GTA REALTORS® RELEASE FEBRUARY STATS

TORONTO, ONTARIO, March 3, 2021 – Record home sales in the Greater Toronto Area (GTA) continued in February as buyers remained confident in their employment situations and took advantage of ultra-low borrowing costs. With multiple buyers continuing to compete for many available listings, double-digit annual price growth was the norm throughout the GTA, with stronger rates of growth in the suburbs surrounding the City of Toronto.

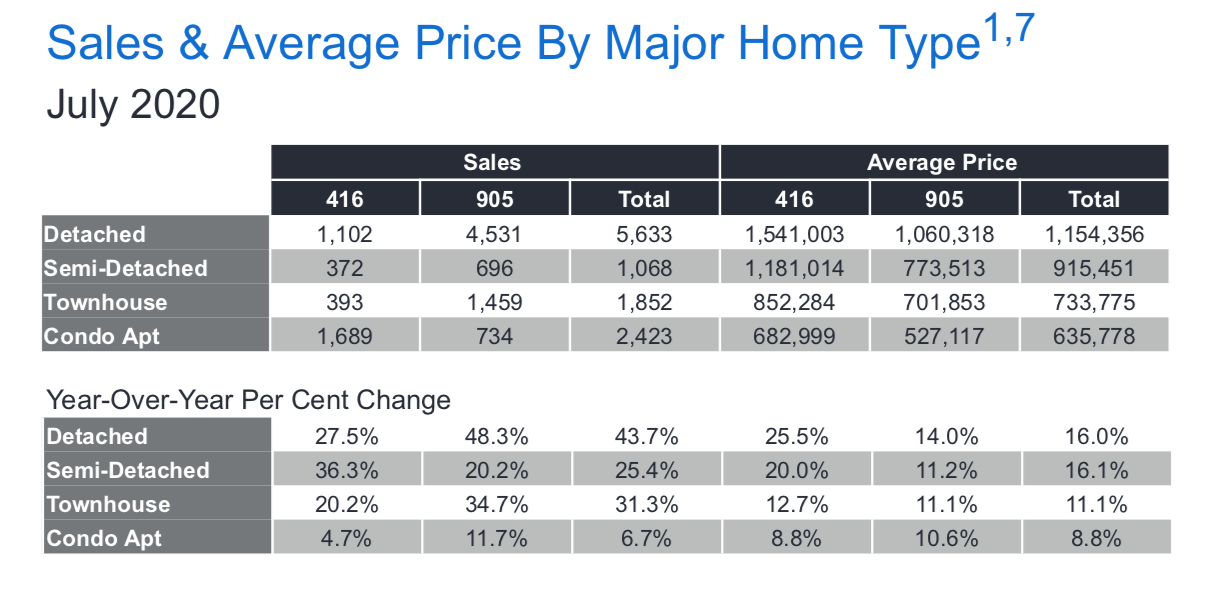

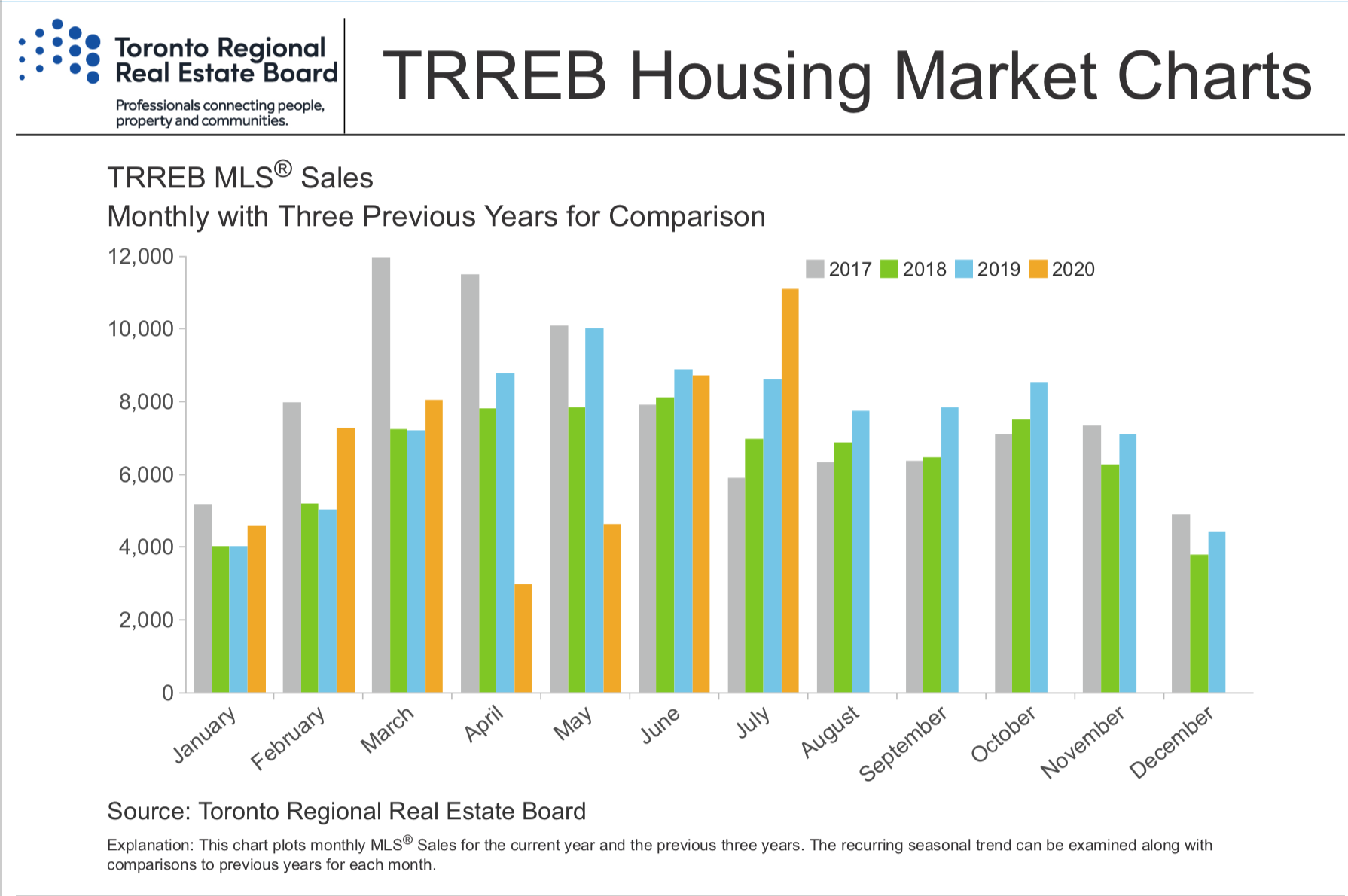

GTA REALTORS® reported 10,970 sales through TRREB’s MLS® System in February 2021 – a 52.5 per cent increase compared to 7,193 sales reported in February 2020. Looking at all areas of the GTA combined, the condominium apartment segment led the way with a 64 per cent sales increase compared to last year, with similar rates of increase in the ‘416’ and ‘905’ area codes.

