The Pulse of the Greater Toronto Area Housing Market

The housing market in the Greater Toronto Area (GTA) is displaying mixed signals, indicating a potential impending shift. In June, the average price of properties in the GTA decreased by $13,972, resulting in a final price of $1,182,129. However, when compared to the previous year, average sale prices have still seen a significant increase of $35,875. This is the first occurrence in 2023 where month-over-month values dropped, but it also marks the first positive yearly comparison.

Despite the slight decline in prices, overall inventory levels have continued to sluggishly rise, with 14,107 active listings at the end of June. While this represents a month-over-month increase of over 2,000 properties, the final total is still the second-lowest June total inventory over the past decade, low inventory has intensified the competition among buyers for the limited available properties. Sales, however, are still happening at a rapid pace, with properties selling on average in just 14 days for the second consecutive month. The number of active listings remains well below the monthly 10-year average, currently sitting 19% lower than historical levels. The market absorption rate remains remarkably robust, with 52.5% of available listings being sold in June, and properties achieving a sales price of 104% of the list price.

As the summer months begin, the Greater Toronto market remains active. Home sales have experienced a surge of 944 sales compared to June 2022. Multiple offers are still prevalent, leading to sale prices surpassing the initial asking prices for the fifth consecutive month. Despite a 0.25 basis point interest rate increase in June, buyers who have already secured pre-approved mortgages are likely to take advantage of their rate hold and make their purchases before the rate hold expires. However, rising interest rates are expected to have a temporary negative impact on the housing market, as highlighted by Phil Soper, President and CEO of Royal LePage, who stated that “Rising rates have an oversized psychological impact on people buying and selling properties in this country, and so it will create a small stall in the market,” Soper said.

When examining individual asset classes, the semi-detached market saw a monthly increase in the average sales price of $16,687, while the detached, townhouse, and condo markets experienced minor declines of $25,569, $29,729, and $7,821, respectively. Interestingly, on a year-over-year basis, the detached, semi-detached, and townhouse markets have shown increases of $76,095, $90,149, and $58,990, while the condo market remains slightly below its value from the previous year by only $7,821. Comparing current average sales prices to the market highs of 2022, condos have experienced an 8% decrease, semi-detached properties are down 10%, townhouses are down by 13%, and detached properties have decreased by 14%. It is important to note that real estate investment is a long-term endeavour, and when compared to values five years ago, the market still presents appealing opportunities for investors. Detached properties have appreciated by $497,423, semi-detached by $410,958, townhomes by $395,855, and condos by $178,298.

The GTA housing market has emerged as a global investment hub, with property values continuing to rise and population growth expanding. Investors will continue to play a significant role in future housing availability. According to a recent report, "CHSP said condominium apartments were more likely to be investment properties than other housing types, such as detached or row housing. For example, almost 42 per cent of condominium apartments in Ontario were investment properties. Furthermore, 112,220 households in the City of Toronto rented condominiums and another 53,000 rented ground-oriented housing from investors in 2020.” This highlights the importance of investors in the housing market.

However, the lack of inventory remains a challenge for potential homebuyers in the GTA. Overall active listings remain low, with just 14,107 at the end of June, which is a decrease of 1,986 compared to June 2022. Similarly, all individual asset classes have declined on a year-over-year basis. The June 2023 data indicated detached properties had 6,476 listings, condos had 4,796 listings, townhomes had 968 listings, and semi-detached properties had 767 listed homes.

Despite the persistent struggles with inventory, buyers remain highly active, the semi-detached asset class exhibits the strongest performance in terms of absorption rates, with a rate of 88%, followed by townhomes at 68%, detached properties at 52%, and condos with an absorption rate of 44%.

Toronto Regional Real Estate Board (TRREB) President Paul Baron acknowledges the demand for ownership housing, which is stronger than last year, despite higher borrowing costs. However, uncertainty surrounding the Bank of Canada's outlook on inflation and interest rates, coupled with a persistent lack of inventory, may have hampered home sales. Baron emphasizes that the inability to find a home meeting buyers' needs due to limited availability has prevented some willing buyers from making a purchase.

