Serious inventory shortage likely to be the single biggest driver for the Spring Market

TORONTO, MARCH 4, 2020 – In line with the forecast contained in the Toronto Regional Real Estate Board’s recently released Market Year in Review and Outlook Report, TRREB President Michael Collins announced a very strong year-over-year sales and price growth in February 2020.

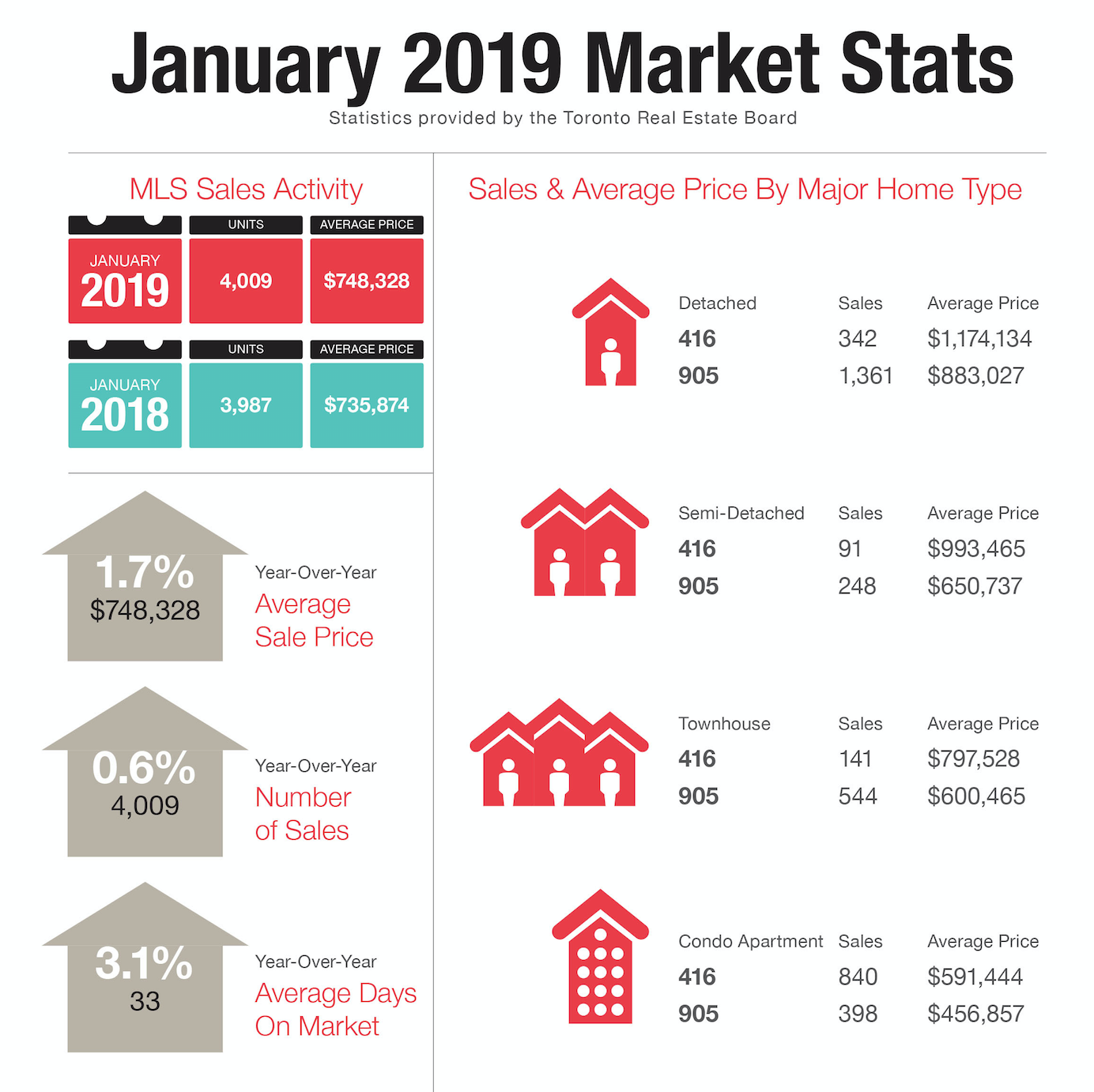

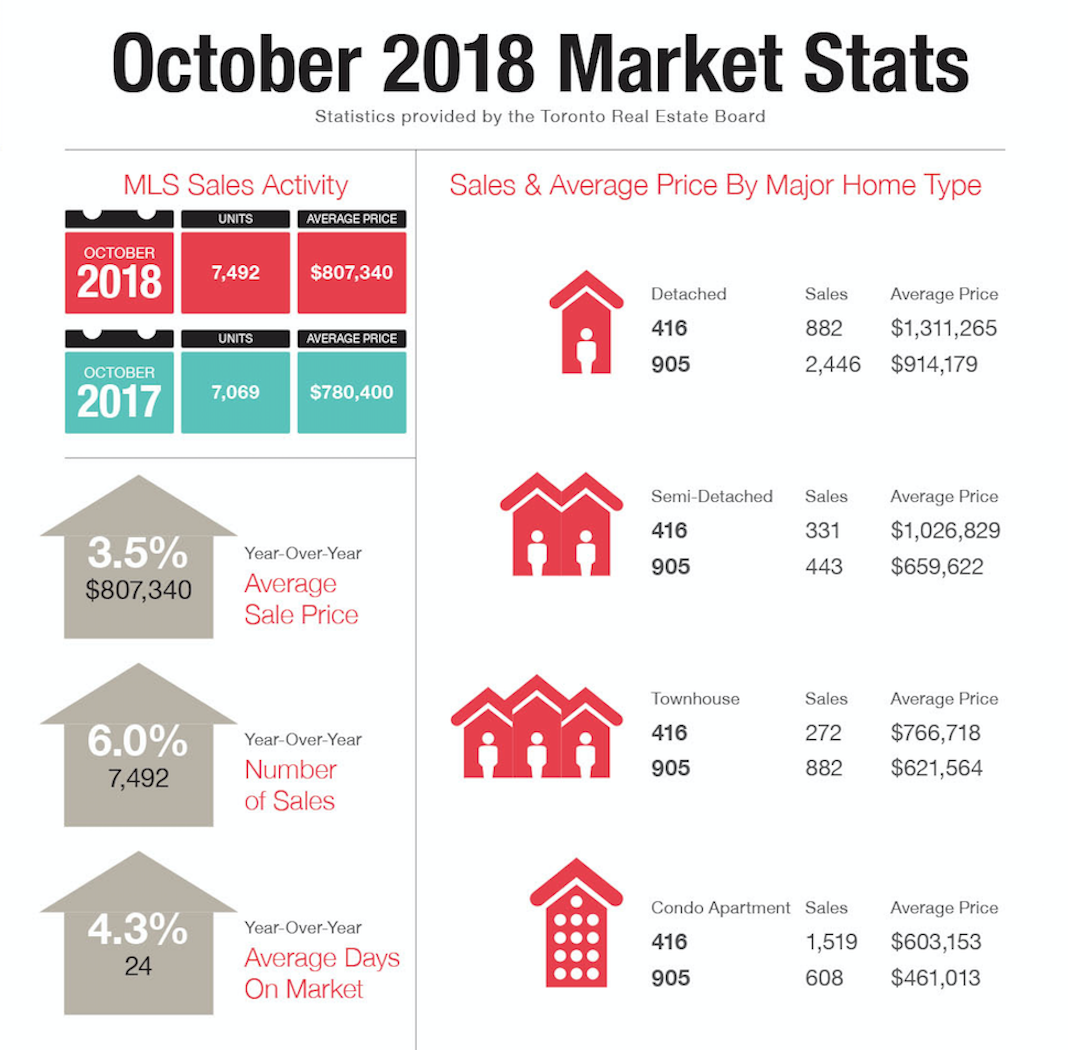

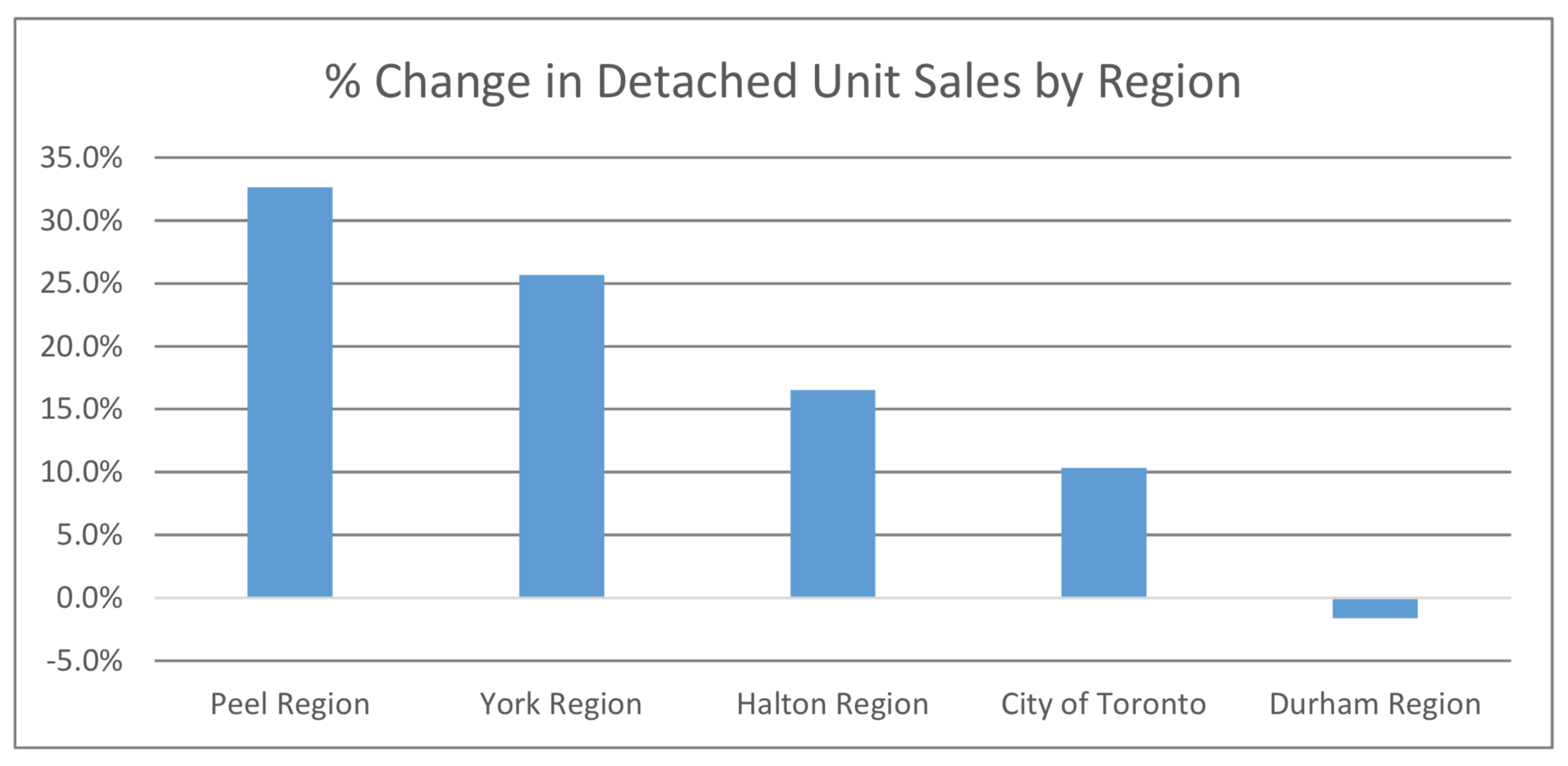

Greater Toronto Area REALTORS® reported 7,256 residential transactions through TRREB’s MLS® System in February 2020, representing a 45.6 per cent increase compared to a 10-year sales low in February 2019. However, February 2020 sales were still below the 2017 record result. Year-over-year sales growth, for the GTA as a whole, was strongest for ground-oriented home types.

After preliminary seasonal adjustment, February 2020 sales also exhibited positive momentum, up by 14.8 per cent compared to January 2020.

