March 2023 Greater Toronto Area Market Statistics

Springtime has arrived for the housing market in the Greater Toronto Area (GTA), where sales prices are trending upward once again. The aggregate average sales price for March settled at $1,108,606, with detached homes increasing to $1,468,651 or a 9.6% rise compared to January. Similarly, townhouses rose to $1,036,571, an increase of 6%. The interest rate environment has stabilized, and previously sidelined buyers have released their pent-up demand on the market, creating a shortage of inventory.

As the first quarter of the year ends, the number of sales have been steadily increasing, and all asset classes are firmly back in a sellers’ market. Townhouses had the highest absorption rate, with 640 sales and only 539 active properties remaining at the end of the month.

The detached market also had an impressive 68% sales-to-listing ratio. While the condo market lags behind other asset classes, the sales-to listing ratio remains at an impressive 54%, the highest since April 2022.

Overall, the GTA is currently experiencing an absorption rate of 68%, double the rate of January.

There were 6896 total sales across the GTA in March. The condo market had the largest month-over-month sales increase, with 2,121 transactions or an increase of 46%, closely followed by the detached and townhouse markets, which also experienced monthly sales increases of 45% and 38%, respectively.

The shortage of available properties is heavily contributing to the decrease in sales activity as compared to previous years. Due to a lack of supply, multiple offers have become prevalent across the GTA again. If sellers remain on the sidelines, sales totals will continue to be lower than historical averages. However, sellers willing to list will be feeling like the belle of the ball, with a number of suitors looking to purchase.

“As we moved through the first quarter, Toronto Regional Real Estate Board (TRREB) Members were increasingly reporting that competition between buyers was heating up in many GTA neighbourhoods.

The most recent statistics bear this out,” said TRREB President Paul Baron. “Recent consumer polling also suggests that demand for ownership housing will continue to recover this year. Look for first-time buyers to lead this recovery, as high average rents move more closely in line with the cost of ownership.”

The GTA housing market has been able to withstand a rapidly rising interest rate environment with great aplomb, which bodes well for the future of the Canadian Real Estate market, according to Royal LePage President and CEO Phil Soper “Eight times a year, the Bank of Canada announces changes to its key interest rate, and for eight consecutive meetings, they aggressively raised rates in an effort to tame runaway inflation.

On March 8th, 2023 they did nothing and doing nothing was a very big deal,” said Soper. “Based on our just-completed national survey, this was the signal that many Canadians were waiting for – an indication that it was safe to wade back into the housing market to search for the family home they so desperately want or need.”

The survey found that more than a quarter (26%) of Canadians who put their home purchase plans on hold over the last year due to rising interest rates will resume their search this spring, following the Bank of Canada’s announcement last week to hold the overnight lending rate at 4.5%.

Meanwhile, more than one third (36%) say they plan to move forward with their buying intentions, but will wait for the central bank to maintain the current rate for several consecutive months.

With the resurgence of multiple offers, sellers should be increasingly motivated to list their properties, as the downward pressure on sale prices has seemingly dissipated. Property values in the Greater Toronto Area (GTA) have not only stabilized but have also witnessed substantial gains since the beginning of the year.

Looking ahead to the rest of 2023, barring any significant increases in interest rates or unemployment numbers, this upward trend is expected to persist.

