Greater Toronto Area housing sales of 6,939 units increased by 8.5% in August, 2018, compared to August, 2017 when 6,306 unit sales were recorded. The average price of a home in the GTA also rose by 4.7% year over year and now stands at $765,270, compared to $730,969 in August 2017. Month-over-month sales and price growth also continued in August and the annual rate of sales growth outpaced the annual rate of new listings growth.

Detached home sales were up by over 16% on a year-over-year basis in August, substantially more than the 1.6% increase in the other less-expensive semi-detached, townhome and condominium segments of the market.

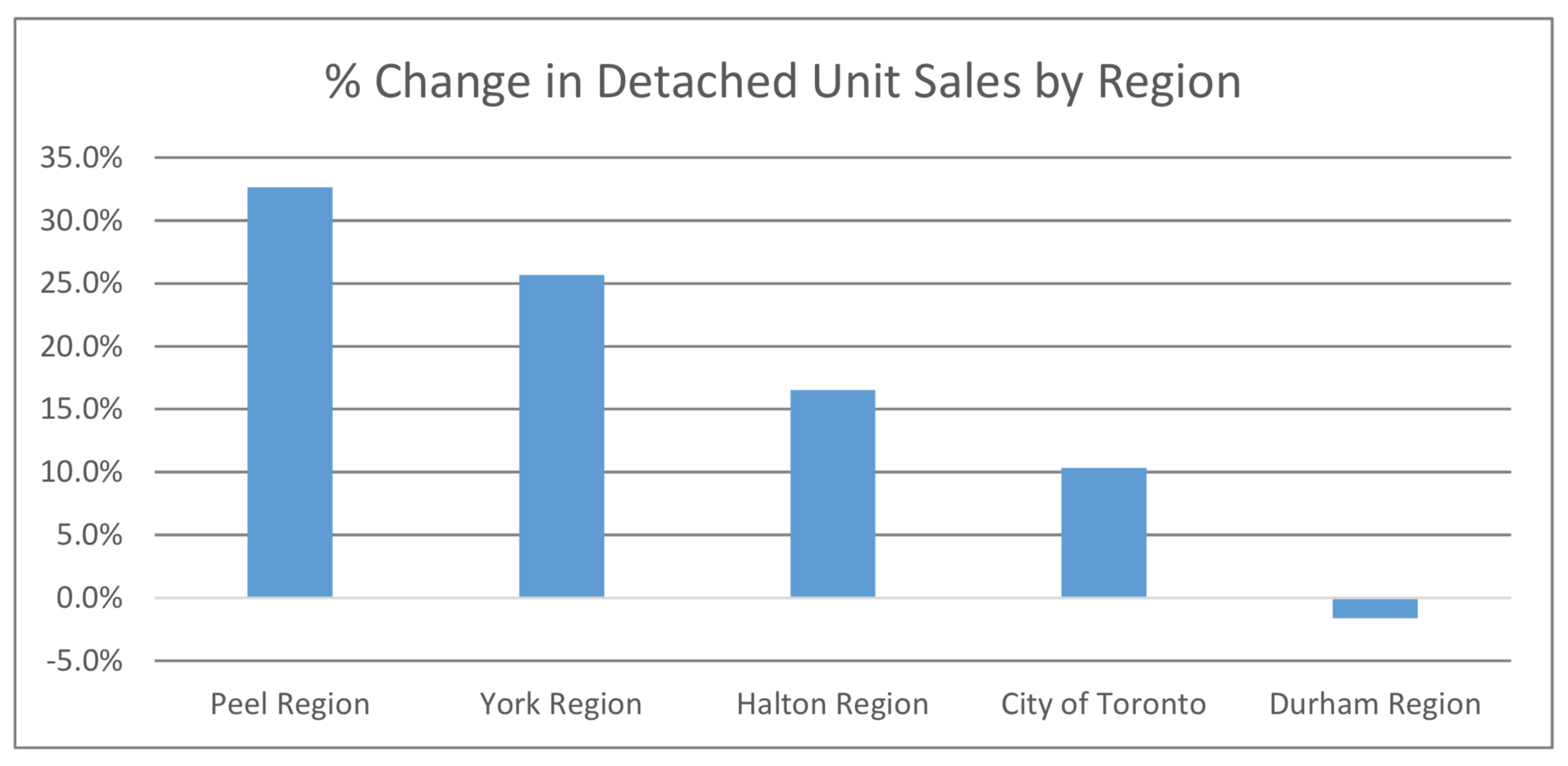

The 905 Regions surrounding the City fuelled most of this growth in detached unit sales, particularly in the Peel and York Regions, which recorded increases in detached unit sales of 32.6%, and 25.7%, respectively, as seen in the chart below. In the City of Toronto (416) detached unit sales increased by 10.3%.

Conversely, the City of Toronto is where average sales prices increased the most, at 8.1% year-over-year. Prices also rose by 7.6% in Peel Region, while other areas of the GTA mostly experienced a percentage decrease in average selling prices.

There is now only slightly more than 2 ½ months inventory in the GTA as a whole and less than 2 months of inventory in the City of Toronto. Many GTA neighbourhoods continue to suffer from a lack of inventory, although this is more pronounced in the City of Toronto. York Region (north of the City) continues to have the largest supply of homes available for sale at 4.3 months supply, while in Halton, Peel and Durham (the regions northwest, west and east of the City, respectively), inventories are only slightly higher than in the City, at 2.3 to 2.4 months supply.

Ownership of a home remains a solid long-term investment in the GTA, a region where the economy remains strong and the population continues to grow.

If you would like to find out what these statistics mean to you, or if you are curious to know how much your property is worth today or how much you can afford to buy, please reach out.

If you found this article helpful please hit "Like" and "Share".