Shorter than anticipated housing market correction puts Toronto back on track

Highlights:

Toronto to have a shorter housing correction than seen in Vancouver

Tighter access to mortgage financing and eroding affordability in Vancouver and Toronto have more buyers shifting their focus to condominiums, putting upward pressure on price appreciation

Rising interest rates and a strong Canadian dollar support more moderate home price appreciation

TORONTO, October 12, 2017 – According to the Royal LePage House Price Survey [1], home prices in Canada’s five most populated housing markets are rising at a similar, healthy pace on a quarter-over-quarter basis, the first time this has occurred in six years.

The year-over-year price change data in the Royal LePage House Price Composite is the most useful metric for determining the health of Canada’s real estate market. However, examining quarter-over-quarter movements can reveal useful short-term housing market trends. In the third quarter, home prices in the Greater Toronto Area, Greater Vancouver, Greater Montreal Area, Calgary and Ottawa all rose at rates between 1.5 and 3.5 per cent on a quarter-over-quarter basis, indicative of a much more balanced Canadian residential real estate market.

The Royal LePage National House Price Composite, compiled from proprietary property data in 53 of the nation’s largest real estate markets, showed that the price of a home in Canada increased 13.3 per cent year-over-year to $628,411 in the third quarter. When broken out by housing type, the median price of a standard two-storey home rose 13.9 per cent year-over-year to $748,049, and the median price of a bungalow grew 9.5 per cent to $525,781. During the same period, the median price of a condominium rose 15.2 per cent to $413,670.

“Uneven regional economic growth has plagued Canada for much of the past decade, a challenge most evident in the nation’s housing markets,” said Phil Soper, President and CEO, Royal LePage. “For the first time since 2011, we are seeing real estate in all five of our largest cities appreciate at a manageable, healthy clip. Canadian housing is enjoying a Goldilocks moment – not too hot, and not too cold.”

“For now, the Toronto and Vancouver housing markets have returned to earth,” continued Soper. “After a period of unsustainable price inflation and sharp market corrections, we are seeing low single digit appreciation in each. Calgary has shaken off the oil-bust blues and Montreal appears to be at the beginning of a new era of economic prosperity. Rounding out the ‘big five,’ the Ottawa market is behaving like it usually does – a picture of healthy market growth.”

“Marginally higher borrowing costs should dampen domestic demand somewhat, and with less currency-adjusted purchasing power, foreign buyer activity is off peak levels and will likely stay that way in the near-term,” added Soper.

During the third quarter, the Greater Toronto Area saw the largest year-over-year home price increase of any major Canadian market, surging 21.7 per cent on the back of strong gains witnessed at the beginning of 2017. Meanwhile, home prices in Montreal continued to climb at a rate beyond what has been the historical norm, appreciating by 14.3 per cent when compared to the same time last year, while Ottawa grew by 7.9 per cent over the same period. When looking at the largest markets in Canada’s westernmost provinces, Calgary and Greater Vancouver inched further out of their recovery, with home prices rising 5.0 and 2.5 per cent year-over-year, respectively.