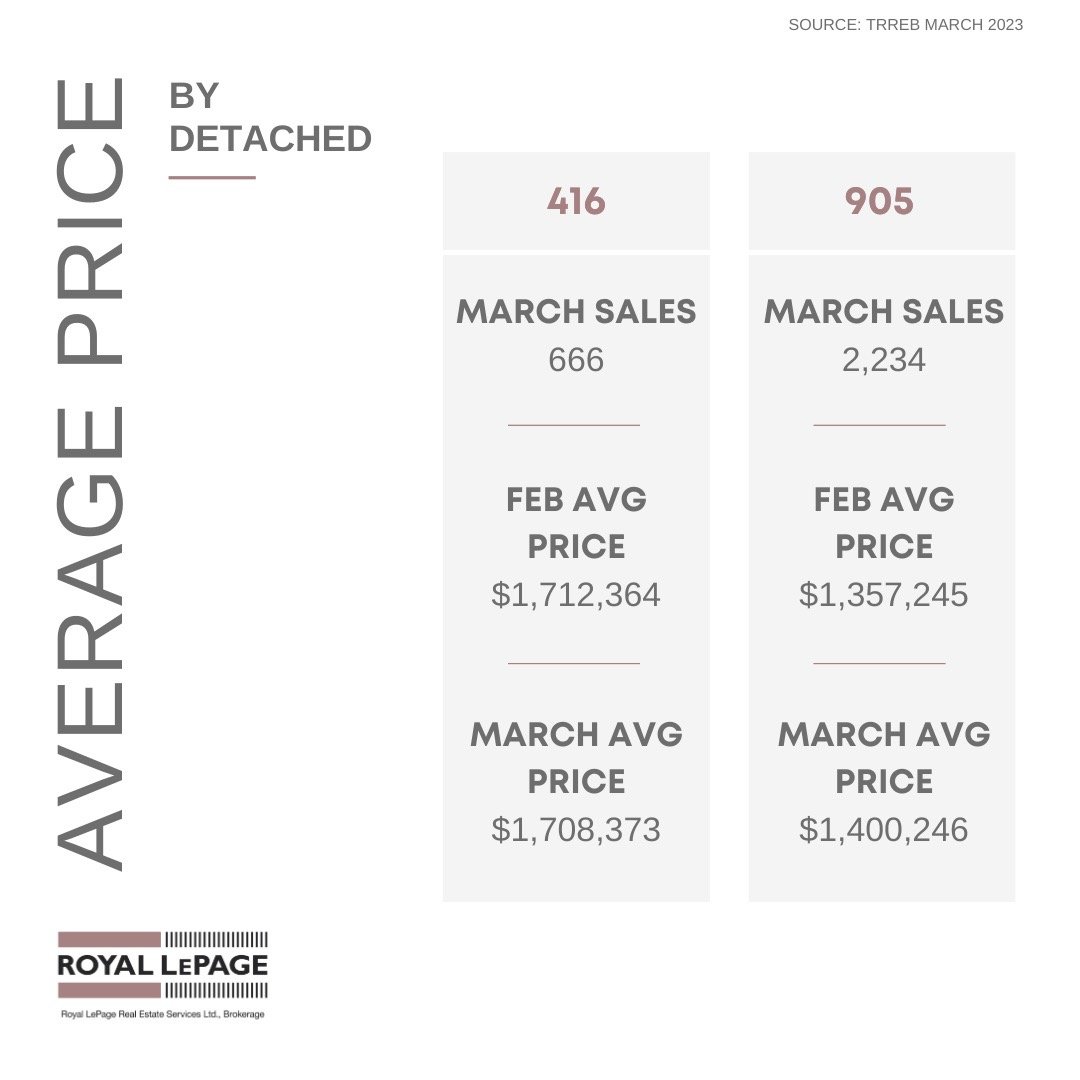

The gains in property values were observed across all asset classes, with the detached market realizing an impressive uptick of 7.2%, resulting in an average sales price of $1,439,735, the largest increase since January 2022.

