Trying to make sense of the 2026 Toronto housing forecast? In this article, I break down what the softer 2026 Toronto housing market really means for buyers and sellers, with a clear look at GTA home prices, condos, detached houses and mortgage rates.

Viewing entries tagged

ROYAL LEPAGE

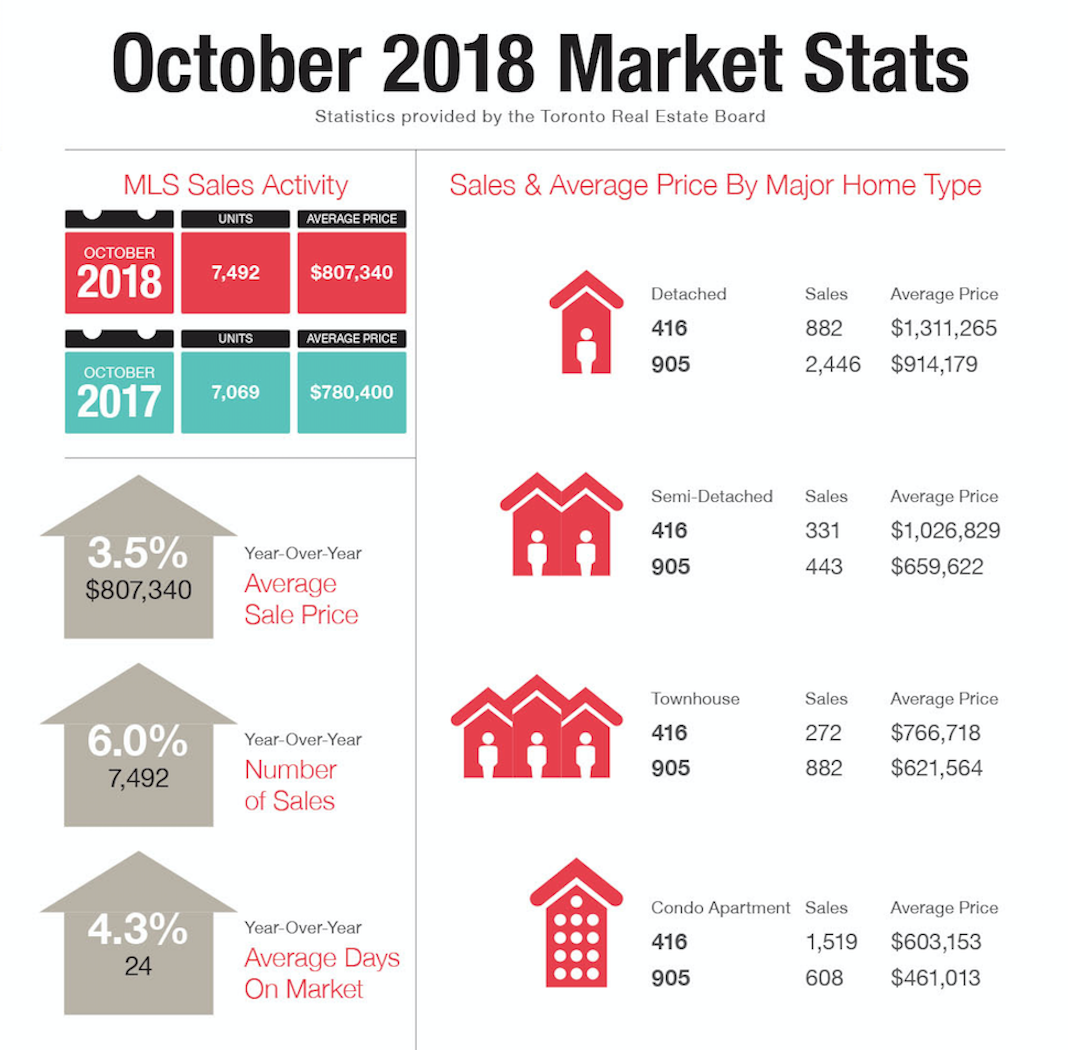

The Toronto Real Estate Board released results for October 2018, reporting tightening conditions in the GTA with sales up and new listings down.

Housing sales across the GTA rose last month compared to a year ago. Prices also rose, helped by strong sales in the condo market. The overall average selling price for all housing types in the GTA was $807,340, up 3.5% year over year. Condos were the housing type that experienced the greatest price growth with a 7.5% increase.

A total of 7,492 sales of all housing types were reported throughout the MLS system in October, which is 6% higher than the same month last year. Condos further drove the October market in unit sales, where 1,519 condo units were sold in the 416 area in October, a result that was greater than the total number of units sold of all other housing types combined in the 416. It was a very different story in the 905 regions of the GTA where combined sales of 3,771 detached, semi-detached and townhome units in the month outpaced condo units sold by over 6 to 1.