The GTA housing market has emerged as a global investment hub, with property values continuing to rise and population growth expanding. Investors will continue to play a significant role in future housing availability. According to a recent report, "CHSP said condominium apartments were more likely to be investment properties than other housing types, such as detached or row housing. For example, almost 42 per cent of condominium apartments in Ontario were investment properties. Furthermore, 112,220 households in the City of Toronto rented condominiums and another 53,000 rented ground-oriented housing from investors in 2020.” This highlights the importance of investors in the housing market.

However, the lack of inventory remains a challenge for potential homebuyers in the GTA. Overall active listings remain low, with just 14,107 at the end of June, which is a decrease of 1,986 compared to June 2022. Similarly, all individual asset classes have declined on a year-over-year basis. The June 2023 data indicated detached properties had 6,476 listings, condos had 4,796 listings, townhomes had 968 listings, and semi-detached properties had 767 listed homes.

Despite the persistent struggles with inventory, buyers remain highly active, the semi-detached asset class exhibits the strongest performance in terms of absorption rates, with a rate of 88%, followed by townhomes at 68%, detached properties at 52%, and condos with an absorption rate of 44%.

Toronto Regional Real Estate Board (TRREB) President Paul Baron acknowledges the demand for ownership housing, which is stronger than last year, despite higher borrowing costs. However, uncertainty surrounding the Bank of Canada's outlook on inflation and interest rates, coupled with a persistent lack of inventory, may have hampered home sales. Baron emphasizes that the inability to find a home meeting buyers' needs due to limited availability has prevented some willing buyers from making a purchase.

In conclusion, the GTA housing market is experiencing a complex mix of indicators, suggesting a potential shift in the near future. While average prices have decreased slightly, the market remains active, with rising competition and rapid sales. Investors continue to play a significant role in the market, which has become a global investment hub. However, the low inventory levels and limited availability pose challenges for prospective homebuyers. The market's performance in different asset classes varies, with the semi-detached market showing strength and condos experiencing a slight decline. Despite short-term fluctuations, the long-term appeal of real estate investment in the GTA remains promising.

