2022 In Review

While the housing market in the Greater Toronto Area (GTA) experienced a shift in 2022, it also showed its resiliency in the face of rising interest rates. The average selling price last year in the GTA was $1,189,850, representing an 8.6% increase over the 2021 average of $1,095,333. The increase in average price growth is attributed to the strong start we saw in 2022. The pace of growth moderated from the spring of 2022 onwards.

As interest rates increased, home sales trended lower in the spring and summer of 2022. Transactions were down 38.2% compared to the record sales activity we saw in 2021, and home prices adjusted downward to accommodate the impact of higher interest rates. However, in August we saw home prices start to level off, and remain steady for the remainder of the year. Supply remained tight despite fewer transactions, and the lack of homes available for sale supported price stability and in some pockets of the GTA led to continued price increases, despite higher borrowing costs.

Lack of supply also impacted the rental market and tight rental market conditions caused rental rates to skyrocket in 2022, up 23.7% in the GTA compared to last year.

GTA Market Activity – December 2022

In December, seasonally adjusted sales activity increased 1.1% over November and prices remained flat month-over-month.

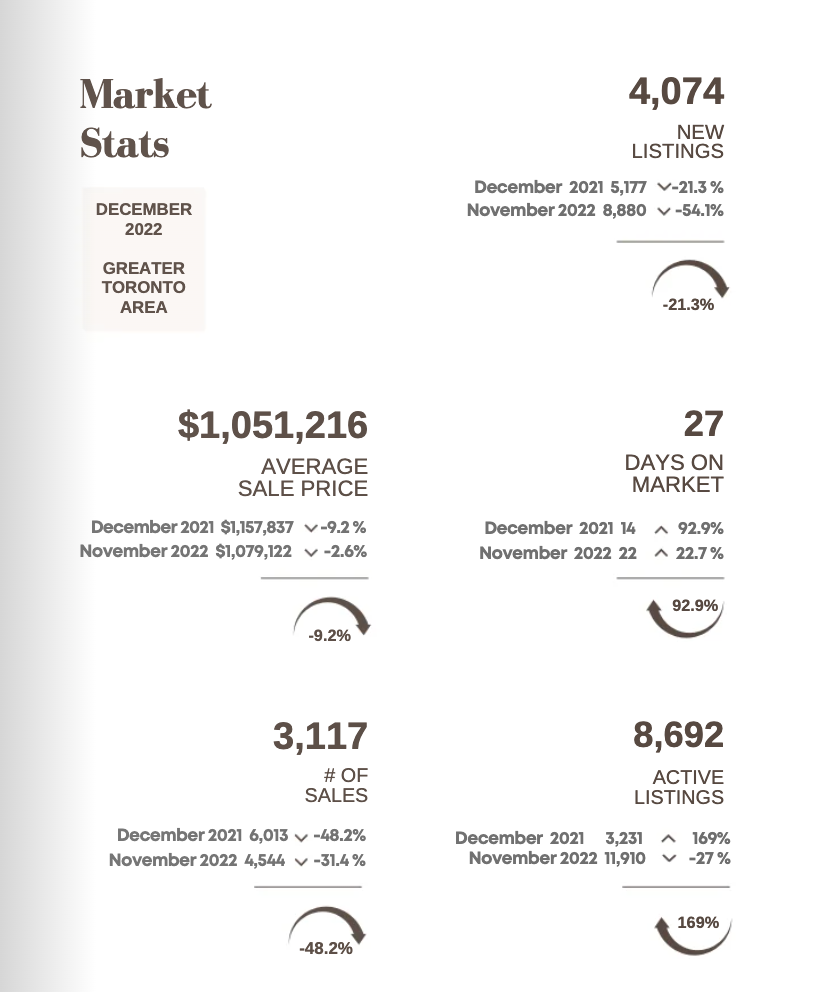

The Toronto Regional Real Estate Board reported 3,117 sales in December 2022, down 48.2% compared to last December’s unprecedented level of activity, and new listings were also down 21.3% as compared to last year.

Homes averaged 27 days on market, an average that is longer than the blistering pace we saw last December, however still shorter than the average days on market in December 2020 and December 2019.

Looking Ahead

Home prices in the GTA levelled off in the late summer and remained stable for the rest of 2022, suggesting the market adjustments seen earlier in year may be coming to an end.