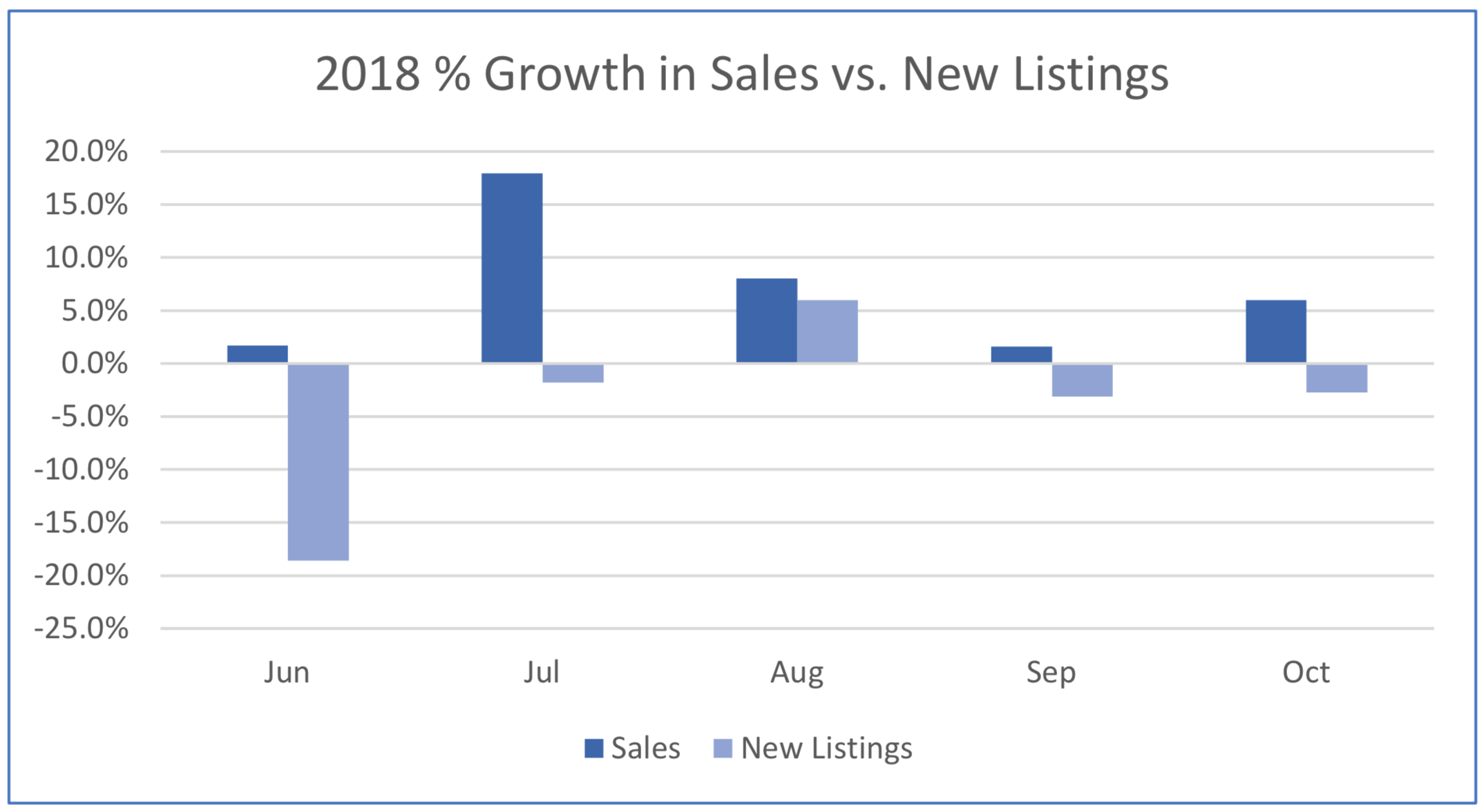

“Annual sales growth has outstripped annual growth in new listings for the last five months, underpinning the fact that listings supply remains an issue in the Greater Toronto Area” noted TREB’s Director of Market Analysis, Jason Mercer, and as seen in the graphic below.

If you would like to find out what these statistics mean to you, or if you are curious to know how much your property is worth today or how much you can afford to buy, please reach out.

If you found this article helpful please hit "Like" and "Share".

The rate of increase in Toronto home prices continues to outpace that of the 905 regions, particularly in the higher density home types. The price of a detached home in Toronto was roughly 50% higher than in the suburbs on average in September. Two years ago the price of a detached home in the City was approximately 40% higher than one in the suburbs. Compare that with condo prices in the City, which two years ago were about 20% more expensive than in the suburbs, but in September, 2018 are now almost 35% more expensive, as seen in the chart below. The average price of the 6,455 homes sold in the GTA in September was $796,786, 2.9% higher than the average of $774,489 a year earlier when 6,334 units were sold in the GTA.