JUNE 2023 MARKET STATS SUMMARY

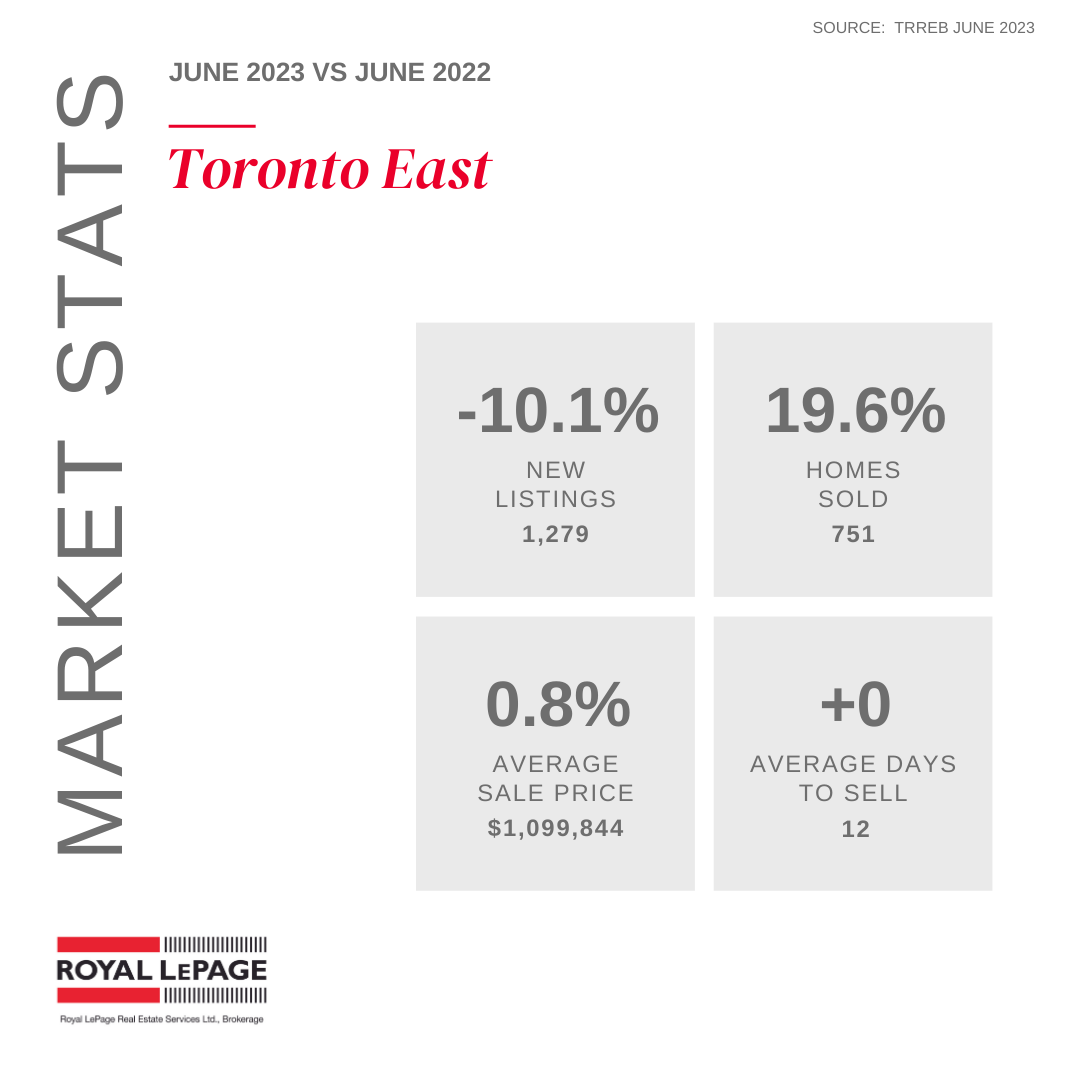

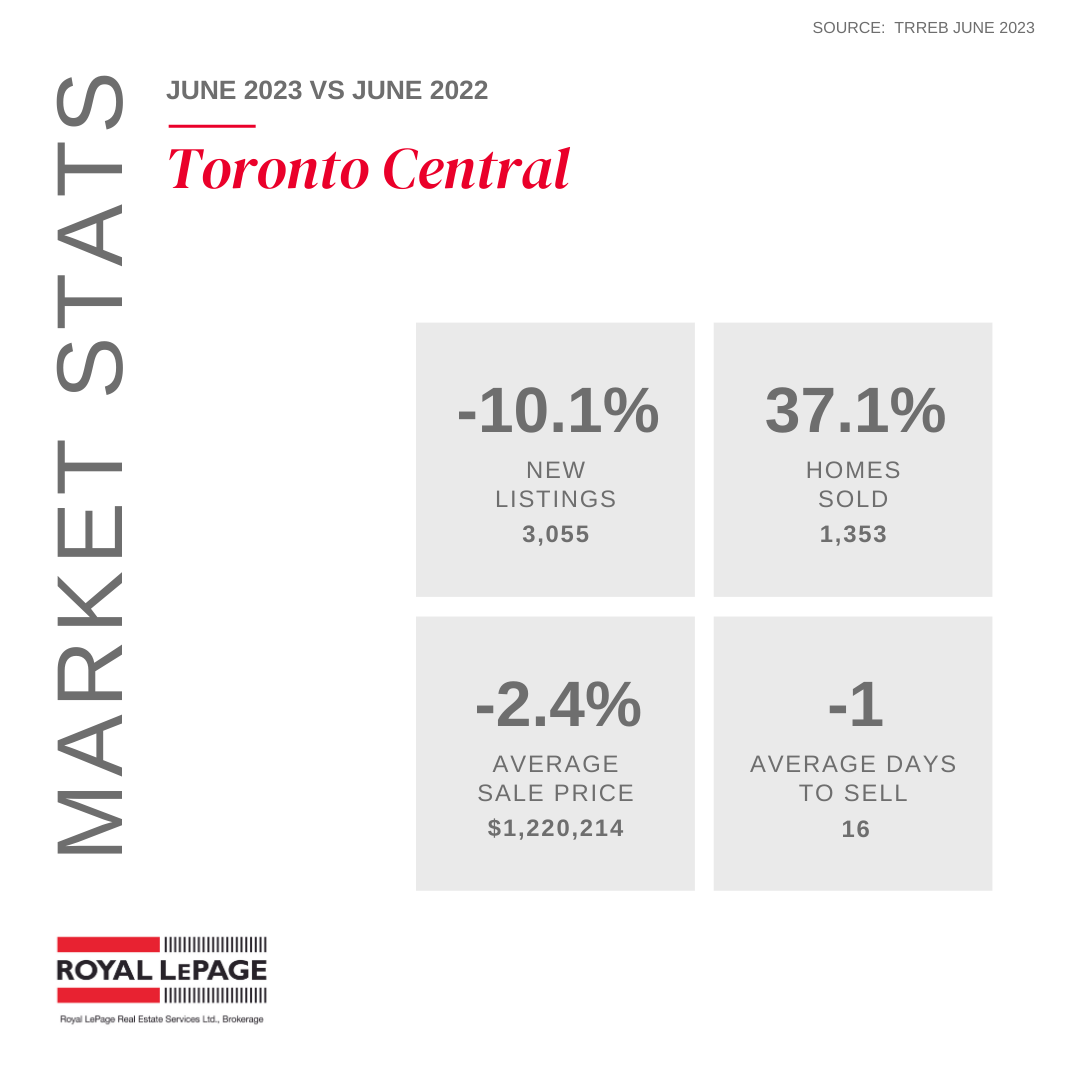

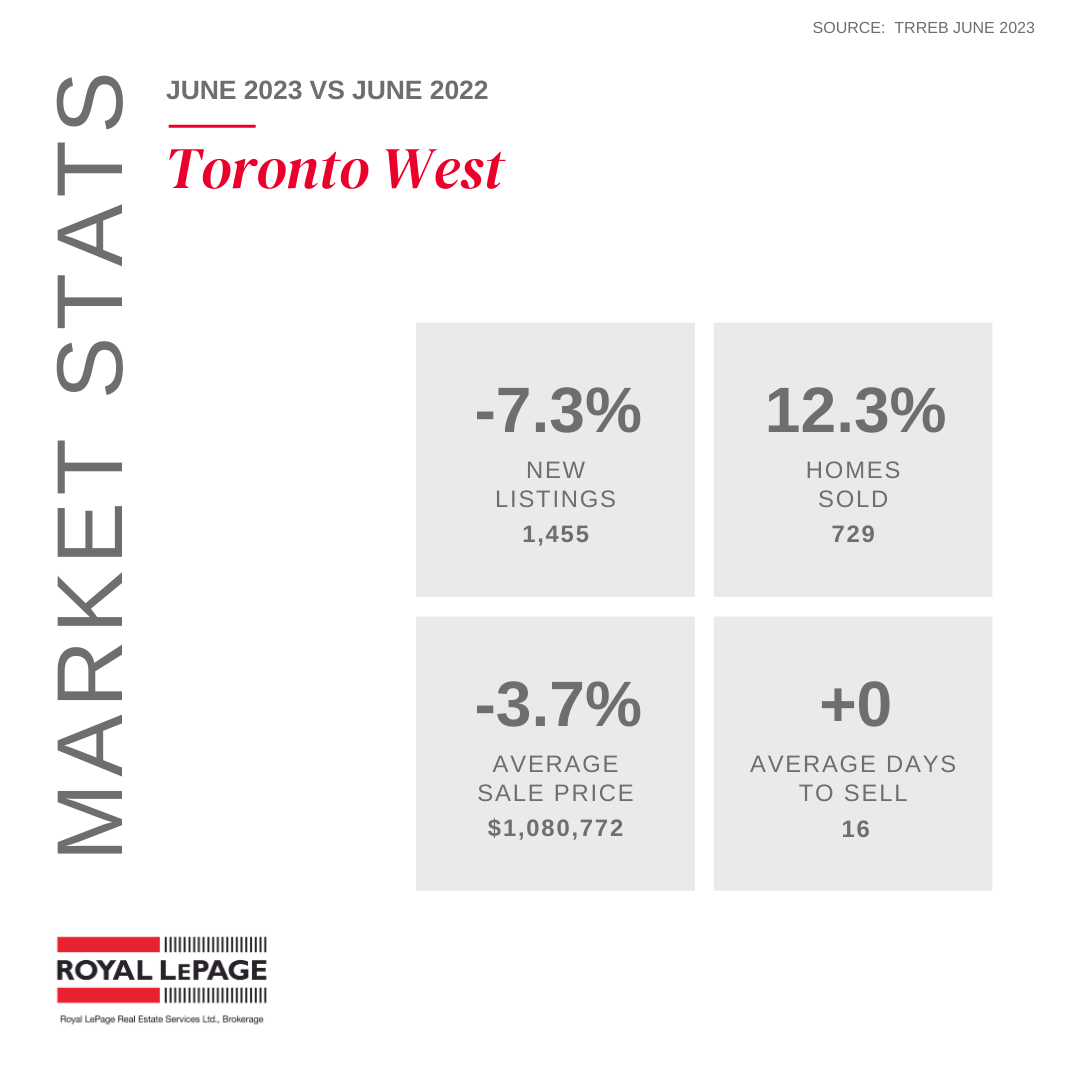