While much focus has been directed at the negative impact of rising rates, there are a number of factors supporting stable home prices in the current environment.

The Royal LePage Market Survey Forecast suggests that the supply of homes for sale must exceed demand in order for prices to drop materially. Organic demand is supported by the current lifecycle of our large millennial demographic and a record number of new immigrants who need to be housed. This month, Immigration, Refugees and Citizenship Canada announced that Canada added over 431,000 new permanent residents in 2022, breaking 2021’s record of 401,000 newcomers.

Smaller household sizes also mean more housing units are needed per capita than in the past. Pent-up demand is growing from buyers who have the ability to transact but have chosen not to in these less certain times.

Based on pent-up demand and the influx of newcomers to the GTA in 2023, demand for condominiums is anticipated to increase. Homebuyers who have been sitting on the sidelines who begin to return to the market in search of more affordable housing options will be particularly drawn to this housing segment, as will investors anticipating greater returns based on the sharp rise in rental prices and the pace of people looking for housing entering Toronto and the surrounding areas.

Low unemployment, and a large buffer of unfilled job vacancies, means that few families are likely to need to sell their homes for financial reasons. Homes are modestly less expensive today than at the height of the pandemic boom, offsetting some of the impact of rising rates, and household savings remain above long-term norms, helping overcome down payment hurdles.

In terms of sales activity, the Bank of Canada has suggested that the current interest rate hiking cycle is nearing its end. An important trend in 2023 will be the transition from a rising interest rate environment to a stable interest rate environment, which will help revive consumer confidence and begin increasing the number of annual transactions to more typical levels.

New Year, New Rules

The ringing in of the New Year also ushered in new federal regulations to assist home buyers, as well as reduce speculation.

Starting in the 2022 tax year, the First Time Home Buyers Tax Credit has doubled to $1,500.

This year, Canada is also introducing a First Home Savings Account. Starting April 1, first-time homebuyers under 40 years old will be allowed to invest up to $40,000 total or up to $8,000 each year toward the purchase of a home with no tax on contributions or withdrawals. If funds are not used to purchase a home by the age of 40, they can be converted into RRSP savings.

For non-first time buyers, another Canadian savings vehicle, the Tax Free Savings Account, or TSFA, has increased its annual contribution cap to $6,500. TSFA savings are tax free upon withdrawal.

In order to limit real estate speculation, Canada has also introduced a ‘flipping tax’. As of January 1, 2023, profits from the sale of a property which has been owned for less than 12 months will be taxed as business income. The new law is subject to a number of exceptions, such as death or serious illness of the homeowner and sales due to the dissolution of a marriage.

Finally, effective January 1, 2023, Canada’s two-year foreign buyer ban took effect. Under the ban, individuals and corporations from outside of Canada can no longer purchase residential real estate. There are exceptions to the ban for permanent residents, commercial property including multiplexes of four or more units and properties situated in certain rural areas. Individuals in Canada on work permits may also be exempt provided they meet certain requirements including working and filing taxes within Canada for three out of the four years prior to purchasing a property.

2023 national aggregate home price forecast to end year 1.0% below fourth quarter of 2022: Royal LePage

First quarter expected to show double-digit year-over-year declines, with modest quarterly price growth in the second half of next year

On a quarter-over-quarter basis, prices expected to flatten in Q2 and begin modest improvement in second half of the year, ending 2023 on upward trajectory; release includes national aggregate quarterly forecast for 2023

Condominium prices expected to outperform single-family homes in all major markets except Edmonton and Winnipeg.

Greater regions of Toronto and Montreal forecast to see Q4 2023 aggregate price decline of 2.0% year-over-year.

Q4 2023 aggregate home price in Greater Vancouver projected to dip 1.0% year-over-year.

Despite declining affordability, heightened by rising interest rates, continued housing supply shortage acts as a floor on home price declines.