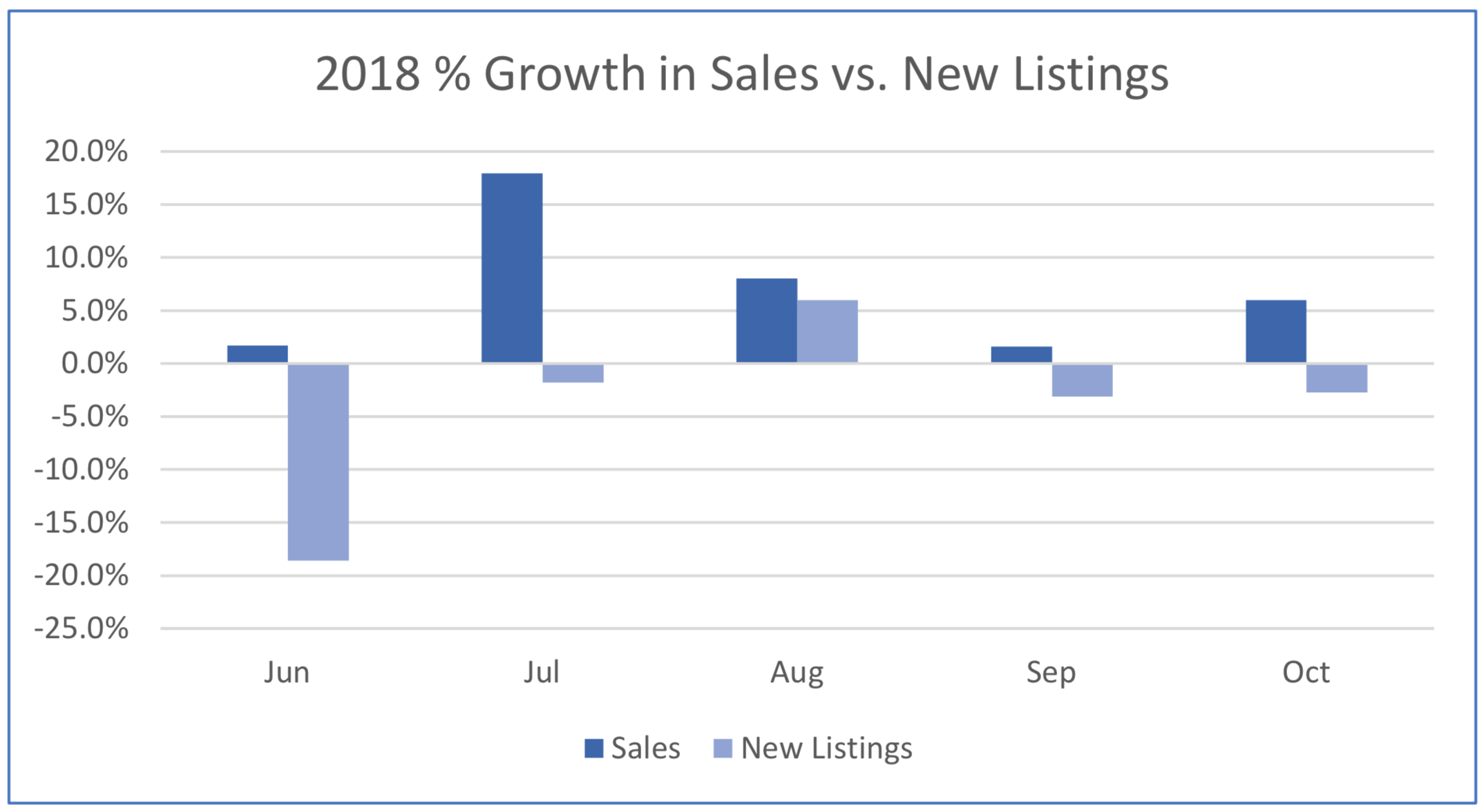

New listings amounted to 10,613 in February 2020, a 7.9 per cent increase compared to February 2019. This moderate annual growth rate was much smaller than that reported for sales, which means market conditions tightened considerably over the past year.