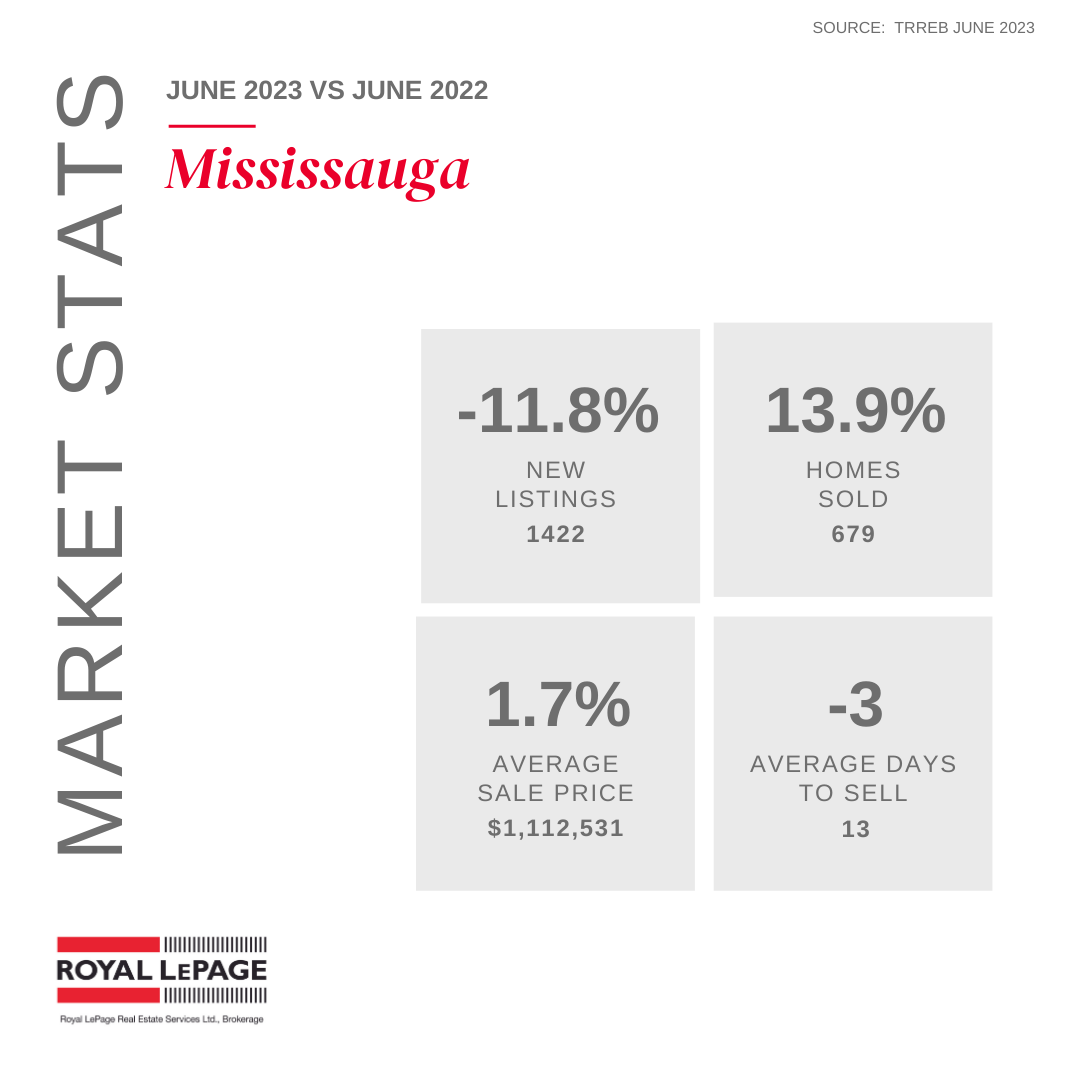

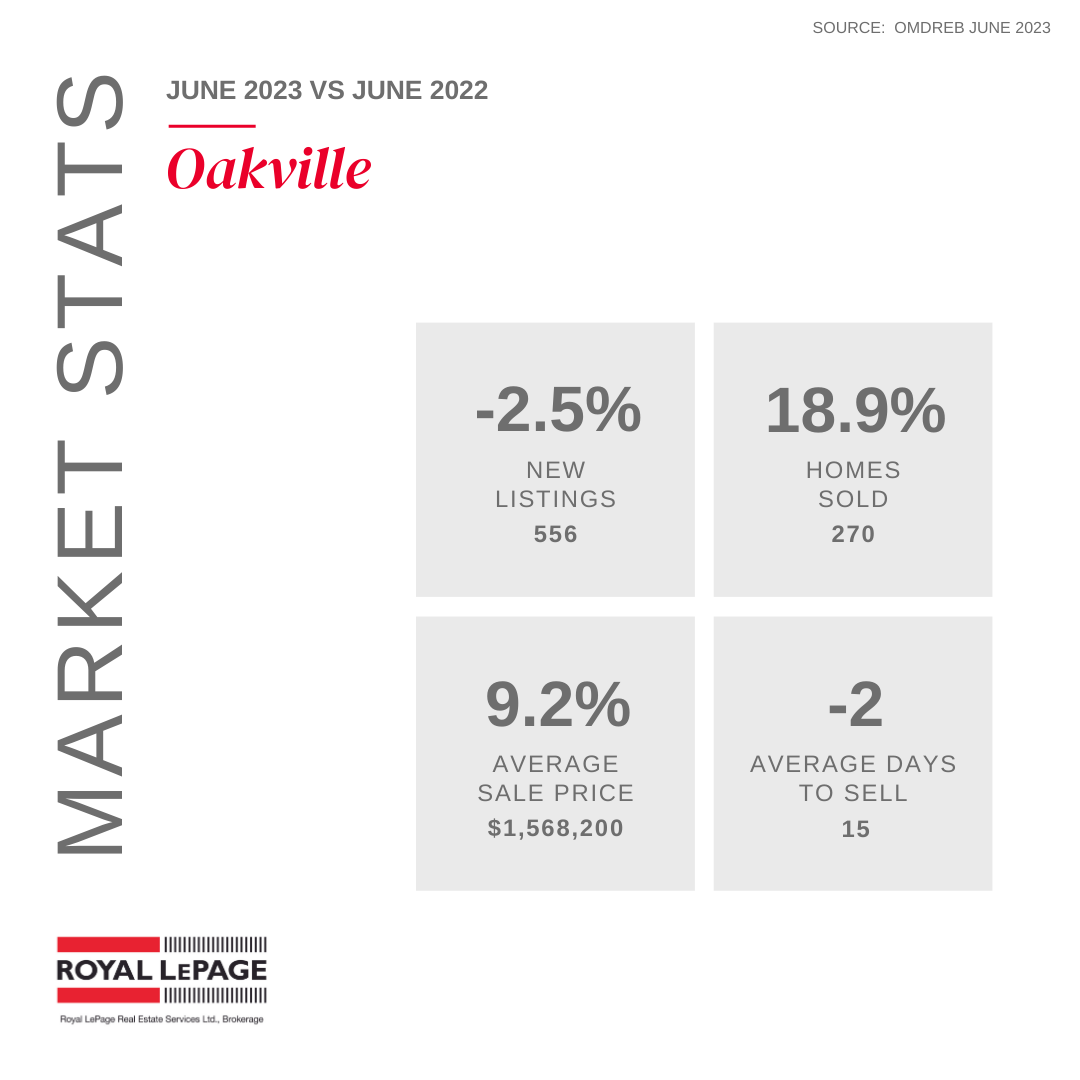

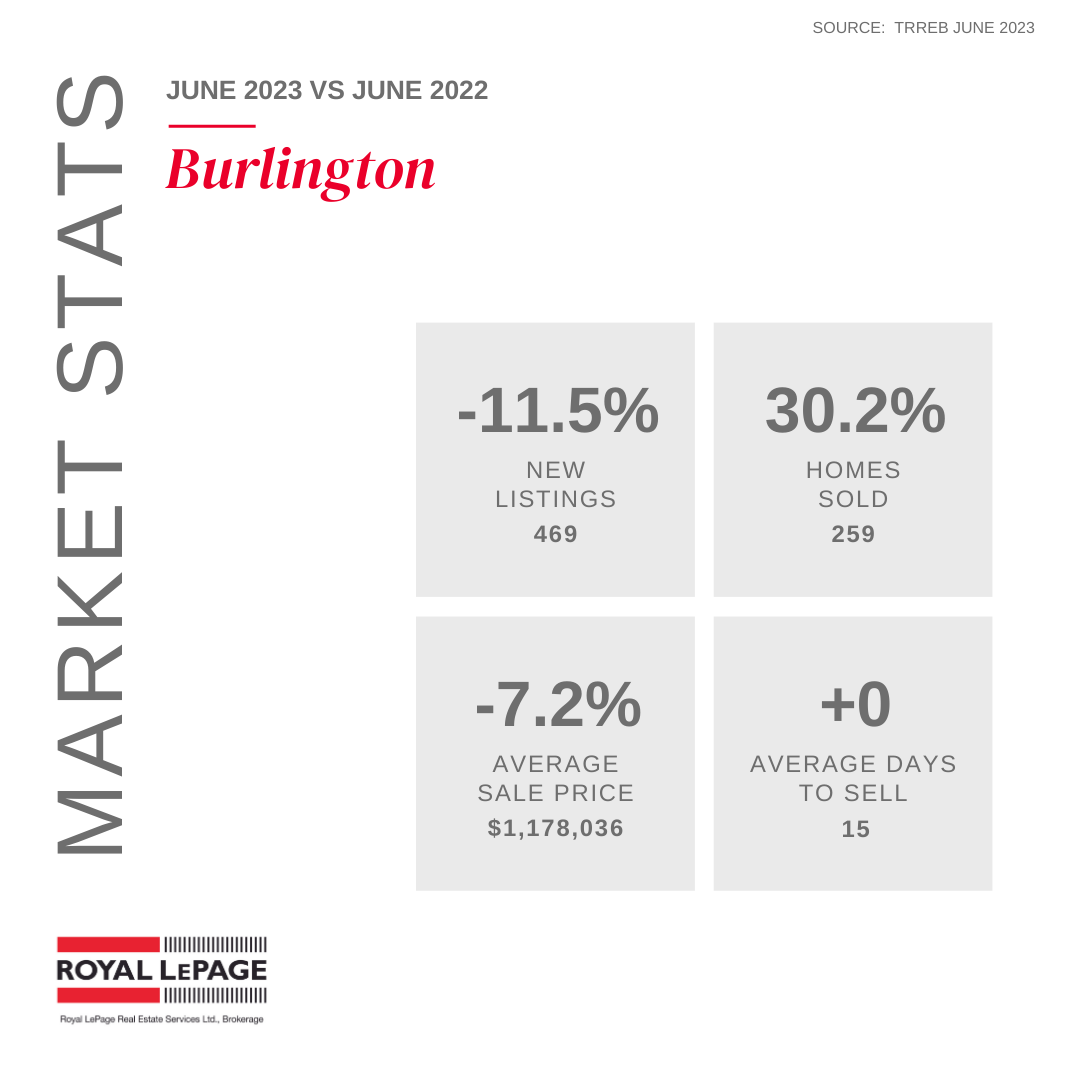

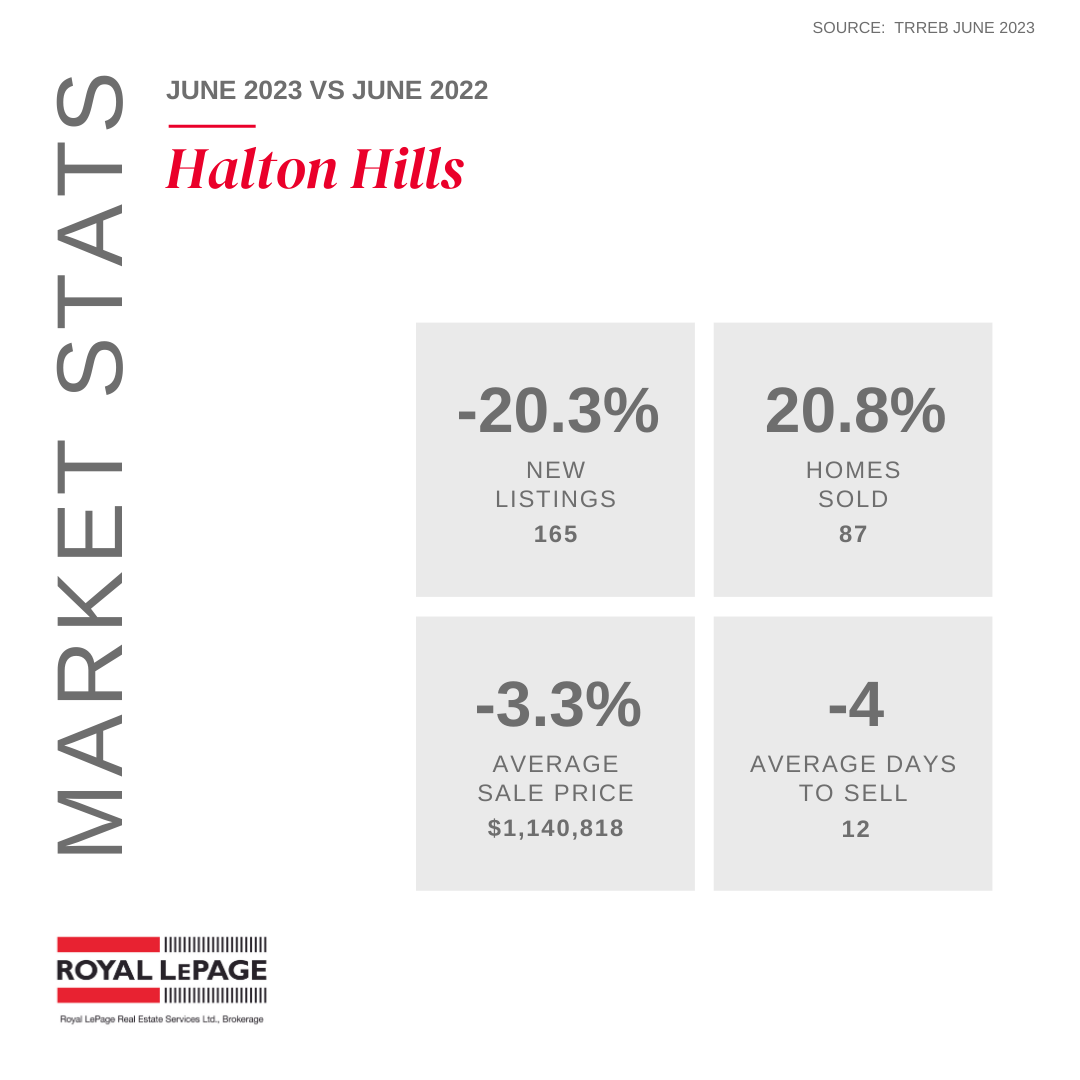

MARKET STATS BY CITY/TOWNS

If you would like to understand how these statistics relate to your specific situation or if you're curious about the current value of your property or your affordability for a new purchase, please don't hesitate to reach out.

If you found this article informative and useful, we kindly ask you to show your support by hitting the "Like" and "Share" buttons. Your engagement is greatly appreciated.

#junemarketreport #realestatemarketreport #royallepage #torontoliving #torontomarket #thejunction #highpark #bloorwestvillage #swansea #homesellers #homebuyers #realestatebroker #lubabeleybroker #sellingrealestate #sellingtorontohomes #serviceyoucantrust #workingforyou #lubabeleyrealestateservices #royallepagebroker