with TRREB’s outlook and recent consumer polling results, we are seeing a gradual improvement in sales and average selling price. Many buyers have come to terms with higher borrowing costs and are taking advantage of lower selling prices compared to this time last year. The issue moving forward will not be the demand for ownership housing, but rather the ability to meet this demand with adequate supply. This is a policy issue that requires sustained effort from all levels of government,” said Paul.

Not only are GTA values trending higher but real estate values nationally have begun to follow suit. While price trends are currently moving upward, there are potential headwinds on the horizon if those with variable rate mortgages run into trouble keeping up with payments that in some cases have doubled over the past year. This could lead to an influx of properties entering the market, which would be a welcome development given the current low inventory levels. If this surge in listings were to materialize, it could halt the current trajectory of price increases. Without more inventory, we can expect price appreciation to continue.

MARKET STATS BY CITY/TOWNS

APRIL 2023 MARKET STATS SUMMARY

MARKET STATS BY PROPERTY TYPES

Housing prices rise month over month for the first time in 10 months

Cost of Canadian housing could finally be tracking back up

The cost of Canadian housing could finally be tracking back up, according to the latest results from a long-running index, but the economist who prepared the report thinks it’s too early to say.

Housing prices in March increased 0.5 per cent from February, the first monthly increase for the index in 10 months, according to the Teranet-National Bank Composite House Price Index released on April 20.

The index tracks the average price of homes sold at least twice in 11 major metropolitan areas: Calgary, Edmonton, Vancouver, Victoria, Winnipeg, Halifax, Hamilton, Ottawa-Gatineau, Toronto, Montreal and Quebec City.

Daren King, an economist at National Bank of Canada who prepared the Teranet report, said most of the increase in March could be attributed to the traditionally strong nature of the spring real estate market, which is when the most houses are sold in Canada.

“It’s the big season (for real estate). That’s what explains most of it,” he said. “I think we will have to wait until after spring to assess if there is a pick up in the real estate market.”

Real estate boards have been touting monthly price and sales gains as signs of a possible revival in the sector.

Earlier this month, the Aggregate Composite MLS Home Price Index rose 0.2 per cent on a month-over-month basis in March, according to a report by the Canadian Real Estate Association (CREA) on April 14. CREA said it was the first increase since February 2022.

And prices in Toronto rose by more than one per cent in March from February, the Toronto Regional Real Estate Board said when it released data on April 5. Real estate boards for Calgary and Vancouver also reported month-over-month increases in home prices.

But once adjusted for seasonality, the Teranet-National Bank index fell 0.8 per cent in March from February.

Seasonally adjusted prices dropped in seven of the 11 cities, led by Victoria’s 4.5 per cent decline. Winnipeg dropped by 2.4 per cent, Toronto by 1.9 per cent, Edmonton by 0.9 per cent, and Hamilton, Quebec City and Ottawa-Gatineau all fell by 0.1 per cent.

The cities bucking that trend include Halifax, up by 2.3 per cent, Montreal (0.5 per cent), Vancouver (0.3 per cent) and Calgary (0.1 per cent).

Spring fever aside, King said a low number of new listings could also be affecting March pricing.

“That is definitely a factor. Probably the (seasonally adjusted) decrease would be bigger than it is right now,” he said. “For the rest of the year, the price decrease will be less than we expect.”

On a yearly basis, the Teranet index fell 6.9 per cent in March from the same time last year, “slightly worse than the previous record contraction recorded during the 2008-2009 financial crisis,” Teranet-National Bank said.

Prices fell the most in Hamilton (13.5 per cent), Toronto (12.1 per cent) and Victoria (8.7 per cent). Housing prices rose in three cities, with Calgary up 7.6 per cent, followed by Quebec City (4.1 per cent) and Edmonton (2.2 per cent).

Teranet also tracks price changes for 20 other cities not included in the index. Among those cities, the largest year-over-year price declines were recorded in Oshawa, Ont., down 19.3 per cent, Abbotsford-Mission, B.C., down 17.7 per cent, and Peterborough, Ont., down 17.2 per cent and Guelph, Ont., down 15.8 per cent.

Seven cities posted price gains, led by Trois-Rivières, Que., up 18.8 per cent, and Sherbrooke, Que., up 12.4 per cent.

“I don’t think the market will go back to more normal transactions with such high interest rates,” King said. “I think it will be a story for 2024 when we are expecting the Bank of Canada to decrease interest rates.”

Toronto condo prices will increase this year, new report suggests

A new report from the Toronto Regional Real Estate Board (TRREB) suggests that condo prices could be set for a rebound later in 2023, despite a double digit decline over the last year.

The report, distributed on Thursday, says condo apartment selling prices were 11.4 per cent lower in the first quarter of 2023 than in the same period in 2022.

Sales, meanwhile, were down 42.9 per cent over the same time period as many prospective sellers and buyers remained on the sidelines amid an aggressive interest rate hiking campaign by the Bank of Canada.

However, strong population growth, combined with a crowded market and a larger number of first-time buyers, will result in “renewed growth” in condo sales for the rest of the year, TRREB says.

“Despite increased interest rates, mortgage payments on a condo are now closer to the cost of renting for a lot of potential buyers. In addition, homeownership has the added benefits of equity growth and asset appreciation over the long term,” said TRREB president Paul Baron in a press release.

The average selling price for Toronto condos in the first quarter of 2023 was $726,664, down from $809,879 during the same period in 2022. But that number is expected to increase as first-time buyers enter the market this year.

The condo-specific forecast from TREBB comes amid some signs of a rebounding market overall.

In April, the average selling price of a home in the GTA hit $1,108,606 compared with

$1,096,519 the month before. Prices were still down 15 per cent year-over-year.

“Based on the expectation that first-time buying activity will increase this year, look for the condominium apartment segment to be one of the recovery leaders in terms of sales and price growth,” said TRREB chief market analyst Jason Mercer.

If you would like to find out what these statistics mean to you, or if you are curious to know how much your property is worth today or how much you can afford to buy, please reach out.

If you found this article helpful please hit "Like" and "Share".

#Aprilmarketreport #realestatemarketreport #royallepage #torontoliving #torontomarket #thejunction #highpark #bloorwestvillage #swansea #homesellers #homebuyers #realestatebroker #lubabeleybroker #sellingrealestate #sellingtorontohomes #serviceyoucantrust #workingforyou #lubabeleyrealestateservices #royallepagebroker