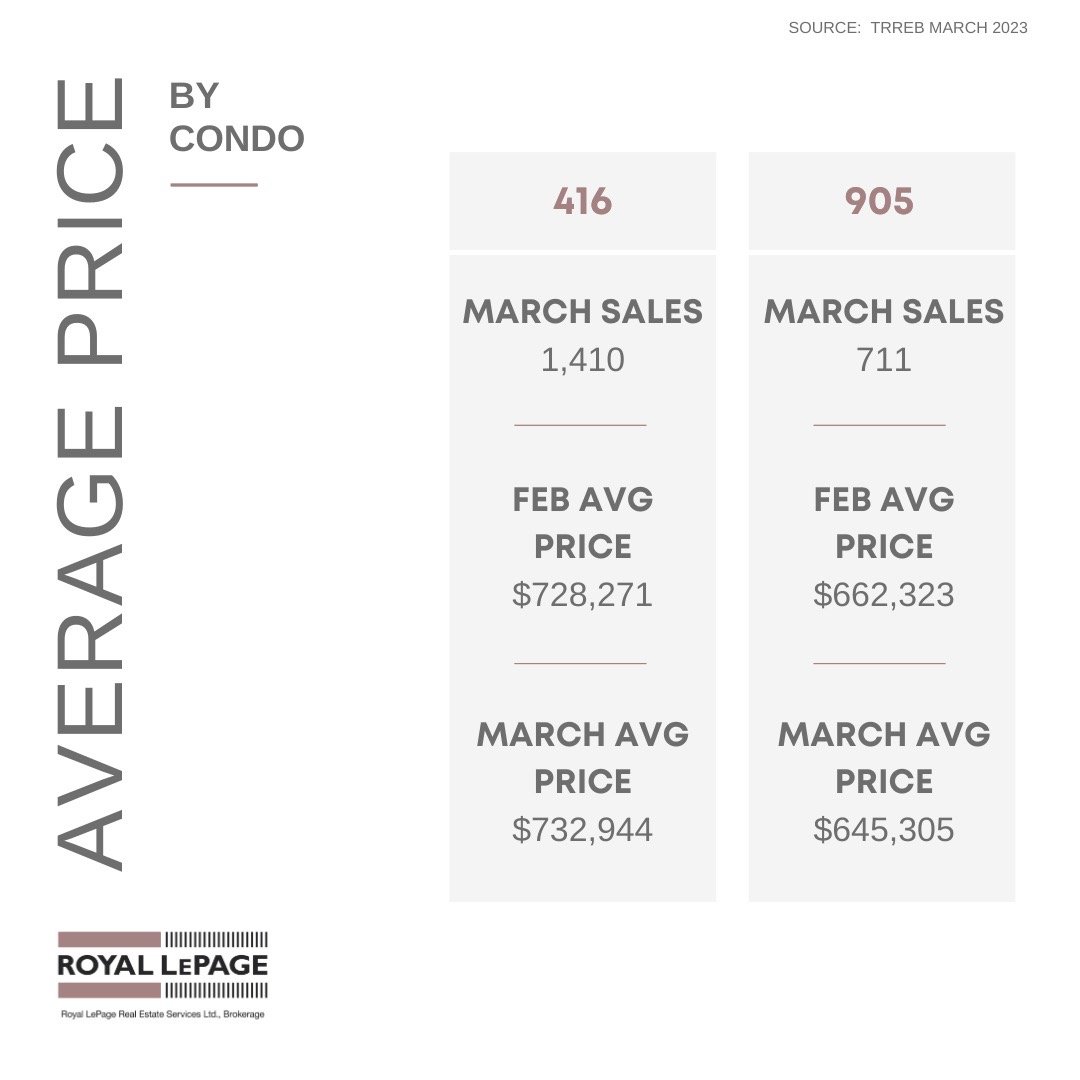

Similarly, the condominium market increased month-over-month with an appreciation of 2.5%, translating into a final average sales price of $705,472 for the month of February. Pressure on inventory led to a substantial drop in average days on market which now sits at 22 days, the lowest since August 2022.

Market activity also increased, as evidenced by a substantial improvement in both sales and inventory in comparison to January. The number of properties sold reached its highest level since November 2022, with 4,783 homes changing hands.

Concurrently, inventory levels continued to rise, with 9,643 active listings across the GTA's housing market. That said, transactions continue to lag as compared to the level of activity we have seen over the past several years.

As fewer homes change hands, demand from those who in the medium-term anticipate participating in the housing market continues to build.

The positive March data bodes well for the rest of 2023 and beyond, indicating the return of stability and significant demand that will propel the market higher as consumer confidence continues to rise. As we move into the spring, more inventory will be welcomed by eager buyers who have been stymied by an ultra-low inventory environment.