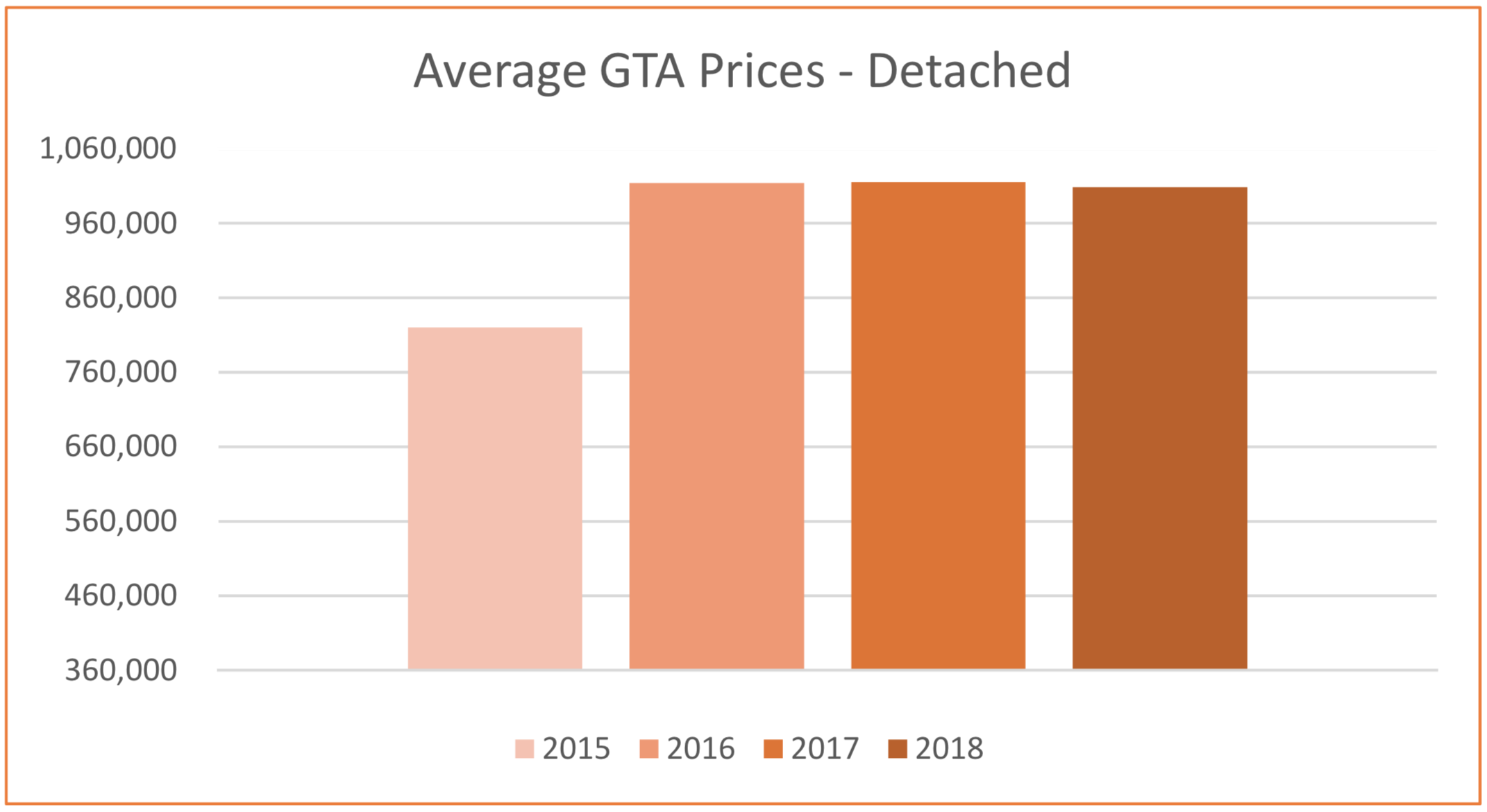

The more affordable home types including condominiums, townhouses and semi-detached homes all saw strong price growth in September, compared to the prior year. In contrast, the average price of a detached home in the GTA was relatively flat compared to 2017. The average price of a detached home in the City of Toronto, where approximately 23% of total GTA detached home sales occurred, was down by 1.4%, compared to the suburbs, where the average price was 0.6% less than a year earlier. The average selling price for a detached home in Toronto in September was $1,342,363, compared to the average suburban selling price of $905,722.

In the City of Toronto, where slightly more than 70% of total GTA condominium sales occurred in September, the Toronto Real Estate Board (TREB) reported 1,282 condominium unit sales. The average price of a condominium in Toronto rose by 11.7% in September year-over-year, almost twice the rate of increase in the price of the average condominium in the 905 regions, where prices rose by 6.4%. The average selling price for condominium in Toronto in September was $615,582, compared to the average suburban selling price of $455,686.

This final chart shows how Toronto has continued to dominate the share of the total GTA condominium sales in September for the past three years. Now more millennials and Gen Z (those born between the early 1980s and early 2000s) are entering the housing market. For them, a condo lifestyle is both preferred and affordable. Condos also remain in high demand among retiring boomers, particularly those who are downsizing and wish to remain in an urban setting in a large metropolitan City such as Toronto.

If you would like to find out what these statistics mean to you, or if you are curious to know how much your property is worth today or how much you can afford to buy, please reach out.

If you found this article helpful please hit "Like" and "Share".

Greater Toronto Area housing sales of 6,939 units increased by 8.5% in August, 2018, compared to August, 2017 when 6,306 unit sales were recorded. The average price of a home in the GTA also rose by 4.7% year over year and now stands at $765,270, compared to $730,969 in August 2017. Month-over-month sales and price growth also continued in August and the annual rate of sales growth outpaced the annual rate of new listings growth.

Detached home sales were up by over 16% on a year-over-year basis in August, substantially more than the 1.6% increase in the other less-expensive semi-detached, townhome and condominium segments of the market.