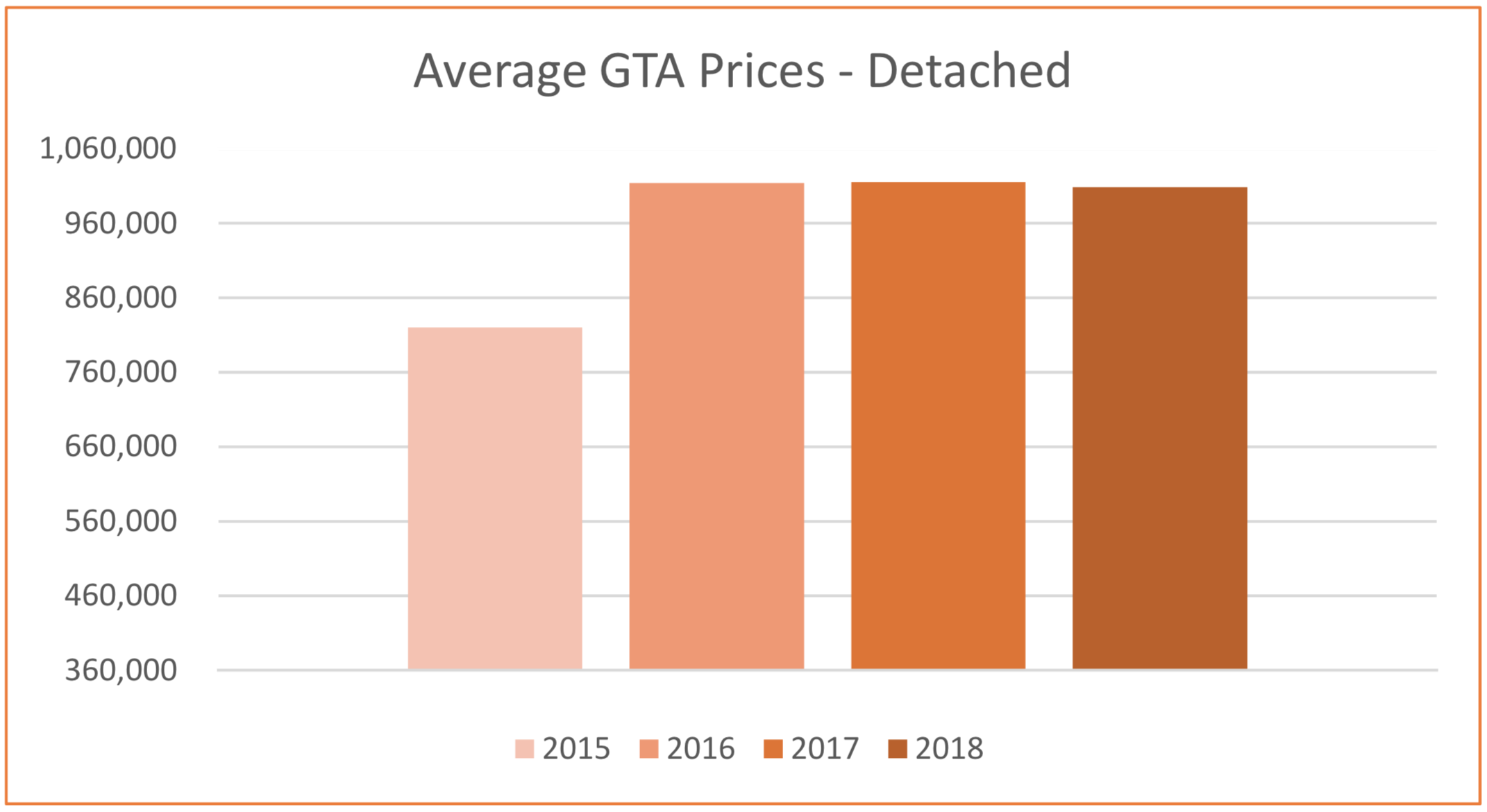

As market conditions tightened over the past year, competition between buyers has clearly increased. This resulted in a further acceleration in year-over-year price growth in February. The MLS® Home Price Index Composite Benchmark was up by 10.2 per cent. The average selling price for all home types combined was up by 16.7 per cent to $910,290. Double-digit average price growth was experienced for most major market segments, including detached houses and condominium apartments.

As shown in this 10 year summary of TRREB activity, February 2020 sales have recovered to 95% of February 2016 levels. However, February 2016 saw activation of 6% more new listings than this February, in a year that ultimately saw 85,731 total transactions. Of even greater significance, February 2016 saw 24% more active listings versus this February overall, yet TRREB's forecast for 2020 is for 97,000 transactions or 13% more than occurred in 2016. All this points to increasing pressure to win insufficient product in an environment where buyers are returning post OSFI stress test adjustments, and a return to record low interest rates on the heels of last week's Bank of Canada announcement.

If you would like to find out what these statistics mean to you, or if you are curious to know how much your property is worth today or how much you can afford to buy, please reach out.

If you found this article helpful please hit "Like" and "Share".

*Image of Toronto - courtesy of Marco Manna.