TORONTO, December 13, 2022 –Since the Bank of Canada began raising interest rates aggressively in March of this year, home prices in many major markets across Canada have been decreasing. The rate of decline, however, has been modest. According to the Royal LePage Market Survey Forecast, the aggregate[1] price of a home in Canada is set to decrease 1.0 per cent year over-year to $765,171 in the fourth quarter of 2023, with the median price of a single-family detached property and condominium projected to decrease 2.0 per cent and increase 1.0 per cent to $781,256 and $568,933, respectively.[2] “After nearly two years of record price appreciation, fuelled by a steep climb in household savings, very low borrowing costs and an overwhelming desire for more space during the COVID-19 pandemic, the frenzied housing market overshot and the inevitable downward slide or market correction began, intensified by rapidly rising borrowing rates,” said Phil Soper, president and CEO, Royal LePage. “In an era characterized by the unusual, this correction has not followed historical patterns. While the volume of homes trading hands has dropped steeply, home prices have held on, with relatively modest declines. We see this as a continuing trend.”

Soper continued, “Much focus has been directed at the negative impact of rising rates; there has been far less discussion on factors supporting home prices.”

The higher cost of borrowing erodes affordability, which historically has pushed people out of the market, reducing demand and resulting in falling home prices. Conversely, there are a number of factors supporting home prices in the current environment.

The supply of homes for sale must exceed demand in order for prices to drop materially. Canada is struggling with an acute, long-term housing supply shortage. Organic demand is supported by the current lifecycle of our large millennial demographic and a record number of new immigrants who need to be housed. Smaller household sizes mean more housing units are needed per capita than in

the past. Pent-up demand is growing from buyers who have the ability to transact but have chosen not to in these turbulent times.

Low unemployment, and a large buffer of unfilled job vacancies, means that few families are likely to need to sell their homes for financial reasons. Homes are modestly cheaper today than at the height of the pandemic boom, offsetting some of the impact of rising rates, and household savings remain above long-term norms, making it easier to overcome down payment hurdles.

“Traditional wisdom says that a recession triggers widespread job losses and missed mortgage payments. People are forced to sell or the bank forecloses and lists the property, flooding the market with new listings when demand is weak. In this post-pandemic period, people have kept their jobs. In fact, they have seen wages and salaries rise,” said Soper. “We have a tightly managed national mortgage portfolio, with historically low default rates, supported by homeowners who have been required to qualify for a loan under the strict federal stress test for the last five years. And, we can’t forget that Canada has been grappling with an acute shortage of homes overall. We simply don’t see the factors at play that would result in a large drop in home values.”

While home prices nationally are forecast to see modest quarterly gains in the third and fourth quarters of 2023, values are expected to remain lower than the same periods in 2022 throughout the year. The aggregate price of a home in Canada is forecast to be 12.0 per cent lower in Q1 of 2023, compared to the same quarter in 2022, reflecting a 2.4 per cent decline over the fourth quarter of 2022. In the second quarter of next year, the national aggregate price is forecast to be 7.5 per cent lower year-over-year, and remain virtually flat on a quarterly basis. In the third quarter, homes are expected to be 2.0 per cent lower year-over-year, reflecting a 0.7 per cent increase on a quarterly basis. And, in the fourth quarter of 2023, the national aggregate price of a home is expected to end the year 1.0 per cent below the same quarter in 2022, an increase of 0.8 per cent quarter-over-quarter.

“Comparing prices to the previous year, the first quarter of 2023 should show the deepest decline in home values,” said Soper. “At that time, we will be comparing 2022’s final weeks of pandemic housing market excess – when home prices reached historically high levels – to a much quieter market, where values have had a full year to moderate. We expect year-over-year comparisons to show progressively less price decline as the year goes on, with small week-to week improvements in the third and fourth quarters, allowing Canadian home values to end 2023 essentially flat to where we are today.”

The recovery is not expected to be evenly distributed. Regional markets that saw more moderate price growth during the pandemic real estate boom are expected to experience more modest declines. Due to their relative affordability, cities like Calgary, Edmonton and Halifax are expected to record modest price gains in 2023, as they continue to attract out-of-province buyers, especially first-time homebuyers from southern Ontario and British Columbia looking for more affordable housing.

While home prices have come down from the record highs recorded in the first half of this year, they remain well above pre-pandemic levels. The projected aggregate price of a home in Canada in the fourth quarter of 2023 is expected to sit 15.0 per cent above Q4 of 2020, and 18.4 per cent above Q4 of 2019.

Without a significant increase in housing supply, a return of buyers to the market, some driven by very high rental rates, should start to put upward pressure on prices again. And, in a tight-inventory market, sellers will remain hesitant to list their properties if they are unable to find a move-up home to purchase.