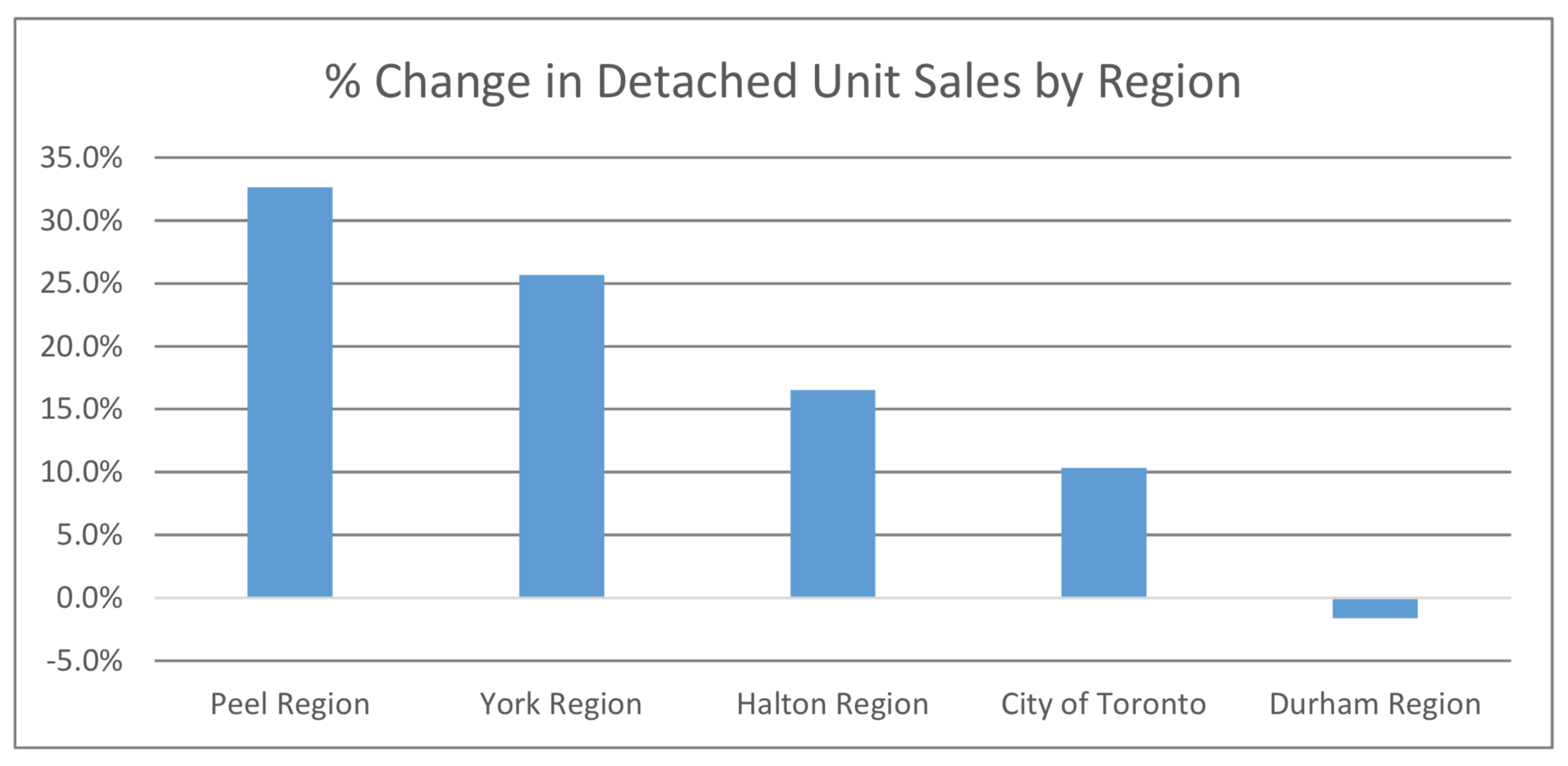

The 905 Regions surrounding the City fuelled most of this growth in detached unit sales, particularly in the Peel and York Regions, which recorded increases in detached unit sales of 32.6%, and 25.7%, respectively, as seen in the chart below. In the City of Toronto (416) detached unit sales increased by 10.3%.

Conversely, the City of Toronto is where average sales prices increased the most, at 8.1% year-over-year. Prices also rose by 7.6% in Peel Region, while other areas of the GTA mostly experienced a percentage decrease in average selling prices.

There is now only slightly more than 2 ½ months inventory in the GTA as a whole and less than 2 months of inventory in the City of Toronto. Many GTA neighbourhoods continue to suffer from a lack of inventory, although this is more pronounced in the City of Toronto. York Region (north of the City) continues to have the largest supply of homes available for sale at 4.3 months supply, while in Halton, Peel and Durham (the regions northwest, west and east of the City, respectively), inventories are only slightly higher than in the City, at 2.3 to 2.4 months supply.

Ownership of a home remains a solid long-term investment in the GTA, a region where the economy remains strong and the population continues to grow.

If you would like to find out what these statistics mean to you, or if you are curious to know how much your property is worth today or how much you can afford to buy, please reach out.

If you found this article helpful please hit "Like" and "Share".

Let's take a look at turning your single-family home into a two-family, income generating property. This strategy can be an attractive alternative for empty-nesters and retirees who’d prefer not to move – and who’d be happy to generate some extra income.

At some point, usually after the children have moved out, many home owners decide to downsize. Today, that usually means moving into a condo or to a smaller community.

But many couples would prefer to stay in the family home, continuing to enjoy the neighbourhood they know so well. Here’s an alternative for anyone considering their options in such a situation.

Why not re-configure your home into a two-family, income-generating property? This strategy has a number of advantages.

You get to stay in the home and the neighbourhood you love

You can avoid many of stressors involved in adapting to a new neighbourhood, new neighbours, and unfamiliar amenities and services.

You end up with less home to manage.

You can generate important extra income to help fund your retirement years and lifestyle enhancements.

You may significantly increase your property’s value when it’s reclassified as an income property.

Offsetting these advantages, you’ll have to deal with some challenging realties:

Living through the renovation process, likely four months to a year. During this period, you might have to find a temporary residence.

Financing the renovations.

Managing the renovation process to be sure it meets your expectations and stays within budget.

Living alongside tenants who may not share your lifestyle.

Assuming the role of “property manager” – this means, at a minimum, dealing with occupancy, rent collection and maintenance issues.

Should you decide to re-configure your home to generate an income, here’s an ACTION PLAN to get the process underway.

Zoning and Permits

First, you’ll need to check out zoning issues. Is your area zoned for the living arrangement you’re hoping to create? Do you need to apply for rezoning or get a zoning restriction waiver?