“Views on real estate have consistently been a foundational element in consumer confidence,” said Nik Nanos, chief data scientist of Nanos Research. “Although not returning to the exuberant levels from a year ago when the housing market was red hot, the weekly tracking is seeing the beginnings of a potential positive trajectory.”

As the trajectory of the market moves in a positive direction and sale prices start to tick upward, we anticipate more sellers re-entering the GTA housing market in the coming weeks.

MARKET STATS BY PROPERTY TYPES

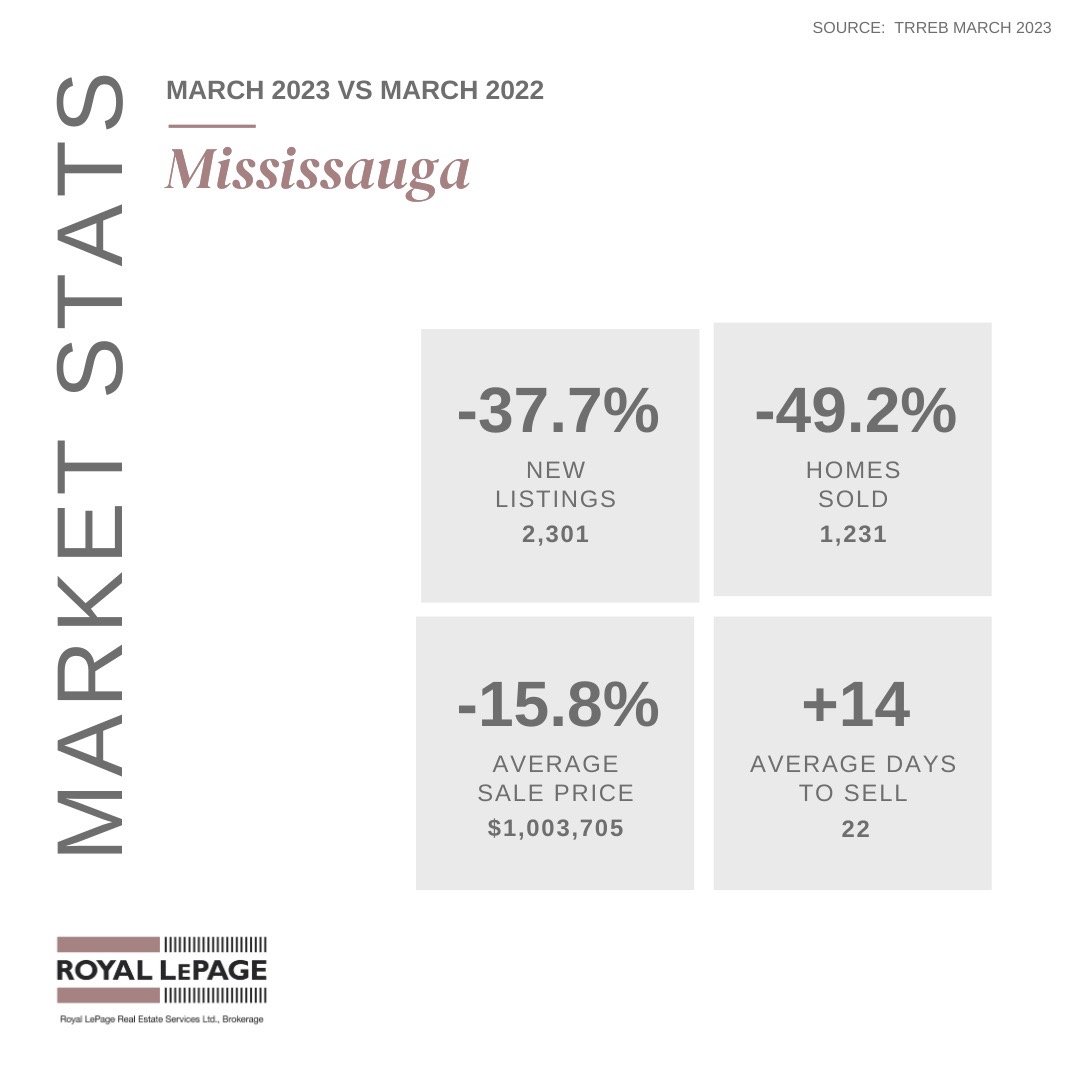

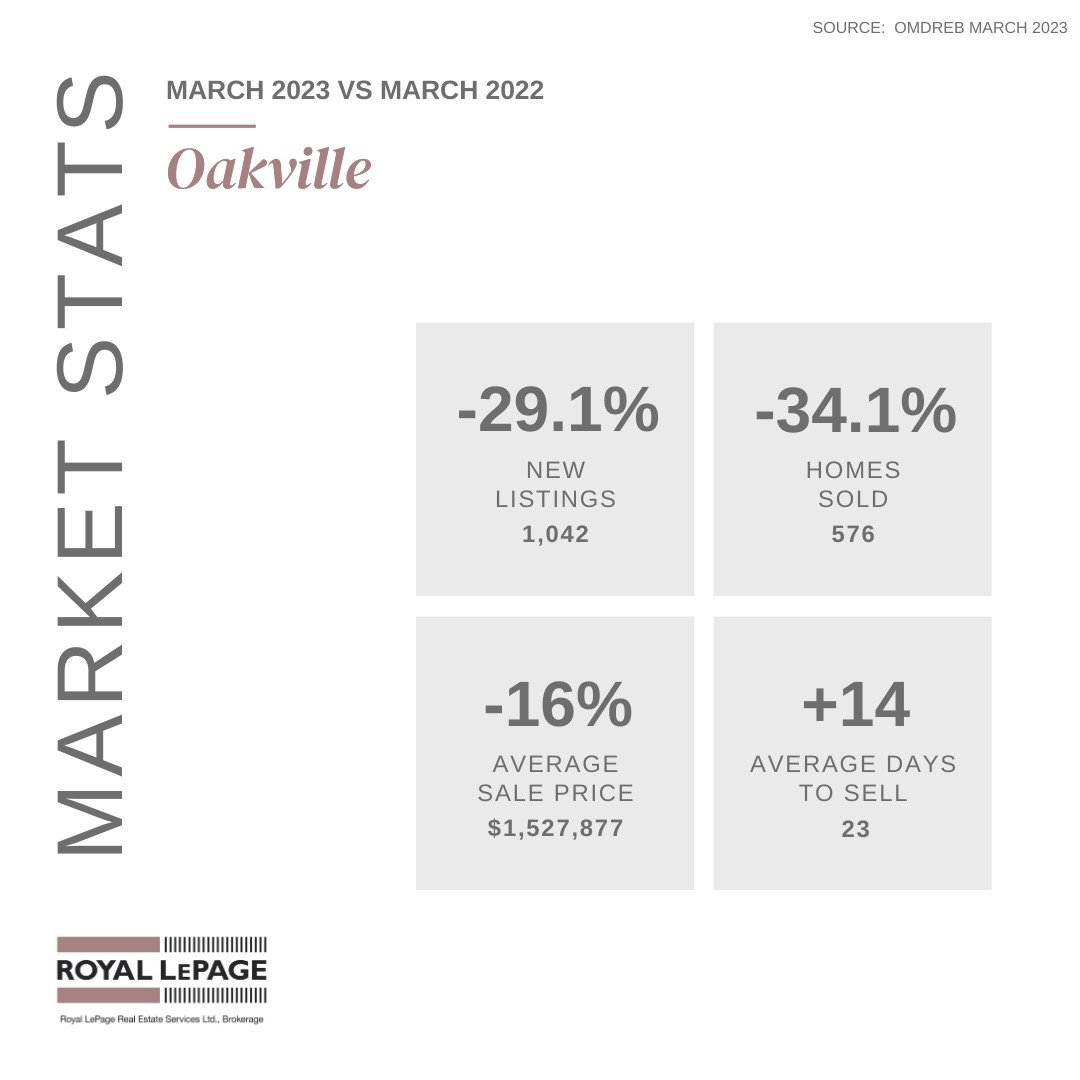

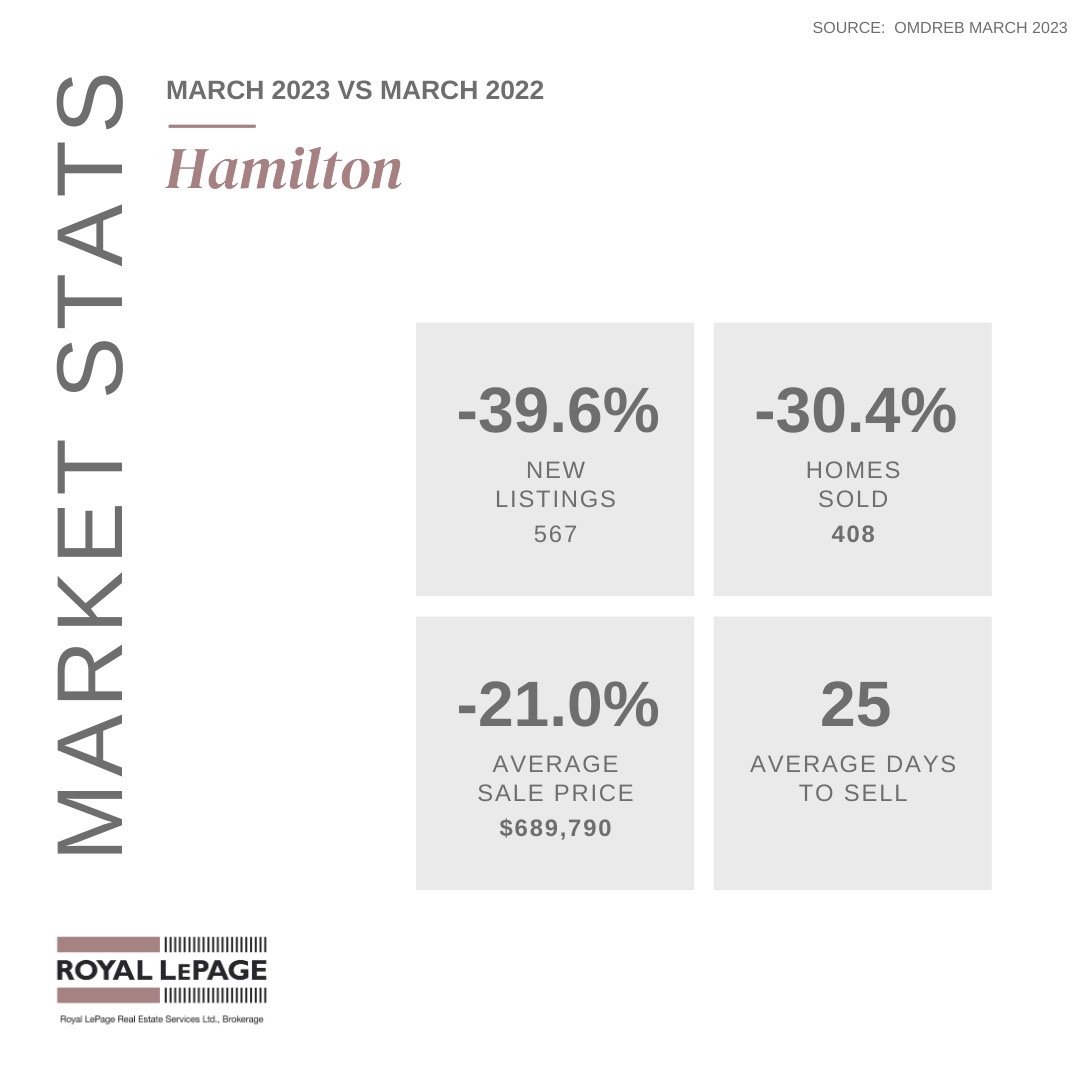

MARKET STATS BY CITY/TOWNS

LACKIE: The real estate market is rallying but WHY?