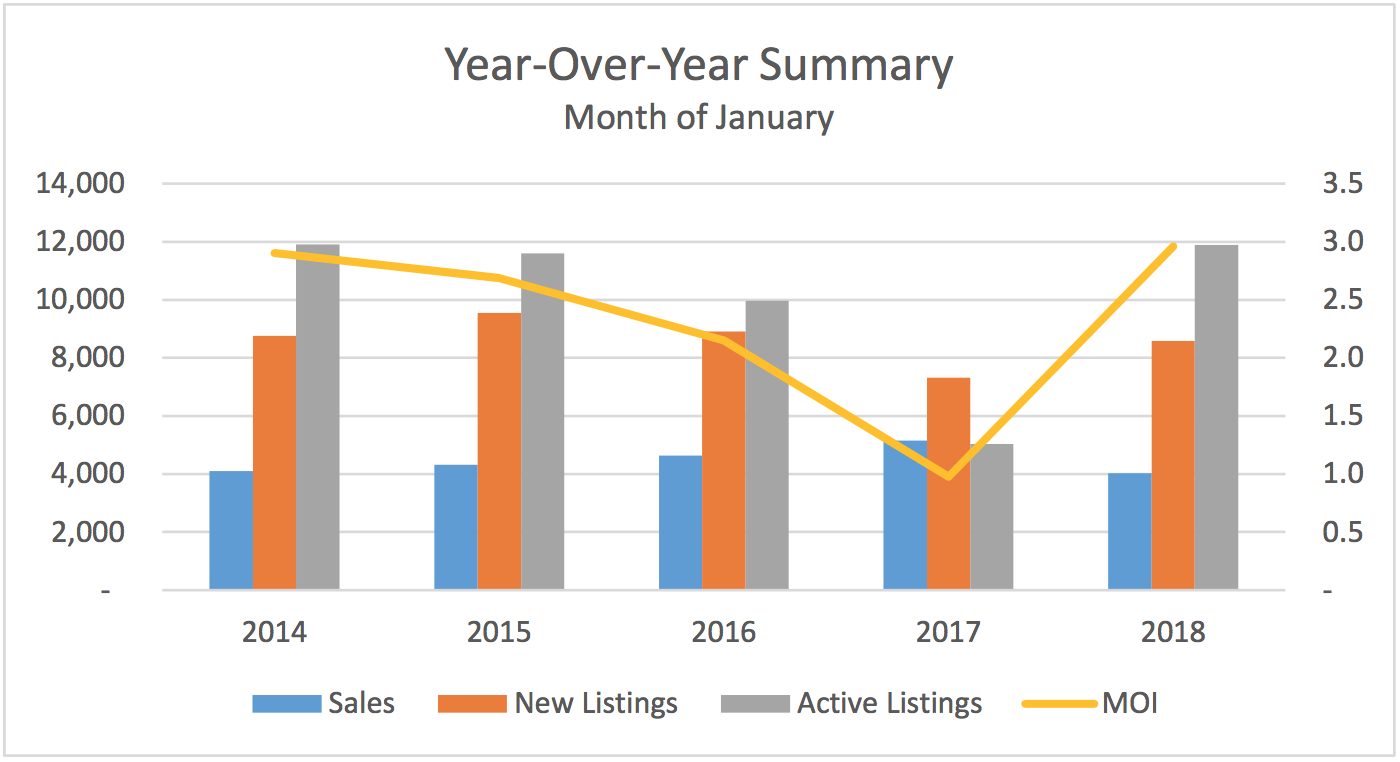

Following a very similar trend to the Vancouver housing correction of 2016, the Greater Toronto Area market experienced a sharp drop in sales volumes beginning in April 2017, which continued through much of the third quarter. With underlying employment and economic growth on solid footing, the Toronto market began to grow again in August.

Potential buyers who were previously on the sidelines taking a wait-and-see approach have now jumped back into the market after realizing prices did not drop as certain market watchers had anticipated. On the supply side, some sellers who had attempted to capitalize on an uncharacteristically strong spring have taken their homes off the market. Together, these trends have caused the region to revert to a more balanced market where supply and demand have stabilized in the majority of areas.

Nationally, condominium prices increased 15.2 per cent on a year-over-year basis and have begun to appreciate faster than any other housing segment in large urban centres such as Toronto and Vancouver. This is likely to continue for the foreseeable future and begin a trend in other cities. The overall affordability of condominiums continues to attract first-time homebuyers and purchasers looking for attractively-priced real estate as new mortgage regulations, interest rate increases and higher home prices have effectively limited purchasing power.

Under the Ontario Fair Housing Plan, all private rental units in the province are now subject to rent control, and housing market watchers have a number of concerns regarding the impact of this legislation. Removing the ability to adjust prices by more than 2.5 per cent a year when long-term residential real estate price appreciation is approximately 5.0 per cent per year makes rental units less attractive to investors. It is likely fewer purpose-built rental projects will be launched in the near future. According to one industry report, more than 1,000 such projects have already been cancelled and vacancies have already fallen to 1.3 per cent across the GTA[2].

“Ontarians deciding between renting and buying a home are facing two tough options,” said Soper. “Purchasers trying to break into the entry-level market now face a highly competitive environment, while those waiting to buy are met with high rental prices brought on by a significant shortage of inventory.”

“There may be unintended consequences to new province-wide rent controls,” concluded Soper. “We need more family-sized units in the province’s cities; apartments with two or three bedrooms. Yet purpose-built rental projects are likely to focus on smaller bachelor or one-bedroom units, which tend to attract shorter-term tenants. The higher turn-over allows landlords to raise rates more frequently. This will put further upward pressure on the price of existing family-sized rental units.”

Full article link here.

Provincial and City Summaries and Trends

![Hotel Mono is All Monochrome [Singapore]](https://images.squarespace-cdn.com/content/v1/58ce8b4db3db2b938eb31992/1498245340339-FKZBVE33NCF7287LT9AH/hotel-facade.jpg)

![Heavenly White & Blue Churreria El Moro [Mexico City]](https://images.squarespace-cdn.com/content/v1/58ce8b4db3db2b938eb31992/1498234810993-9OCDJJLEIIIK515UAFJM/1498232944330.jpeg)