Requirements vary from region to region, although there are some basics that will apply almost anywhere – each residence will need at least one exit of its own, plus bedroom, bathroom and kitchen area, and perhaps separate utilities and meters.

Other safety standards, such as fire codes, might change once you turn the space into a two-family dwelling – such information is available from your local building planning department.

Space planning

You’ll need to consider what kind of people you want to occupy the new space – a family, students, another retired couple? This will affect the number of rooms and their sizes, the design of kitchen and bathroom spaces, and other considerations.

If you need or want to make big changes, consult with a structural engineer. This is the time to think about major issues like the building’s envelope, and to fix any deficiencies or reconfigure the roof, walls, windows or doors.

Determine the rental income you can expect

Contact a real estate agent you trust to determine the rental income you can expect to earn, taking into consideration periods when the unit is vacant. As part of this analysis, find out how this revenue will be taxed, and what portion can be offset as expenses when you file.

Financing

You may need to take out a home improvement loan, a business loan, or even a second mortgage. Prospective lenders will need to factor in a number of elements: the use of second unit, your credit rating, etc. Ask your real estate agent to provide you with a home valuation before beginning.

Retain an architect

To be sure your re-configured property is in compliance with local zoning, building codes and safety regulations, retain an architect with local knowledge and expertise in handling this type of project. Be sure to get at least two or preferably three quotes.

Recruit a construction company

Be sure the company is experienced in this kind of project. Get at least three quotes. Have the company you select meet with the architect to work out potential issues before the construction process begins.

Have qualified back-up in place to help keep the project on track. It’s always a good idea to have someone who cares for you to act as your back-up or to offer support as you go through the renovation process. Maybe one of your grown children, or a close friend.

Should you wish to explore this alternative to downsizing, I’d be pleased to help you assess this opportunity in respect to your specific home.

If you found this article helpful please hit "Like" and "Share".

Hello May! Sunny days are finally here. Japanese Cherry blossoms are reflecting the warmth of the sun and the earth and expressing their beauty in full boom! This time of the year makes me very happy - time for awaking, rebirth and celebration of nature. Be sure to check out the beauty of the cherry blossoms in High Park now!

As you know, I'm always on the hunt for something new and interesting, especially when it comes to interior design.

If you were looking for new ways to update your kitchen, did you think of painting your kitchen cabinets in the colour that's not grey, brown, beige or white? Try some of these bold and vibrant hues that truly transform the space. Choosing a colour isn't easy, that's why Benjamin Moore and other companies offer a variety of tips how to do it right. Be brave, be daring and enjoy!

Images are curtesy of www.houzz.com.

Average Selling Price for Homes in the GTA up 9.2% Year to Date, OR

Average Selling Price for Homes in the GTA down 12.4% in April Year-Over-Year?

Well, both are true actually. But which one is more relevant?

I believe the first headline is more relevant, because it tells us what is happening in the current real estate market. We already know that the GTA real estate market reset from its historical highs (in April, 2017 the GTA recorded the highest ever average selling price) after the introduction last year of the foreign buyers tax in Q2, followed by the more restrictive mortgage qualification rules introduced at the beginning of 2018. Add to those measures the 2 successive increases in interest rates by the Bank of Canada and the market cooled down considerably.

Headlines are meant to grab the reader’s attention. And one could argue that negative headlines tend to attract more attention than positive ones. But the facts are that the GTA real estate market is trending positive, despite being off its historical highs. Take a look at these statistics for the first 4 months of 2018:

Unit Sales and Active Listings have increased in each month. Average selling price is up 9.2% in four months. Days on the Market have gone down by more than a third, and Average Selling Price to List Price is stable. These are all signs of a healthy real estate market.

But the GTA real estate market is really a tale of 2 cities. As reported by TREB in their latest Market Watch:

“The year-over-year change in the overall average selling price has been impacted by both changes in market conditions as well as changes in the type and price point of homes being purchased. This is especially clear at the higher end of the market. Detached home sales for $2 million or more accounted for 5.5% of total detached sales in April 2018, versus 10 per cent in April 2017.”

The differences in the composition of the current GTA real estate market can seen by looking at the following statistics broken down by major home type:

There is roughly a 3 month supply of detached homes for sale in the GTA, whereas there is only a 1 ½ month supply of condominium units for sale. As well, the increase in Average Selling Price for Condominiums, at 10.2% for the first four months of 2018, is outpacing the rate of increase for Detached homes, at 6.1%, as there is obvious pressure at the lower end with Condominiums in short supply. TREB expects that “once we are past the current policy-based volatility, home owners should expect to see the resumption of a moderate and sustained pace of price growth in line with a strong local economy and steady population growth”.

If you would like to find out what these statistics mean to you, or if you are curious to know how much your property is worth today or how much you can afford to buy, please reach out.

If you found this article helpful please hit "Like" and "Share".

There were a total of 7,118 residential sales reported through TREB’s MLS system in October, compared to 9,715 transactions a year ago. Even though the number of transactions was down by 26.7% year-over-year, the jump of almost 12% in residential sales reported between the months of September and October in 2017 was more pronounced than usual compared to the last 10 years, a clear signal that market momentum is picking up.

Active listings were 78.5% higher than a year ago, an indication that supply and demand are continuing to balance out as inventories settled at 2.6 months of supply in October, down marginally from the 3.0 months of supply in September, but still much healthier than the scant 1.1 months of supply experienced in October, 2016. There is, however, a continuing lack of quality listings in core GTA neighbourhoods and there are early indications that offer dates are reappearing as homes are being underpriced to generate bidding wars, although this has yet to manifest in the overall selling price to list price ratio which is currently holding at 98%.

