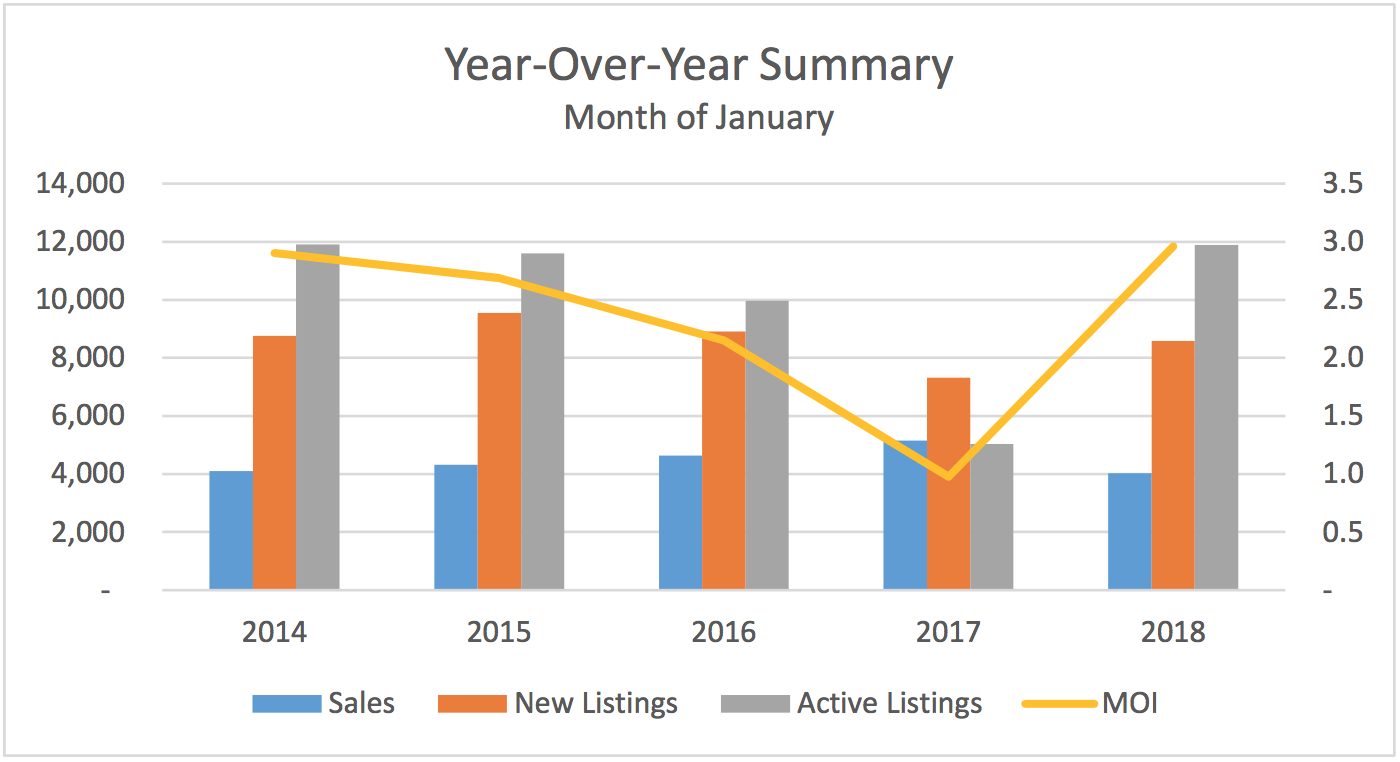

In May, we saw a continuation of the steady price growth experienced in the Greater Toronto Area (GTA) housing market during the 4 previous months. So far, in the first 5 months of 2018, average home prices in the GTA have increased by 9.6%, to $805,320. Unit sales have also increased each month in 2018 - from 4,019 units in January, to 7,834 units in May.

As I mentioned in last month’s blog, the housing market conditions in 2018 are very different than the conditions experienced during the comparative period in 2017. But beginning in May, and through the second half of 2018, the comparisons will become more meaningful, as May, 2017 was the first month last year when the impact of the foreign buyers tax began to effect a slowdown in the rate of price growth and market activity, following the frenzy in the months prior when prices were bid up to unreasonable levels due to short supply and speculation. So for the first time, we have the impact of the foreign buyers tax in both monthly results year-over-year, which makes a May to May comparison a little more relevant.

It is interesting to note, therefore, that new listings were down by more than sales this May compared to last year, (26.2% versus 22.2%), meaning that competition heated up among buyers. And there are indications from sellers that listing intentions are down significantly since the Fall, meaning the supply of homes available for sale could continue to be an issue in the latter half of 2018. And when the supply of homes decreases, prices increase, as competition among buyers intensifies.

This is particularly true in the City of Toronto (416) where, for example, average selling prices were at or above average listing prices for all major home types in May. What is even more interesting, is that the further out you travel from Downtown Toronto, the weaker the market gets. And since the GTA housing numbers are an average over the entire 416 and 905 regions, this proves how strong the market is right now in the City of Toronto, compared to the rest of the GTA, as the following chart shows:

Finally, these last two charts highlight the composition of the May sales by home type in each of the 416 and 905 sub markets. In the 416 region, condominiums accounted for a commanding 57% of unit sales and detached homes made up 25%, while in the 905 region it was detached homes that accounted for the majority of unit sales, at 55% of the total. What these charts clearly indicate is that condominiums are the dominant force driving unit sales in the 416 region and are in high demand compared to higher priced detached homes, while the opposite is true in the 905 region where the inventory of detached homes tends to be more prevalent and buyers have more choice, which means these homes take longer on average to sell.

If you would like to find out what these statistics mean to you, or if you are curious to know how much your property is worth today or how much you can afford to buy, please reach out.

If you found this article helpful please hit "Like" and "Share".

![Hotel Mono is All Monochrome [Singapore]](https://images.squarespace-cdn.com/content/v1/58ce8b4db3db2b938eb31992/1498245340339-FKZBVE33NCF7287LT9AH/hotel-facade.jpg)