A few weeks back, I went out on a limb and said that all signs were pointing to the fact that the real estate market was waking back up again.

I spoke of houses selling in multiple offers a day or two after going to market. Colleagues around the water cooler who were telling me of clients coming back in out of the wind, ready to think about real estate again.

Buyers were showing a willingness to come in off the sidelines, I said. Could it be that they think the worst is now over?

Well, turns out that theory of mine wasn’t just born of “hopium” — incidentally, my new, most favourite word to come out of the past few months of real estate downtime.

No, no. Hopium be damned — the real estate market is alive again.

By Wednesday of last week — the first days post-March break, which is unofficially the start of the spring market — I personally witnessed four midtown houses go within hours of being listed.

What might we glean from that?

Could it be that people are feeling optimistic?

Clearly consumer sentiment has improved. Though if a year ago someone had told me there could be excitement at seeing rates creep just below 5%, I would have told them to give their head a shake.

But those rates have clearly started to normalize.

Assisted by the fact that markets are evidently now considering the banking meltdown south of the border may serve to bring about the great pivot sooner than late-2024 as consensus had previously thought. Even the permabears seem to acknowledge we are witnessing a rally of sorts.

And while it’s hard to know why, the reality is that life will always go on.

The three D’s of real estate — death, divorce and debt — are immune to consumer sentiment. And with record lows in transaction volume, there is without a doubt pent up demand waiting to greet spring.

But this appears to be more than that. This seems to also relate to a belief that the worst is now over and while it has certainly been bumpy, better days lie ahead.

But why is that?

I often hear people say Canada is way too dependent upon our housing market to ever let it fail. Of all the G7 nations, Canada is the most indebted with Canadians taking on far more household debt than our G7 peers.

It seems the takeaway from that should-be sobering reality has done less to inspire people to reconsider their comfort levels with debt and more to reaffirm their entrenched belief that it’s probably safe to keep going as we are too big to fail.

The notion of moral hazard comes to mind. Simply put, it’s the idea that one is less likely to guard against financial risk if one believes they are to be protected from potential consequences.

Here we have spent the last year weathering the storm of a real estate bubble bursting and while it has certainly been unpleasant, even painful, most people seem to be okay.

They may now have 80-year amortizations on their mortgage with payments barely covering a dime of principal, but they’re still standing and this too shall pass.

But really, does anyone born after 1980 actually believe they’ll ever be mortgage free? Or are we the generation that was forced to rethink our understanding of homeownership from one of pay-it-down-as-fast-as-possible to that of find-a payment-that-works as you build equity enough to ascend to the next rung. And repeat.

For many, the fact they are in the market at all feels like a penultimate win given the number of surveys that show the extent to which more recent generations feel shut out of the market entirely.

Being mortgage free must seem like pure Boomer fantasy; we should just be happy not to have to live as renters at the mercy of financialized real estate.

And, of course, the fact that it took so long for the Bank of Canada to step in and raise interest rates in the midst of a rapidly inflating housing bubble has led to questions about how insulated it can really be from wider political pressures.

With that in mind, it’s hard not to think that influence is now baked in. Will our government really allow the housing market to collapse?

Seems many believe not. And honestly who could blame them.

Source: https://torontosun.com/opinion/columnists/lackie-the-real-estate-market-is-rallying-but-why

If you would like to find out what these statistics mean to you, or if you are curious to know how much your property is worth today or how much you can afford to buy, please reach out.

If you found this article helpful please hit "Like" and "Share".

#Marchmarketreport #realestatemarketreport #royallepage #torontoliving #torontomarket #thejunction #highpark #bloorwestvillage #swansea #homesellers #homebuyers #realestatebroker #lubabeleybroker #sellingrealestate #sellingtorontohomes #serviceyoucantrust #workingforyou #lubabeleyrealestateservices #royallepagebroker