While the average selling price for October transactions was $780,104 – up by 2.3% compared to the average of $762,691 in October 2016 - the continuing low supply of, and high demand for, condominiums fuelled a 21.8% increase in prices in that segment of the market.

Expectations are that market activity will pick up further in the next 6-8 weeks as buyers rush to obtain mortgage pre-approvals and submit offers before the new stress tests announced by OSFI last month are implemented at the beginning of 2018, further reducing buying power as the pre-qualification hurdle rate increases to the higher of the 5-year benchmark rate published by the Bank of Canada or your negotiated contract borrowing rate + 2%.

Do you remember the story of Goldilocks and the Three Bears? When Goldilocks arrived at the bears’ house in the forest there were three bowls of porridge on the table and she was hungry. The first bowl of porridge she tried was “too hot”, the next one was “too cold”, but the third one was “just right”. Well, this just might be a “Goldilocks” moment in the GTA housing market!

If you are curious to know how much your property is worth today or how much you can afford to buy, please feel free to reach out; and if you found this article helpful please hit "Like" and "Share".

Beginning January 1, 2018, if you are buying a home, even if you have equity of 20% or more, a new regulation announced this week by OSFI (the Ontario Superintendent of Financial Institutions) could make it more difficult for you to qualify for a mortgage.

The revised Residential Mortgage Underwriting Practices and Procedures include several key changes that the regulator says is part of its expectation that federally-regulated mortgage lenders remain vigilant in their underwriting practices, the most significant of which is a new “stress test”.

One fear hitting the headlines today is that the impacted borrowers will turn to unregulated lenders including credit unions and caisses populaires, which are not subject to the new rules.

If you stay with the same institution, banking competition will be even further restricted as those renewing mortgages will not have the ability to shop around. Great for the banks!

In order to qualify for an uninsured mortgage the minimum qualifying rate for uninsured mortgages will be the greater of the five-year benchmark rate published by the Bank of Canada or the contractual mortgage rate +2%. So if the Bank of Canada five-year rate is 5% and you are able to negotiate a lower rate from your financial institution – say 3.5%, then the stress test will mean that you would otherwise have to qualify for a 5.5% rate mortgage in order to be approved. Alternatively, if you were only able to negotiate a 50 basis point reduction from the posted rate, or 4.5%, then you would have to show that you would qualify for a 6.5% rate mortgage of the same amount. What this will likely mean for most borrowers, is that they will not be able to afford the home that they thought they could before the change in regulations.

For example, as reported by TREB (The Toronto Real Estate Board) the average price of a semi-detached home in the GTA in September, 2017 was $752,379. A buyer with a 20% down payment would need a mortgage of approximately $600,000 in order to purchase this “average” home. Let’s say that the Bank of Canada five-year benchmark rate is 5.0% and that this purchaser was able to negotiate a rate of 4% with their financial institution. Therefore, the purchaser would have to demonstrate that they could afford the payments on a 6% mortgage of this amount (roughly an additional $350.00 per month or $4,200.00 per year on a monthly pay mortgage amortized over 25 years), otherwise they would only qualify for a smaller mortgage. If they could not come up with that extra income to show that they would qualify for a $600,000 mortgage under the new regulation, then they would have to settle for a mortgage of $545,000, meaning that with their $150,000 down payment they could only afford a home priced around $695,000, or roughly 8% less than the price of the average semi-detached home selling currently in the GTA.

So for many, the alternative will be to look for a smaller home to purchase, perhaps a less expensive condominium, rent or move out of the city. And sadly, the news does not get much better with those alternatives, due to the shortages of available units in both the sales and rental markets for condominiums. And affordability is becoming a real issue as the focus of buyers and renters alike has shifted to condominiums, bidding up prices both for units for sale and units for rent.

Urbanation just released its analysis of this year’s third quarter and found condo rents averaged $2,219 a month for units averaging 743 square feet – a $232 year-over-year increase. It also found that newly signed leases in the third quarter, at 7,761, hadn’t much changed in a year.

A new report commissioned by the Federation of Rental-Housing Providers of Ontario says the Liberal government’s Fair Housing Plan has negatively impacted the province’s rental housing supply. Before the introduction of the government legislation, 28,000 rental units were in the planning pipeline, but since the new rules were introduced 1,000 of those units have been cancelled or converted to condominiums. The report estimates that if 6,250 new rental units are not built per year in Ontario supply will continue to drop and naturally drive the demand up and the prices.

A lot of factors have conspired to put relentless pressure on the rental market – the astronomical cost of homeownership, stricter mortgage qualifications, high migration and the Fair Housing Plan, among others – but none has been more pronounced than the supply shortage. Moreover, the reintroduction of rent control has provided tenants increased incentive to remain in their dwellings, stunting the turnover rate.

Tim Hudak, CEO of OREA (The Ontario Real Estate Association) recently had this to say about the latest regulation. “It’s time for governments to hit the brakes on more demand side policy interventions and take a wait and see approach. Ontario’s housing market is too important to the provincial economy to move ahead with unnecessary regulation that will hurt the dream of home ownership.”

If you are curious to know how much your property is worth today or how much you can afford to buy, please feel free to reach out; and if you found this article helpful please hit "Like" and "Share".

Shorter than anticipated housing market correction puts Toronto back on track

Highlights:

Toronto to have a shorter housing correction than seen in Vancouver

Tighter access to mortgage financing and eroding affordability in Vancouver and Toronto have more buyers shifting their focus to condominiums, putting upward pressure on price appreciation

Rising interest rates and a strong Canadian dollar support more moderate home price appreciation

TORONTO, October 12, 2017 – According to the Royal LePage House Price Survey [1], home prices in Canada’s five most populated housing markets are rising at a similar, healthy pace on a quarter-over-quarter basis, the first time this has occurred in six years.

