The rate of increase in Toronto home prices continues to outpace that of the 905 regions, particularly in the higher density home types. The price of a detached home in Toronto was roughly 50% higher than in the suburbs on average in September. Two years ago the price of a detached home in the City was approximately 40% higher than one in the suburbs. Compare that with condo prices in the City, which two years ago were about 20% more expensive than in the suburbs, but in September, 2018 are now almost 35% more expensive, as seen in the chart below. The average price of the 6,455 homes sold in the GTA in September was $796,786, 2.9% higher than the average of $774,489 a year earlier when 6,334 units were sold in the GTA.

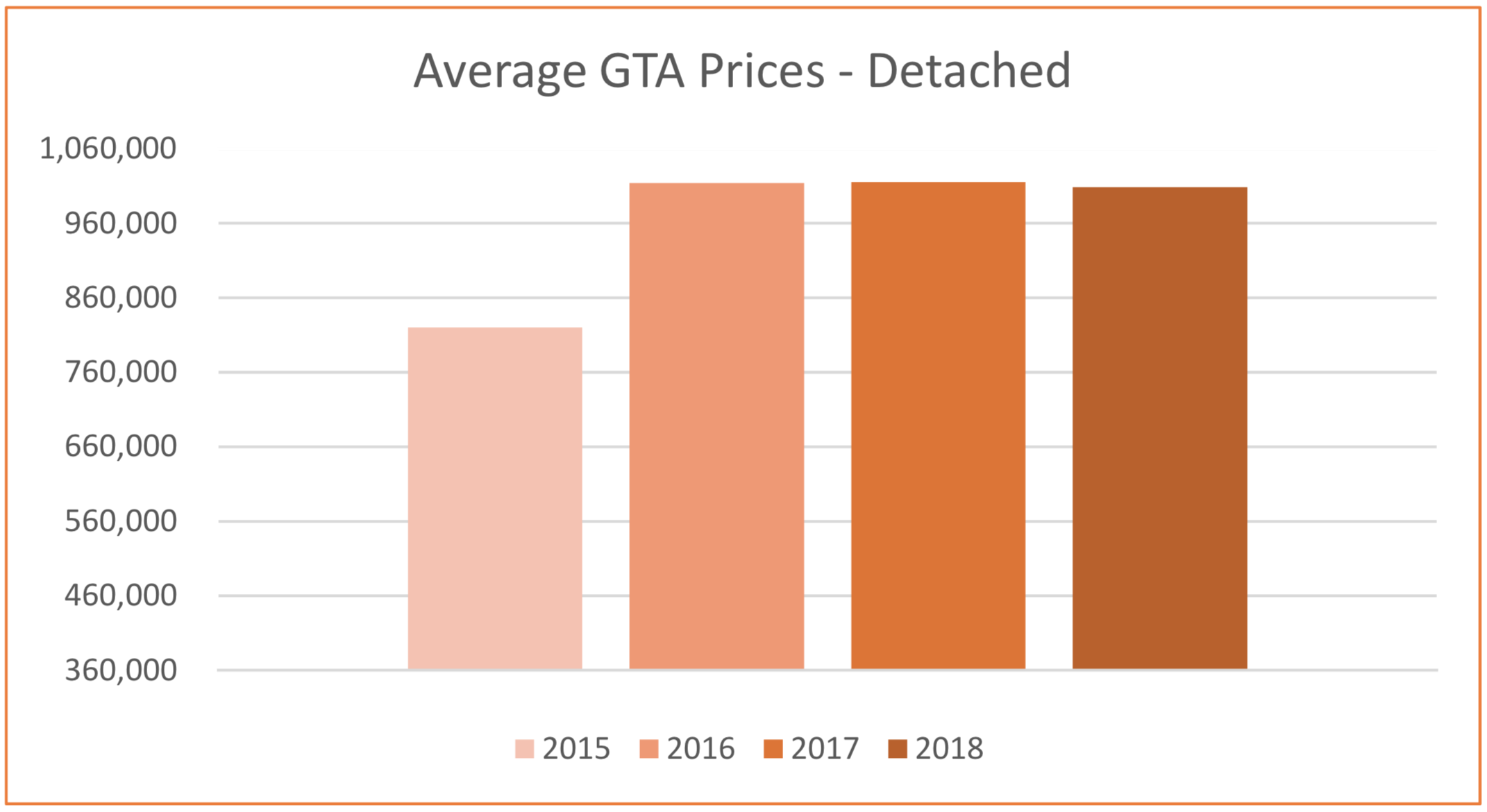

The more affordable home types including condominiums, townhouses and semi-detached homes all saw strong price growth in September, compared to the prior year. In contrast, the average price of a detached home in the GTA was relatively flat compared to 2017. The average price of a detached home in the City of Toronto, where approximately 23% of total GTA detached home sales occurred, was down by 1.4%, compared to the suburbs, where the average price was 0.6% less than a year earlier. The average selling price for a detached home in Toronto in September was $1,342,363, compared to the average suburban selling price of $905,722.

In the City of Toronto, where slightly more than 70% of total GTA condominium sales occurred in September, the Toronto Real Estate Board (TREB) reported 1,282 condominium unit sales. The average price of a condominium in Toronto rose by 11.7% in September year-over-year, almost twice the rate of increase in the price of the average condominium in the 905 regions, where prices rose by 6.4%. The average selling price for condominium in Toronto in September was $615,582, compared to the average suburban selling price of $455,686.

This final chart shows how Toronto has continued to dominate the share of the total GTA condominium sales in September for the past three years. Now more millennials and Gen Z (those born between the early 1980s and early 2000s) are entering the housing market. For them, a condo lifestyle is both preferred and affordable. Condos also remain in high demand among retiring boomers, particularly those who are downsizing and wish to remain in an urban setting in a large metropolitan City such as Toronto.

If you would like to find out what these statistics mean to you, or if you are curious to know how much your property is worth today or how much you can afford to buy, please reach out.

If you found this article helpful please hit "Like" and "Share".