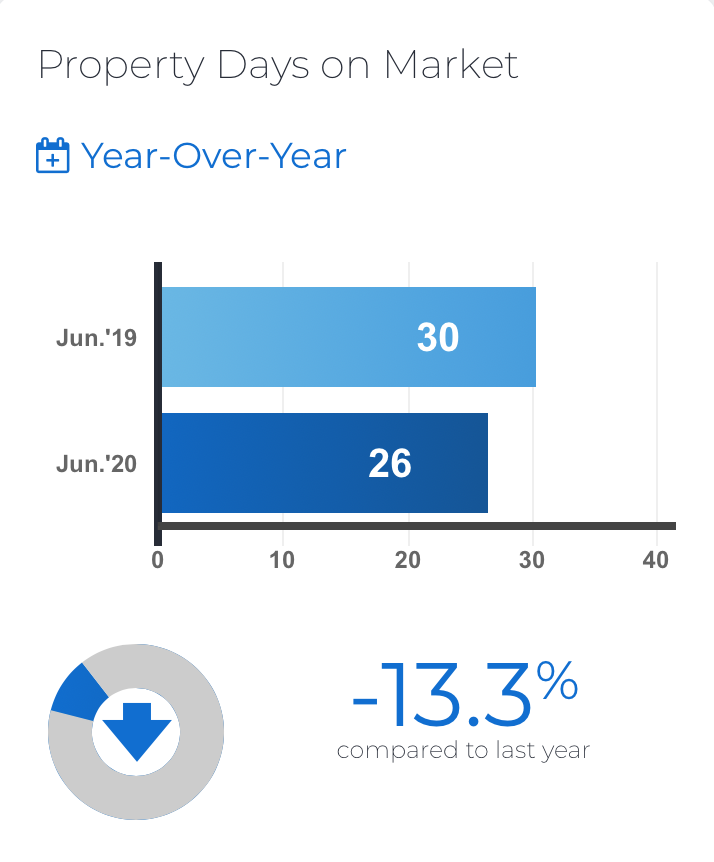

“It’s clear that the historic demand for housing experienced in the second half of last year has carried forward into the first quarter of this year with some similar themes, including the continued popularity of suburban low-rise properties. It’s also evident that the supply of listings is not keeping up with demand, which could present an even larger problem once population growth picks up following widespread vaccinations later this year and into 2022,” said TRREB President Lisa Patel.

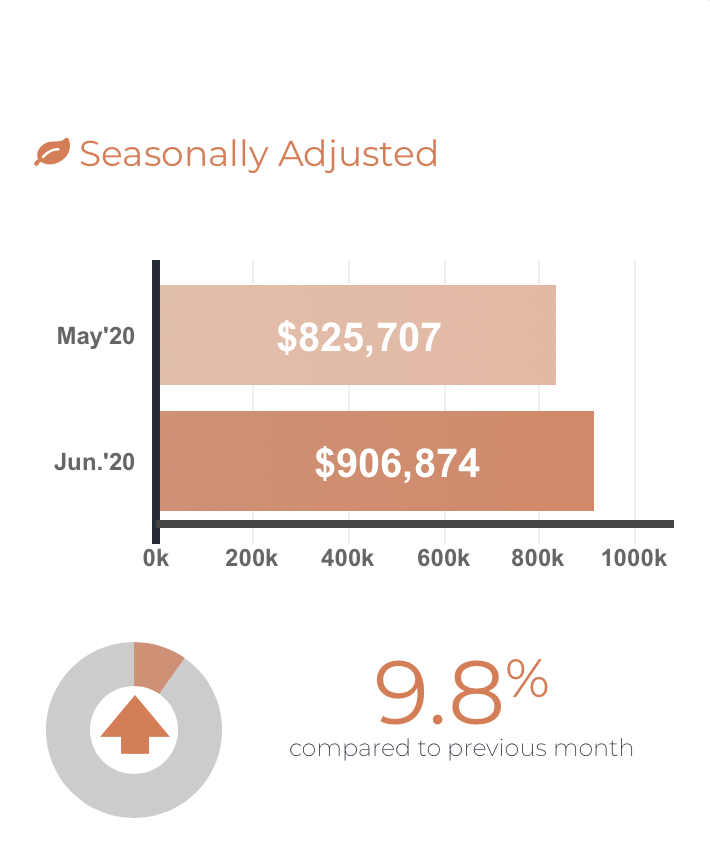

The MLS® Home Price Index Composite Benchmark was up by 14.8 per cent year-over-year in February 2021. Over the same period, the average selling price was up by 14.9 per cent to $1,045,488. While market conditions were tight throughout the GTA region in February, the detached, semi-detached and townhouse market segments in suburban areas were the drivers of average price growth, with annual rates of increase above 20 per cent in all three cases.