The year-over-year price change data in the Royal LePage House Price Composite is the most useful metric for determining the health of Canada’s real estate market. However, examining quarter-over-quarter movements can reveal useful short-term housing market trends. In the third quarter, home prices in the Greater Toronto Area, Greater Vancouver, Greater Montreal Area, Calgary and Ottawa all rose at rates between 1.5 and 3.5 per cent on a quarter-over-quarter basis, indicative of a much more balanced Canadian residential real estate market.

The Royal LePage National House Price Composite, compiled from proprietary property data in 53 of the nation’s largest real estate markets, showed that the price of a home in Canada increased 13.3 per cent year-over-year to $628,411 in the third quarter. When broken out by housing type, the median price of a standard two-storey home rose 13.9 per cent year-over-year to $748,049, and the median price of a bungalow grew 9.5 per cent to $525,781. During the same period, the median price of a condominium rose 15.2 per cent to $413,670.

“Uneven regional economic growth has plagued Canada for much of the past decade, a challenge most evident in the nation’s housing markets,” said Phil Soper, President and CEO, Royal LePage. “For the first time since 2011, we are seeing real estate in all five of our largest cities appreciate at a manageable, healthy clip. Canadian housing is enjoying a Goldilocks moment – not too hot, and not too cold.”

“For now, the Toronto and Vancouver housing markets have returned to earth,” continued Soper. “After a period of unsustainable price inflation and sharp market corrections, we are seeing low single digit appreciation in each. Calgary has shaken off the oil-bust blues and Montreal appears to be at the beginning of a new era of economic prosperity. Rounding out the ‘big five,’ the Ottawa market is behaving like it usually does – a picture of healthy market growth.”

“Marginally higher borrowing costs should dampen domestic demand somewhat, and with less currency-adjusted purchasing power, foreign buyer activity is off peak levels and will likely stay that way in the near-term,” added Soper.

During the third quarter, the Greater Toronto Area saw the largest year-over-year home price increase of any major Canadian market, surging 21.7 per cent on the back of strong gains witnessed at the beginning of 2017. Meanwhile, home prices in Montreal continued to climb at a rate beyond what has been the historical norm, appreciating by 14.3 per cent when compared to the same time last year, while Ottawa grew by 7.9 per cent over the same period. When looking at the largest markets in Canada’s westernmost provinces, Calgary and Greater Vancouver inched further out of their recovery, with home prices rising 5.0 and 2.5 per cent year-over-year, respectively.

Following a very similar trend to the Vancouver housing correction of 2016, the Greater Toronto Area market experienced a sharp drop in sales volumes beginning in April 2017, which continued through much of the third quarter. With underlying employment and economic growth on solid footing, the Toronto market began to grow again in August.

Potential buyers who were previously on the sidelines taking a wait-and-see approach have now jumped back into the market after realizing prices did not drop as certain market watchers had anticipated. On the supply side, some sellers who had attempted to capitalize on an uncharacteristically strong spring have taken their homes off the market. Together, these trends have caused the region to revert to a more balanced market where supply and demand have stabilized in the majority of areas.

Nationally, condominium prices increased 15.2 per cent on a year-over-year basis and have begun to appreciate faster than any other housing segment in large urban centres such as Toronto and Vancouver. This is likely to continue for the foreseeable future and begin a trend in other cities. The overall affordability of condominiums continues to attract first-time homebuyers and purchasers looking for attractively-priced real estate as new mortgage regulations, interest rate increases and higher home prices have effectively limited purchasing power.

Under the Ontario Fair Housing Plan, all private rental units in the province are now subject to rent control, and housing market watchers have a number of concerns regarding the impact of this legislation. Removing the ability to adjust prices by more than 2.5 per cent a year when long-term residential real estate price appreciation is approximately 5.0 per cent per year makes rental units less attractive to investors. It is likely fewer purpose-built rental projects will be launched in the near future. According to one industry report, more than 1,000 such projects have already been cancelled and vacancies have already fallen to 1.3 per cent across the GTA[2].

“Ontarians deciding between renting and buying a home are facing two tough options,” said Soper. “Purchasers trying to break into the entry-level market now face a highly competitive environment, while those waiting to buy are met with high rental prices brought on by a significant shortage of inventory.”

“There may be unintended consequences to new province-wide rent controls,” concluded Soper. “We need more family-sized units in the province’s cities; apartments with two or three bedrooms. Yet purpose-built rental projects are likely to focus on smaller bachelor or one-bedroom units, which tend to attract shorter-term tenants. The higher turn-over allows landlords to raise rates more frequently. This will put further upward pressure on the price of existing family-sized rental units.”

Full article link here.

Provincial and City Summaries and Trends

For more information visit: www.royallepage.ca

[1] Aggregate prices are calculated using a weighted average of the median values of all housing types collected. Data is provided by RPS Real Property Solutions.

[2] Urbanation Inc. report prepared for the Federation of Rental-housing Providers of Ontario, “Ontario Rental Market Study: Measuring the Supply Gap,” September 2017

If you are curious to know how much your property is worth today, please feel free to reach out, and if you found this article helpful please hit "Like" and "Share".

IT LOOKS LIKE THE WORST IS OVER FOR THE TORONTO HOUSING CORRECTION

Last month I spoke about how the Greater Toronto Area Real Estate Market is beginning to change shape and return to balance. Well, the evidence is in, as the number of new listings entered into The Toronto Real Estate Board’s MLS® System amounted to 16,469 in September – up by 9.4 per cent year-over-year. But the real story is that total active listings stood at 19,021, a whopping 69% increase year-over-year. TREB suggests that the improvement in listings in September compared to a year earlier is a sign that home owners are anticipating an uptick in sales activity as we move through the fall, or put another way, more inventory is starting to attract more buyers back to the market.