“It’s important to note that many would-be buyers currently sitting on the sidelines have not been forced to exit the market. While some of these families have been priced out for now by rising borrowing rates, we believe some have voluntarily adopted a wait-and-see attitude, not wanting to buy a property today that may be worth less tomorrow. Yet people in their thirties, forties and fifties have known only in Canada where home prices rise faster than incomes. When interest rates appear to have stabilized, these buyers may jump back into the market, anticipating a return to escalating home values,” concluded Soper.

4 key dates for investors to mark in their 2023 calendars

Investors eager to put 2022 behind them can turn their attention to a new year of opportunity. From a tax perspective, opportunity knocks four times in 2023, giving average Canadians the chance to keep more of their tax dollars in their pockets.

All four can be used as part of a broader tax strategy that can save thousands of dollars over the long run. It can get complicated depending on your individual circumstances, so it might be best to discuss them with a qualified advisor or tax professional.

JANUARY 1: TFSA CONTRIBUTION LIMIT EXTENSION

Canadians who have contributed the maximum amount to their Tax-Free Savings Accounts will be permitted to contribute another $6,500. Ottawa has raised the annual TFSA extension limit from the usual $6,000 as the result of a formula that factors in inflation. If you withdrew money from your TFSA in 2022, that contribution space can also be reclaimed in the new year. There is no contribution deadline for a TFSA. Allowable contribution space can be carried forward to future years for the vast majority of TFSA holders who don’t contribute the maximum amount. Over-contributions can result in penalties from the Canada Revenue Agency (CRA), so it’s important to keep track.

The TFSA is an ideal investment vehicle because those contributions can be invested in just about anything, gains are never taxed, and you can withdraw funds at any time.

MARCH 1: RRSP CONTRIBUTION DEADLINE

Registered Retirement Savings Plan contributions can also be invested and grow tax-free in just about anything, but if you want to deduct them from your 2022 taxable income you must contribute by March 1.

Tax savings are based on your personal marginal tax rate, so the more income you generated in 2022, the bigger the savings. Canadians love to get those RRSP refunds in the spring but it’s important to know RRSPs are fully taxed when they are withdrawn; ideally at a low tax rate in retirement. If your income was low in 2022, a TFSA contribution could be a better option.

If you want to contribute to both your TFSA and RRSP, consider contributing to your RRSP before the March 1 deadline and putting the refund in your TFSA.

APRIL 1: THE LAUNCH OF THE FHSA

It’s no April fool’s joke. The federal government is making good on its election promise to help new homebuyers save for down payments through the First Home Savings Account.

Starting April 1, first-time homebuyers under 40 years old will be allowed to invest up to $40,000 total or up to $8,000 each year toward the purchase of a home with no tax on contributions or withdrawals.

It’s the best tax perks of an RRSP and TFSA and can also be invested in just about anything. That means contributions can result in a tax refund like a RRSP, but contributions and gains are never taxed and can be withdrawn at any time like a TFSA.

If funds held in a FHSA are not used for a home purchase by the age of 40, they can be converted to normal RRSP savings.

APRIL 30: INCOME TAX DEADLINE

There’s no way for individual Canadians to avoid the dreaded income tax deadline but there are ways to steer tax dollars into your investment portfolio.

If you make an RRSP contribution before the deadline and want the refund by spring, don’t forget to deduct it from your taxable income when you file ahead of the April 30 deadline.

Also, don’t forget to include any other deductions or credits you or your spouse have accumulated throughout the year.

TFSA contributions are not tax deductible.

Be sure to include all income received during the year including capital, dividend or income gains from non-registered (not RRSP or TFSA) investment accounts.

If you suffered capital losses on the sale of investments in a non-registered account in 2022, they can be applied against capital gains going back three years or going forward indefinitely.

If you would like to find out what these statistics mean to you, or if you are curious to know how much your property is worth today or how much you can afford to buy, please reach out.

If you found this article helpful please hit "Like" and "Share".

#Decembermarketreport #2022inreview #realestatemarketreport #royallepage #torontoliving #torontomarket #thejunction #highpark #bloorwestvillage #swansea #homesellers #homebuyers #realestatebroker #lubabeleybroker #sellingrealestate #sellingtorontohomes #serviceyoucantrust #workingforyou #lubabeleyrealestateservices #royallepagebroker

Photo curtesy of Marko Manna https://www.instagram.com/markoxto/