“In the absence of a marked uptick in inventory, the current relationship between demand and supply supports continued double-digit average home price growth this year. In addition, if we continue to see growth in condo sales outstrip growth in new condo listings in Toronto, renewed price growth in this market segment is a distinct possibility in the second half of the year,” said TRREB Chief Market Analyst Jason Mercer.

TRREB Releases Q4 2020 Condo Market Statistics

TORONTO, ONTARIO, January 27, 2021 – Fourth quarter 2020 condominium apartment sales reported by Greater Toronto Area REALTORS® totalled 6,469 – up 20.7 per cent compared to 5,358 in Q4 2019. The number of new listings in Q4 2020 amounted to 12,298 – a 91.9 per cent increase over Q4 2019. Active listings totalling 4,294 at the end of Q4 were more than double that reported at the end of Q4 2019.

“While the prominent storyline has been the strong increase in condo listings over the last 12 months, it is important to point out that the demand for condominium apartments has remained very strong, with sales up substantially compared to 2019. The increase in supply, largely attributed to investor selling as both the traditional and short-term rental markets softened along with the looming possibility of a City of Toronto vacancy tax, resulted in much more choice and bargaining power for buyers and a moderate decline in average selling prices,” said Lisa Patel, Toronto Regional Real Estate Board (TRREB) President.

The overall GTA average condominium apartment selling price was down by 1.1 per cent year over year in the fourth quarter to $610,044. The average selling price in Toronto, at $644,516, was down by 2.4 per cent over the same period. Year-over-year price declines were especially evident for smaller units in the City, where investor-driven supply increases were strong.

“TRREB will be releasing its Market Year in Review and 2021 Outlook report at the beginning of February. With this said, we expect the demand for condo apartments to remain strong this year. Once global vaccine uptake is substantial, the exact timing for which remains uncertain, expect a resurgence in immigration and non-permanent migration into the GTA. This will provide continued support for both ownership and rental demand beyond 2021,” said Jason Mercer, TRREB’s Chief Market Analyst.

TRREB Releases Q4 2020 Rental Market Statistics

TORONTO, ONTARIO, January 27, 2021 – Greater Toronto Area REALTORS® reported 12,584 condominium apartment rentals through TRREB’s MLS® System during the fourth quarter of 2020. This represented an increase of 86.3 per cent compared to 6,756 rentals in Q4 2019. The number of condominium apartments listed for rent during Q4 2020 was up by 131.6 per cent compared to Q4 2019.

“Demand for condominium apartment rentals reached record highs in the second half of 2020, particularly in the fourth quarter. However, at the same time, growth in the number of available units far outstripped growth in rental transactions, as many investors chose to make their units available due to the impact of COVID-19 on tourism and the short-term rental market, City of Toronto restrictions on short-term rentals and the prospect of a vacancy tax. The result was much more choice and negotiating power for renters and a downward adjustment in average rents,” said Lisa Patel, Toronto Regional Real Estate Board (TRREB) President.

The average one-bedroom condominium apartment rent was down by 16.5 per cent year over year in Q4 2020 to $1,845 compared to $2,209 in Q4 2019. The average two-bedroom condominium apartment rent was down by 14.5 per cent over the same time period to $2,453 compared to $2,868.

“As we move through 2021, rental demand will remain strong as the economic situation continues to improve, especially as the pace of the vaccine rollout increases and immigration and non-permanent migration into the GTA accelerates. Eventually, this will result in much of the current rental unit inventory being absorbed, but market conditions will likely continue to favour renters through much of 2021,” said Jason Mercer, TRREB’s Chief Market Analyst.

If you would like to find out what these statistics mean to you, or if you are curious to know how much your property is worth today or how much you can afford to buy, please reach out.

If you found this article helpful please hit "Like" and "Share".