TREB announced that Greater Toronto Area REALTORS® reported 6,379 sales through TREB’s MLS® System in September, roughly the same amount as in August, but 35 per cent lower than September of last year. In a balanced market, buyers take longer to make up their minds, as there is more product available to choose from. Likewise, sellers need time to get adjusted to the new market reality. Remember, the last few years were anything but “ordinary”.

Think of it this way. Last year at this time, inventory (the number of active listings on MLS®) stood at approximately one month of sales. So, on average, every home on the market was selling within a month or less, with multiple offers driving up the price paid due to the scarcity of supply. Now that inventory is closer to 3 months supply, what this means is that 1 out of every 3 houses on average is selling within the month, and price is no longer being dictated by the frenzy we saw when homes were in such short supply. So it makes sense to see that sales are about a third lower in September 2017 than they were in September of last year. All of this is happening against a backdrop where average prices are still increasing, albeit at a lower rate than we saw during the run up. The average selling price of a home in the GTA in September 2017 was $775,546 – up 2.6 per cent compared to September 2016.

However, the exception continues to be the condominium apartment market segment, where average prices were up on average by 23 per cent compared to last year. TREB reported in September that “tighter market conditions for condominium apartments follows consumer polling results from the spring that pointed toward a shift to condos in terms of buyer intentions”. In fact, condos accounted for almost 30 per cent of all MLS home sales across the GTA during the month of September, whereas detached homes – the most expensive market segment on average - accounted for a smaller share of overall transactions this year compared to last.

If you are curious to know how much your property is worth today, please feel free to reach out and if you found this article helpful please hit "Like" and "Share".

After an overheated performance for much of 2016 and 2017 which saw most homes selling at sky high prices, often well over list, and with multiple offers, the Greater Toronto Area real estate market is returning to balance as the summer closes.

Don’t believe what’s in the newspapers and media reports that Toronto’s real estate market is reaching a point where the bubble is going to burst. It’s not supported by the facts.

The Toronto Real Estate Board reports in its latest figures, for the month of August, that sales of all homes recorded on MLS across the GTA were 6,357, down 34.8% year on year and that the average price only increased 3.0% to $732,292.

However, averages don’t tell the whole story, and there are pockets of real strength, particularly condominiums, where although sales were down 28.0% (mostly due to lack of supply), prices averaged 21.4% higher across the Greater Toronto Area.

Economic indicators are also pointing to fundamental strength, with real growth in the economy up 4.5% in the second quarter of 2017 and employment growth in the Greater Toronto Area of 1.3% during the month of July. The impact of the recent (generally expected) Bank of Canada interest rate increases have yet to play out, but it's possible that they will not have a significant lasting impact on buyer sentiment, as the extreme “heat” that was being felt in the market has cooled somewhat as it returns to a more healthy balance of supply and demand.

Also, prior to the introduction of the Ontario Government’s Foreign Buyers tax last April, housing inventories in the Greater Toronto Area were running at some of their lowest levels in history, at or below 1 month’s supply, and this was reflected in the lofty month on month price increases experienced in what was truly a “sellers” market.

With the introduction of the new tax measures in April, active listings have begun to rise while sales have tapered off. As a result, supply of homes has increased to a more healthy balance of 2.6 month’s supply in August, although down slightly from 3.1 month’s supply in July.

Typically though, during the summer months many sellers as well as purchasers are on the sidelines and activity wanes, while people are on vacation and out enjoying the good weather. With summer drawing to a close, there is some optimism building, now the Greater Toronto Area real estate market has returned to a more healthy balance, that activity will pick up once again in the Autumn months.

When compared with other major Canadian cities, the Greater Toronto Area still has the lowest monthly inventory of homes, well below Montreal (7.8 months), Edmonton (5.5 months) and Calgary (4.1 months), and slightly lower than Vancouver (2.9 months), meaning the Greater Toronto Area is still the strongest housing market in Canada.

If you are curious to know how much your property is worth today, please feel free to reach out and if you found this article helpful please hit "Like" and "Share".

Eccentrically designed with a British influence by founder and designer Kit Kemp, The Whitby is making it’s debut in Manhattan’s Upper Midtown and is the second addition of Firmdale Hotels’ New York portfolio, following the gorgeous Crosby Street Hotel in SoHo.

There are 86 individually designed bedrooms and suites, each with floor to ceiling windows, many with a private terrace and stunning views of the Manhattan skyline. There is also The Whitby Bar and Restaurant, an Orangery, book-lined Drawing Room, private outdoor terrace as well as three beautifully designed private event rooms, a 130 seat state-of-the-art cinema and a fully equipped gym.

Casa Nostra Fruit Store in Barcelona puts focus on unique display. In this case, fruits are in the spotlight. The minimal interior by Miriam Barrio Studio highlights the colors and forms of food, while white tiles expose the beauty of local products.

The store is divided into two zones – one dedicated to fresh products and the other, storing pre-packed food. Visual identity of Casa Nostra is also intriguing. From sleek typography to beautifully designed shopping bags, the brand redefines the grocery shopping experience.

![The Whitby Hotel [New York] - WOW!](https://images.squarespace-cdn.com/content/v1/58ce8b4db3db2b938eb31992/1498234292888-ROPKOHVVVEQBTBIJ6EPP/whitby-hotel-new-york.jpg)